Tyson Foods 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On July 24, 2006, Moody’s Investors Services, Inc. (Moody’s) down-

graded the Company’s credit rating applicable to the 2016 Notes

from “Baa3” to “Ba1.” This downgrade increased the interest rate

on the 2016 Notes from 6.60% to 6.85%, effective on the first day

of the interest period during which the rating change required an

adjustment to the interest rate (i.e., the issuance of the 2016 Notes).

Accordingly, in the fourth quarter, the Company recorded an addi-

tional $0.7 million for the interest period from March 22, 2006, to

July 1, 2006. This downgrade will increase annual interest expense

and related fees by approximately $5 million, including $2.5 million

related to the 2016 Notes.

On July 31, 2006, Standard & Poor’s (S&P) also downgraded the

Company’s credit rating applicable to the 2016 Notes from “BBB”

to “BBB–.” This downgrade did not result in an increase in the

interest rate on the 2016 Notes, nor did it result in an increase

in interest expense or related fees for other debt.

On September 18, 2006, Tyson Fresh Meats, Inc. (TFM), a wholly-

owned subsidiary of the Company, guaranteed the 2016 Notes. This

guarantee does not extend to the other unsecured senior notes of

the Company. Moody’s and S&P did not change the July 2006 credit

ratings applicable to the 2016 Notes. However, Moody’s issued a

new credit rating of “Ba2,” and S&P issued a new credit rating of “BB+”

related to the other unsecured senior notes not guaranteed by TFM.

These new ratings did not impact the interest rate applicable to the

2016 Notes. However, other interest expense and related fees for

other debt increased by less than $3 million.

It is possible one or both of the debt rating agencies may further

downgrade the Company’s bond rating applicable to the 2016 Notes.

S&P currently rates this long-term debt “BBB–,” with a negative out-

look. Moody’s currently rates this debt “Ba1,” with a negative outlook.

The pretax impact to earnings of each further downgrade would

be approximately $5 million annually, per rating agency, of which

$2.5 million would be related to increased interest expense on

the 2016 Notes.

Total debt at September 30, 2006, was approximately $4.0 billion,

an increase of $984 million from October 1, 2005. However, when

adjusted for the $750 million of proceeds on deposit, debt would

have been $3.2 billion, an increase of $234 million from October 1,

2005. Additionally, the Company has an unsecured revolving credit

facility totaling $1.0 billion that supports the Company’s short-term

funding needs and letters of credit. The $1.0 billion facility expires

in September 2010. This agreement was amended on July 27, 2006,

which reduced the availability of the unsecured revolving credit

facility. See below for further description. Also, at September 30, 2006,

the Company had a receivables purchase agreement with three

co-purchasers to sell up to $750 million of trade receivables. These

agreements were restructured and extended in the fourth quarter

of fiscal 2006 and now consist of $375 million expiring August 2007

and $375 million expiring in August 2009. At September 30, 2006,

there was $79.5 million outstanding on each of the commitments.

At October 1, 2005, there were no amounts drawn under the receiv-

ables purchase agreement. Outstanding debt at September 30,

2006, consisted of $3.4 billion of debt securities, a $345 million

term loan and other indebtedness of $246 million.

