Tyson Foods 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

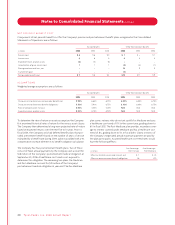

The majority of the Company’s operations are domiciled in the

United States. Approximately 95%, 94% and 94% of sales to external

customers for fiscal years 2006, 2005 and 2004, respectively, were

sourced from the United States. Approximately $6.3 billion of long-

lived assets were located in the United States at September 30, 2006,

and October 1, 2005, and $6.4 billion at October 2, 2004. Approxi-

mately $197 million, $202 million and $171 million of long-lived

assets were located in foreign countries, primarily Canada and

Mexico, at fiscal years ended 2006, 2005 and 2004, respectively.

The Company sells certain products in foreign markets, primarily

Canada, Central America, China, the European Union, Japan,

Mexico, Russia, South Korea, and Taiwan. The Company’s export

sales totaled $2.1 billion for each of fiscal 2006, 2005 and 2004.

Substantially all of the Company’s export sales are facilitated

through unaffiliated brokers, marketing associations and foreign

sales staffs. Foreign sales, which are sales of products produced in

a country other than the United States, were less than 10% of total

consolidated sales for fiscal 2006, 2005 and 2004. In fiscal 2006,

the Company incurred a loss from foreign operations of $36 million

before taxes and cumulative effect of change in accounting princi-

ple. Approximately 21% and 28% of income before taxes for fiscal

2005 and 2004, respectively, was from foreign operations. The

decline in fiscal 2006 was primarily due to decreased margins at

Tyson de Mexico and the Company’s Lakeside operation in Canada.

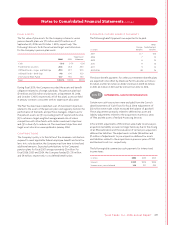

NOTE 18 QUARTERLY FINANCIAL DATA (UNAUDITED)

First SecondThird Fourth

in millions, except per share data Quarter Quarter Quarter Quarter

2006

Sales $6,454 $6,251 $6,383 $6,471

Gross profit 344 153 203 228

Operating income (loss) 110 (142) (25) (20)

Income (loss)

before income taxes 60 (200) (76) (77)

Income tax expense (benefit) 21 (73) (24) (26)

Income (loss) before

cumulative effect of change

in accounting principle 39 (127) (52) (51)

Cumulative effect of change

in accounting principle,

net of tax – – – 5

Net income (loss) 39 (127) (52) (56)

Earnings (loss) before

cumulative effect of change

in accounting principle:

Class A Basic $0.12 $(0.38) $(0.15) $(0.15)

Class B Basic $0.10 $(0.34) $(0.14) $(0.14)

Diluted $0.11 $(0.37) $(0.15) $(0.15)

Cumulative effect of change

in accounting principle,

net of tax:

Class A Basic $ – $ – $ – $ (0.02)

Class B Basic $ – $ – $ – $ (0.01)

Diluted $ – $ – $ – $ (0.02)

Net income (loss):

Class A Basic $0.12 $(0.38) $(0.15) $(0.17)

Class B Basic $0.10 $(0.34) $(0.14) $(0.15)

Diluted $0.11 $(0.37) $(0.15) $(0.17)

2005

Sales $6,452 $6,359 $6,708 $6,495

Gross profit 360 414 519 427

Operating income 126 175 256 188

Net income 48 76 131 117

Class A basic earnings

per share $ 0.14 $0.23 $0.39 $0.35

Class B basic earnings

per share $ 0.13 $0.20 $0.35 $0.32

Diluted earnings per share $ 0.14 $0.21 $0.36 $0.33

54 Ty s on Foods, Inc. 2006 Annual Report

Notes to Consolidated Financial Statements continued