Tyson Foods 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

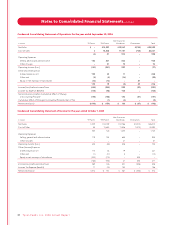

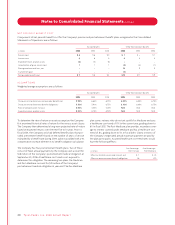

Condensed Consolidating Statement of Operations for the year ended September 30, 2006

Non-Guarantor

in millions TFI Parent TFM Parent Subsidiaries Eliminations Total

Net Sales $ – $14,227 $12,067 $(735) $25,559

Cost of Sales 3 14,206 11,157 (735) 24,631

(3) 21 910 – 928

Operating Expenses:

Selling, general and administrative 130 201 604 – 935

Other charges – 51 19 – 70

Operating Income (Loss) (133) (231) 287 – (77)

Other (Income) Expense:

Interest expense, net 192 35 11 – 238

Other, net (3) (3) (16) – (22)

Equity in net earnings of subsidiaries (14) (13) – 27 –

175 19 (5) 27 216

Income (Loss) before Income Taxes (308) (250) 292 (27) (293)

Income Tax Expense (Benefit) (112) (92) 102 – (102)

Net Income (Loss) before Cumulative Effect of Change

in Accounting Principle (196) (158) 190 (27) (191)

Cumulative Effect of Change in Accounting Principle, Net of Tax – (1) (4) – (5)

Net Income (Loss) $(196) $ (159) $ 186 $ (27) $ (196)

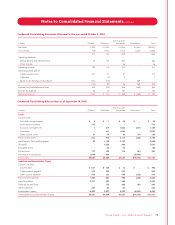

Condensed Consolidating Statement of Income for the year ended October 1, 2005

Non-Guarantor

in millions TFI Parent TFM Parent Subsidiaries Eliminations Total

Net Sales $ 429 $14,009 $12,786 $(1,210) $26,014

Cost of Sales 85 13,883 11,536 (1,210) 24,294

344 126 1,250 – 1,720

Operating Expenses:

Selling, general and administrative 119 154 655 – 928

Other charges – – 47 – 47

Operating Income (Loss) 225 (28) 548 – 745

Other (Income) Expense:

Interest expense, net 170 38 19 – 227

Other, net (1) (17) 8 – (10)

Equity in net earnings of subsidiaries (333) (175) – 508 –

(164) (154) 27 508 217

Income (Loss) before Income Taxes 389 126 521 (508) 528

Income Tax Expense (Benefit) 17 (15) 154 – 156

Net Income (Loss) $ 372 $ 141 $ 367 $ (508) $ 372

38 Ty s o n F o o d s , I n c . 2 0 0 6 A n n u a l R e p o r t

Notes to Consolidated Financial Statements continued