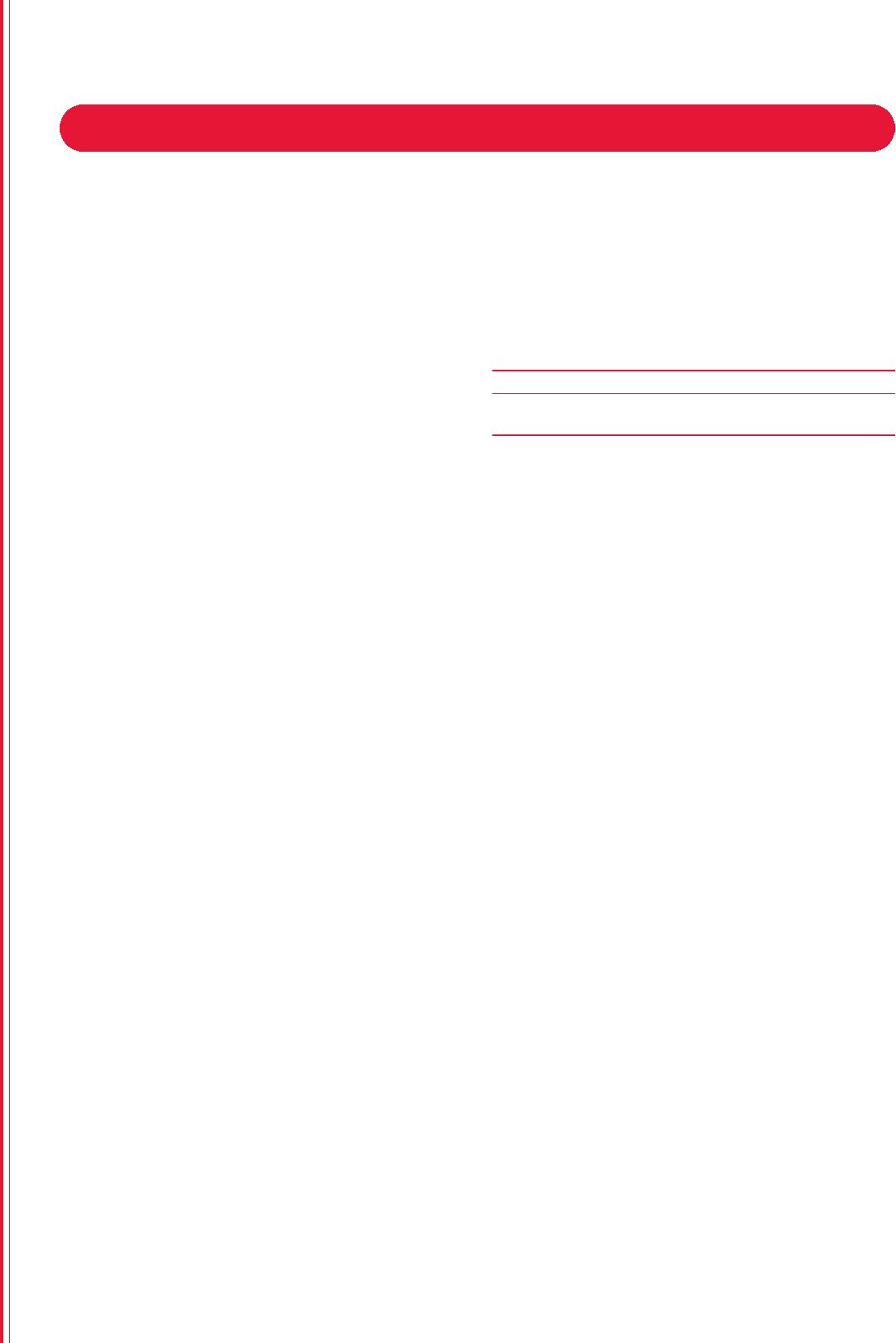

Total Capitalization

in millions 2006 2005 2004

Debt$3,979 $2,995 $3,362

Equity 4,440 4,671 4,292

The revolving credit facility, senior notes, notes, term loan and

accounts receivable securitization contain various covenants, the

more restrictive of which contain a maximum allowed leverage

ratio and a minimum required interest coverage ratio.

On July 27, 2006, the Company entered into a third amendment

to its five-year credit revolving facility and the three-year term

loan facility of its subsidiary, Lakeside Farms Industries, Ltd. These

amendments modified the minimum required interest coverage

ratio, temporarily suspended the maximum allowed leverage ratios

and implemented temporary minimum consolidated EBITDA require-

ments. The Company was in compliance with all of such covenants

at fiscal year end.

In connection with these amendments, the Company’s availability

under its unsecured revolving credit facility decreased, and if the

Company’s credit rating is further downgraded, prior to the delivery

of the second quarter fiscal 2007 compliance certificate, the Company

is required to have certain subsidiaries guarantee the revolving credit

facility and term loan. The amended agreement allows for maximum

availability under the revolving credit facility of 50% of inventory,

reduced by letters of credit issued and amounts outstanding under

its term loan. The amount available as of September 30, 2006, was

$481 million.

The Company’s foreseeable cash needs for operations and capital

expenditures are expected to be met primarily through cash flows

provided by operating activities. Additionally, at September 30, 2006,

the Company had unused borrowing capacity of $1.1 billion, consist-

ing of $481 million available under its $1.0 billion unsecured revolving

credit agreement and $591 million under its accounts receivable

securitization. At September 30, 2006, the Company had con-

struction projects in progress that will require approximately

$182 million to complete. Capital spending for fiscal 2007 is

expected to be approximately $400 million.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements

material to its financial position or results of operations. The off-

balance sheet arrangements the Company has are guarantees of

16 Ty s on Foods, Inc. 2006 Annual Report

Management’s Discussion and Analysiscontinued