Tyson Foods 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Derivative products related to grain procurement, such as futures

and option contracts that meet the criteria for hedge accounting,

are considered cash flow hedges, as they hedge against changes in

the amount of future cash flows related to commodities procure-

ment. The Company does not purchase derivative products related

to grain procurement in excess of its physical grain consumption

requirements. The Company’s grain procurement hedging activities

are for the grain commodity purchase price only and do not hedge

other components of grain cost such as basis differential and freight

costs. The after tax losses, net of gains, recorded in accumulated

other comprehensive loss at September 30, 2006, related to cash

flow hedges, were $3 million. These losses will be recognized within

the next 12 months. Of these losses, the portion resulting from the

Company’s open mark-to-market hedge positions was not signifi-

cant as of September 30, 2006. The Company generally does not

hedge cash flows related to commodities beyond 12 months.

• Fair value hedges: The Company designates certain futures

contracts as fair value hedges of firm commitments to purchase

market hogs for slaughter and natural gas for the operation of its

plants. From time to time, the Company also enters into foreign

currency forward contracts to hedge changes in fair value of receiv-

ables and purchase commitments arising from changes in the exchange

rates of foreign currencies; however, the fair value of the foreign

exchange contracts was not material as of September 30, 2006, and

October 1, 2005. The changes in the fair value of a derivative highly

effective and that is designated and qualifies as a fair value hedge,

along with the gain or loss on the hedged asset or liability attribut-

able to the hedged risk (including gains or losses on firm commit-

ments), are recorded in current period earnings. Ineffectiveness

results when the change in the fair value of the hedge instrument

differs from the change in fair value of the hedged item. Ineffective-

ness related to the Company’s fair value hedges was not significant

during fiscal 2006, 2005 and 2004.

During fiscal 2006, the Company discontinued the use of hedge

accounting for certain financial instruments in place to hedge for-

ward cattle purchases. Hedge accounting was discontinued to provide

a natural offset to the gains and losses resulting from the Company’s

derivatives tied to its forward fixed price sales of boxed beef, as

this activity does not qualify for SFAS No. 133 hedge accounting.

The contracts for which hedge accounting was discontinued had

a fair value of approximately $28 million at the date hedge account-

ing was discontinued. The $28 million primarily was recognized as

a component of cost of sales in the second quarter of fiscal 2006.

• Undesignated positions: The Company holds positions as part

of its risk management activities, primarily certain grains, livestock

and natural gas futures, for which it does not apply hedge account-

ing, but instead marks these positions to fair value through earnings

at each reporting date. Changes in market value of derivatives used

in the Company’s risk management activities surrounding inventories

on hand or anticipated purchases of inventories or supplies are

recorded in cost of sales. Changes in market value of derivatives

used in the Company’s risk management activities surrounding

forward sales contracts are recorded in sales. The Company

generally does not enter into undesignated positions beyond

12 months. The Company recognized pretax net gains of approxi-

mately $8 million, $2 million and $58 million in cost of sales for

fiscal 2006, 2005 and 2004, respectively, related to grain positions

for which it did not apply hedge accounting.

The Company enters into certain forward sales of boxed beef and

boxed pork and forward purchases of cattle at fixed prices. The fixed

price sales contracts lock in the proceeds from a sale in the future

and the fixed cattle purchases lock in the cost of raw material in

the future, although the cost of the livestock and the related boxed

beef and pork market prices at the time of the sale or purchase will

vary from this fixed price. Therefore, as fixed forward sales and for-

ward purchases of cattle are entered into, the Company also enters

into the appropriate number of livestock futures positions. Changes

in market value of the open livestock futures positions are marked to

market and reported in earnings at each reporting date, even though

the economic impact of the Company’sfixed prices being above or

below the market price is only realized at the time of sale or pur-

chase. In connection with these livestock futures, the Company

recorded realized and unrealized net losses of $54 million in fiscal

2006, which included an unrealized pretax loss on open mark-

to-market futures positions of approximately $12 million asof

September 30, 2006. Included in the net losses in fiscal 2006, are

net gains of $28 million recorded subsequent to the removal of

certain fair value designations described above. The Company

recorded realized and unrealized net losses of $9 million and real-

ized and unrealized net gains of $33 million in fiscal 2005 and 2004,

respectively, related to livestock futures positions.

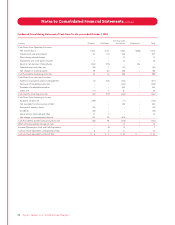

FAIR VALUES OF FINANCIAL INSTRUMENT LIABILITIES:

in millions 2006 2005

Commodity derivative positions $12 $ 7

Interest-rate derivative positions –1

Total debt 4,094 3,232

34 Ty s on Foods, Inc. 2006 Annual Report

Notes to Consolidated Financial Statements continued