Toyota 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 91

Undesignated derivative fi nancial instruments

Toyota uses foreign exchange forward contracts, foreign curren-

cy options, interest rate swaps, interest rate currency swap

agreements, and interest rate options, to manage its exposure

to foreign currency exchange rate fluctuations and interest rate

fluctuations from an economic perspective, and for which Toyota

is unable or has elected not to apply hedge accounting.

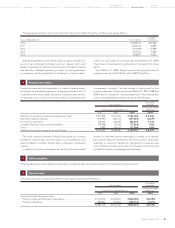

Fair value and gains or losses on derivative fi nancial instruments

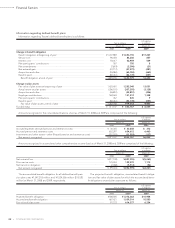

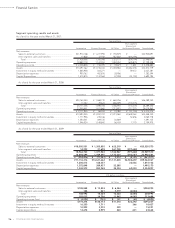

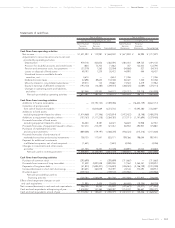

The following table summarizes the fair values of derivative financial instruments at March 31, 2009:

U.S. dollars

Yen in millions in millions

March 31, March 31,

2009 2009

Derivative financial instruments designated as hedging instruments

Interest rate and currency swap agreements

Prepaid expenses and other current assets ................................................................................................... ¥ 35,882 $ 365

Investments and other assets—Other ............................................................................................................ 83,014 845

Total ............................................................................................................................................................... ¥ 118,896 $ 1,210

Other current liabilities .................................................................................................................................... ¥ (47,022) $ (479)

Other long-term liabilities ............................................................................................................................... (79,634) (810)

Total ............................................................................................................................................................... ¥(126,656) $(1,289)

Undesignated derivative financial instruments

Interest rate and currency swap agreements

Prepaid expenses and other current assets ................................................................................................... ¥ 58,454 $ 595

Investments and other assets—Other ............................................................................................................ 177,487 1,807

Total ............................................................................................................................................................... ