Tyson Foods 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

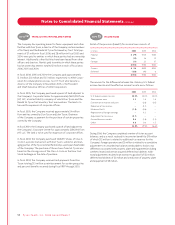

The Company uses a September 30 measurement date for its defined

benefit plans and one postretirement medical plan and a July 31

measurement date for its remaining postretirement medical plans.

The Company generally recognizes the effect of actuarial gains and

losses into earnings immediately rather than amortizing the effect

over future periods.

Other postretirement benefits include postretirement medical costs

and life insurance.

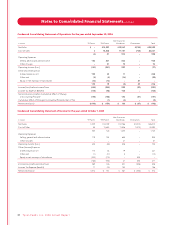

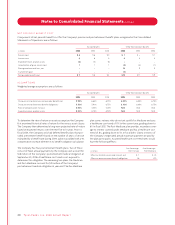

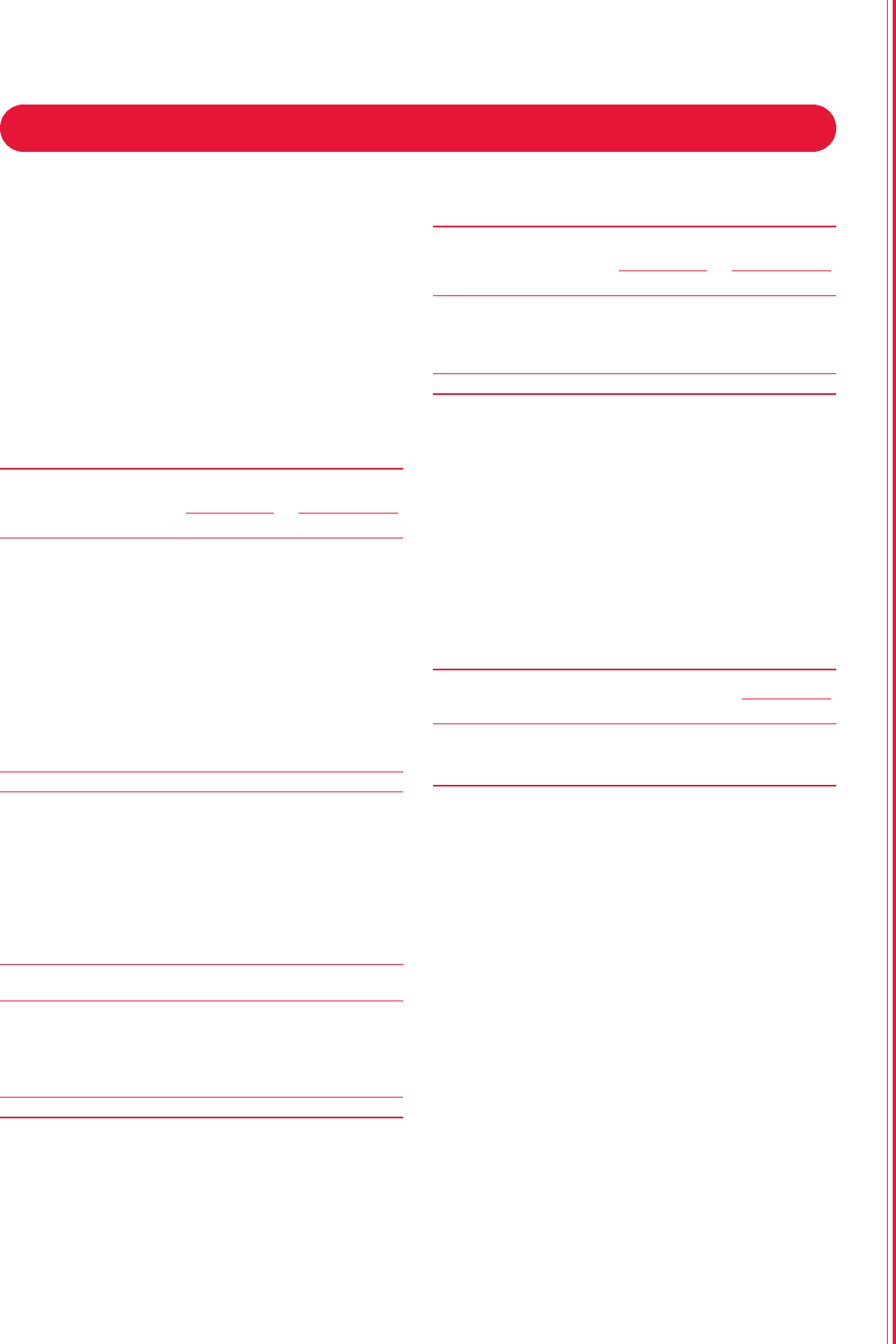

BENEFIT OBLIGATIONS AND FUNDED STATUS

The following table provides a reconciliation of the changes in the

plans’ benefit obligations, assets and funded status as of fiscal year

ends September 30, 2006, and October 1, 2005:

Other Postretirement

Pension Benefits Benefits

in millions 2006 2005 2006 2005

Change in benefit obligation

Benefit obligation at

beginning of year $107 $ 77 $60 $ 66

Service cost 661–

Interest cost 6644

Plan participants’

contributions ––54

Addition of subsidiary plan 118 ––

Amendments ––(3) (9)

Actuarial loss 11 614 9

Benefits paid (7) (6) (18) (14)

Curtailment ––(2) –

Benefit obligation at end of year 124 107 61 60

Change in plan assets

Fair value of plan assets at

beginning of year 82 59 ––

Actual return on plan assets 78––

Employer contributions 210 13 10

Plan participants’

contributions ––54

Addition of subsidiary plan 111 ––

Benefits paid (7) (6) (18) (14)

Fair value of plan assets at

end of year 85 82 ––

Funded status (39) (25) (61) (60)

Amounts not yet recognized:

Unrecognized prior

service cost 67(17) (16)

Unrecognized actuarial loss 25 15 ––

Net amount recognized $(8) $ (3) $(78) $(76)

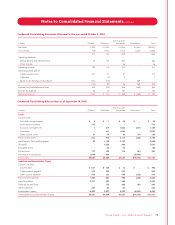

Amounts recognized in the Consolidated Balance Sheets consist of:

Other Postretirement

Pension Benefits Benefits

in millions 2006 2005 2006 2005

Prepaid benefit cost $ – $ 7 $ – $ –

Accrued benefit liability (31) (17) (78) (76)

Accumulated other

comprehensive loss 23 7––

Net amount recognized $(8) $ (3) $(78) $(76)

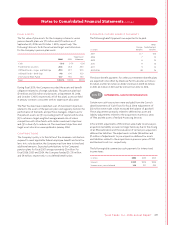

The increase (decrease) in the pretax minimum liability related to

the Company’s pension plans included in other comprehensive

income (loss) was $16 million, $2 million and $(2) million in fiscal

2006, 2005 and 2004, respectively.

At September 30, 2006, all pension plans had an accumulated

benefit obligation in excess of plan assets. At October 1, 2005, two

pension plans had an accumulated benefit obligation in excess of

plan assets, and two pension plans had assets in excess of the accu-

mulated benefit obligation. The accumulated benefit obligation for

all pension plans was $122 million and $98 million at September 30,

2006, and October 1, 2005, respectively. Plans with accumulated

benefit obligations in excess of plan assets are as follows:

Pension Benefits

in millions 2006 2005

Projected benefit obligation $124 $37

Accumulated benefit obligation 122 36

Fair value of plan assets 85 12

Ty s on Foods, Inc. 2006 Annual Report47

Notes to Consolidated Financial Statements continued