Tyson Foods 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

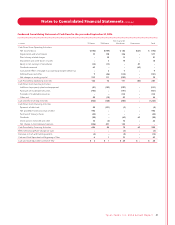

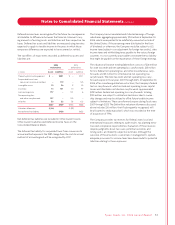

To determine the rate-of-return on assets assumption, the Company

first examined historical rates of return for the various asset classes.

The Company then determined a long-term projected rate-of-return

based on expected returns over the next five to 10 years. Prior to

fiscal 2004, the Company only had defined benefit plans that pro-

vided a retirement benefit based on the number of years of service

multiplied by a benefit rate. During 2004, a plan was added with a 4%

compensation increase inherent in its benefit obligation calculation.

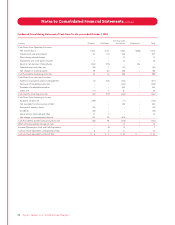

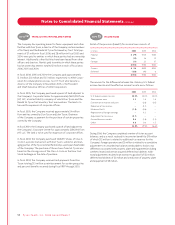

The Company has four postretirement health plans. Two of these

consist of fixed, annual payments by the Company and account for

$38 million of the Company’s postretirement medical obligation at

September 30, 2006. A healthcare cost trend is not required to

determine this obligation. The remaining two plans, Pre-Medicare

and Post-Medicare, account for $23 million of the Company’s

postretirement medical obligation at year end. The Pre-Medicare

plan covers retirees who do not yet qualify for Medicare and uses

a healthcare cost trend of 11% in the current year, grading down to

6% in fiscal 2012. The Post-Medicare plan provides secondary cover-

age to retirees covered under Medicare and has a healthcare cost

trend of 8%, grading down to 5% in fiscal 2010. Claims in excess of

the Company’s negotiated annual maximum payment are paid by

the plan participants. Assumed healthcare cost trend rates would

have the following effects:

One-Percentage- One-Percentage-

in millions Point Increase Point Decrease

Effect on total of service and interest cost $ 1 $ (1)

Effect on postretirement benefit obligation 26 (21)

48 Ty s on Foods, Inc. 2006 Annual Report

Notes to Consolidated Financial Statements continued

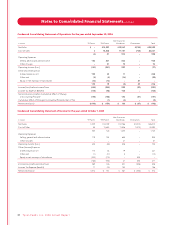

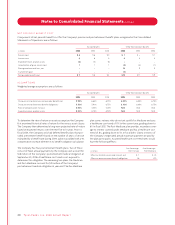

NET PERIODIC BENEFIT CO S T

Components of net periodic benefit cost for the Company’s pension and postretirement benefit plans recognized in the Consolidated

Statements of Operations are as follows:

Pension Benefits Other Postretirement Benefits

in millions 2006 2005 2004 2006 2005 2004

Service cost $ 6 $ 6 $ 3 $ 1 $ – $ 1

Interest cost 66 5 44 4

Expected return on plan assets (6) (5) (5) –– –

Amortization of prior service cost 11 1 (2) (2) (1)

Recognized actuarial loss, net –– – 14 9 5

Curtailment gain –– – (2) – –

Net periodic benefit cost $ 7 $ 8 $ 4 $15 $11 $ 9

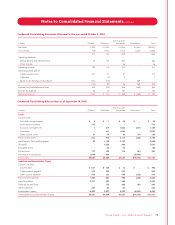

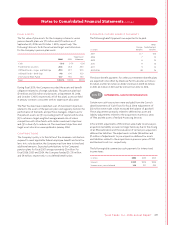

ASSUMPTIONS

Weighted average assumptions are as follows:

Pension Benefits Other Postretirement Benefits

2006 2005 2004 2006 2005 2004

Discount rate to determine net periodic benefit cost 5.94% 6.62% 6.75% 6.00% 6.00% 6.75%

Discount rate to determine benefit obligations 5.80% 5.91% 6.75% 6.10% 6.00% 6.75%

Rate of compensation increase 4.00% 4.00% 4.00% N/A N/A N/A

Expected return on plan assets 8.03% 8.13% 8.50% N/A N/A N/A