Tyson Foods 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

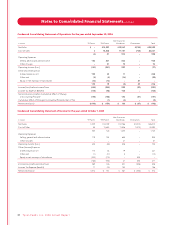

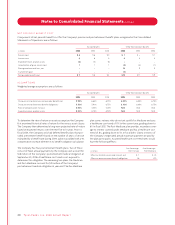

NOTE 10 COMPREHENSIVE INCOME (LOSS)

The components of accumulated other comprehensive income

are as follows:

in millions 2006 2005

Accumulated other comprehensive income:

Currency translation adjustment $38 $ 44

Unrealized net hedging losses, net of taxes (6) (10)

Unrealized net loss on investment, net of taxes –(1)

Minimum pension liability adjustment, net of taxes (15) (5)

Total accumulated other comprehensive income $17 $ 28

The components of other comprehensive income (loss) are as follows:

in millions Before Tax Income Tax After Tax

Fiscal 2006:

Currency translation adjustment $(6) $ – $ (6)

Pension unrealized loss (16) 6 (10)

Investments unrealized gain 1 – 1

Net hedging gain 1 – 1

Net hedging loss reclassified to

income statement 6(3) 3

Other comprehensive loss – 2006 $(14) $ 3 $(11)

Fiscal 2005:

Currency translation adjustment $ 23 $ – $ 23

Pension unrealized loss (2) 1 (1)

Investments unrealized loss (3) 1 (2)

Net hedging loss (1) – (1)

Net hedging loss reclassified to

income statement 34 (13) 21

Other comprehensive income – 2005 $ 51 $ (11) $ 40

Fiscal 2004:

Currency translation adjustment $ 23 $ – $ 23

Pension unrealized gain 2 (1) 1

Net hedging gain 31 (12) 19

Net hedging gain reclassified to

income statement (66) 26 (40)

Other comprehensive income (loss) – 2004 $(10) $ 13 $ 3

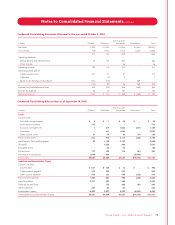

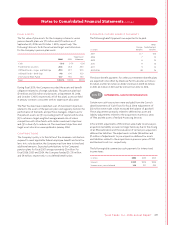

NOTE 11 STOCK-BASED COMPENSATION

In the first quarter of fiscal 2006, the Company adopted SFAS

No. 123R using the modified prospective method. Under the modi-

fied prospective method, compensation cost is recognized for all

share-based payments granted after the adoption of SFAS No. 123R

and for all awards granted to employees prior to the adoption

date of SFAS No. 123R that were unvested on the adoption date.

Accordingly, no restatements were made to prior periods.

Prior to the adoption of SFAS No. 123R, the Company applied

Accounting Principles Board Opinion No. 25, “Accounting for Stock

Issued to Employees” in accounting for its employee stock compen-

sation plans. Accordingly, no compensation expense was recog-

nized for its stock option issuances, as stock options are issued

with an exercise price equal to the closing price at the date of

grant. Also, prior to the adoption of SFAS No. 123R, the Company

issued restricted stock and recorded the fair value of such awards

as deferred compensation amortized over the vesting period. Had

compensation expense for the employee stock compensation plans

been determined based on the fair value method of accounting

for the Company’s stock compensation plans according to FASB

Statement No. 123, “Accounting for Stock-Based Compensation,”

the tax-effected impact would be as follows:

in millions, except per share data 2005 2004

Net income, as reported $ 372 $ 403

Stock-based employee compensation

expense included in net income, net of tax 15 10

Total stock-based employee compensation

expense determined under fair value based

method for all awards, net of tax (22) (16)

Pro forma net income $ 365 $ 397

Earnings per share

As reported

Class A Basic $1.11 $1.20

Class B Basic $1.00 $1.08

Diluted $1.04 $1.13

Pro forma

Class A Basic $1.09 $1.18

Class B Basic $0.98 $1.06

Diluted $1.02 $1.11

44 Ty s on Foods, Inc. 2006 Annual Report

Notes to Consolidated Financial Statements continued