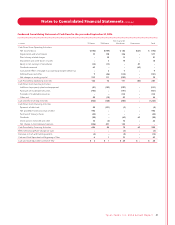

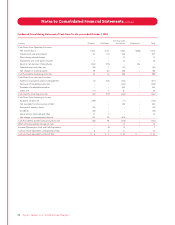

Tyson Foods 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company issues shares under its stock-based compensation

plans by issuing Class A stock from treasury. The total number of

shares available for future grant under the Tyson Foods, Inc. 2000

Stock Incentive Plan (Incentive Plan) was 11,609,585 at September 30,

2006; however, the Board of Directors has submitted a proposal to

the shareholders, which will be voted on at the 2007 annual meet-

ing, to increase the authorized shares under the Stock Incentive

Plan by 20 million.

S T OCK OPTIONS

Shareholders approved the Incentive Plan in January 2001. The

Incentive Plan is administered by the Compensation Committee of

the Board of Directors (Compensation Committee). The Incentive

Plan includes provisions for granting incentive stock options for

shares of Class A stock at a price not less than the fair market value

at the date of grant. Nonqualified stock options may be granted at

a price equal to, less than or more than the fair market value of

Class A stock on the date the option is granted. Stock options under

the Incentive Plan generally become exercisable ratably over two

to five years from the date of grant and must be exercised within

10 years from the date of grant. The Company’s policy is to recog-

nize compensation expense on a straight-line basis over the

requisite service period for the entire award.

Ty s on Foods, Inc. 2006 Annual Report45

Notes to Consolidated Financial Statements continued

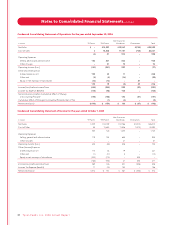

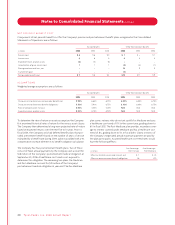

Weighted Weighted

Average Average Aggregate

ExerciseRemaining Intrinsic

Shares Under Price Contractual Value

Option Per ShareLife (in Years) (in millions)

Outstanding, October 1, 2005

17,343,294 $12.93

Exercised (2,259,829) 10.60

Canceled (1,077,275) 14.42

Granted 3,695,728 16.35

Outstanding, September 30, 200617,701,918 13.79 6.0 $43

Exercisable, September 30, 2006 10,054,892 $13.10 4.5 $32

The weighted average grant-date fair value of options granted

during the first quarter of fiscal 2006 was $6.86. No options were

granted during the second, third or fourth quarters of fiscal 2006.

The fair value of each option grant is established on the date of grant

using the Black-Scholes option-pricing model for grants awarded

prior to October 1, 2005, and a binomial lattice method for grants

awarded subsequent to October 1, 2005. The change to the binomial

lattice method was made to better reflect the exercise behavior

of top management. The Company uses historical volatility for a

period of time comparable to the expected life of the option to

determine volatility assumptions. Risk-free interest rates are based

on the five-year Treasury bond rate. Weighted average assumptions

as of September 30, 2006, used in the fair value calculation are

outlined in the following table.

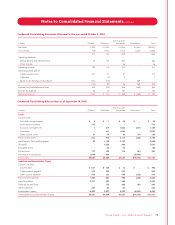

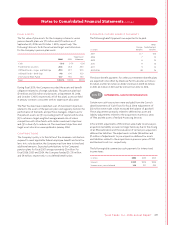

Weighted average expected life 5.9 years

Weighted average risk-free interest rate 3.70%

Range of risk-free interest rates 2.6–4.8%

Weighted average expected volatility 37.83%

Range of expected volatility 35.2–40.1%

Expected dividend yield 1.23%

The Company recognized stock-based compensation expense

related to stock options, net of income taxes, of $9 million during

fiscal 2006, with a $5 million related tax benefit. The Company had

3.3 million options vest in fiscal 2006, with a fair value of $16 million.

In fiscal 2006, the Company received cash of $28 million for the

exercise of stock options. The related tax benefit realized from

stock options exercised during the year ended September 30, 2006,

was $4 million. The total intrinsic value of options exercised in

fiscal 2006, was $10 million. Prior to the adoption of SFAS No. 123R,

the Company classified the tax benefits of deductions resulting

from the exercise of stock options as Cash Flows from Operating

Activities in the Consolidated Statements of Cash Flows. SFAS No. 123R

requires the cash flows resulting from tax deductions in excess of

the compensation cost of those options (excess tax deductions)

to be classified as financing cash flows. The Company realized

$4 million in excess tax deductions during fiscal 2006. As of

September 30, 2006, the Company had $38 million of total unrec-

ognized compensation cost related to stock option plans that will

be recognized over a weighted average period of 2.2 years.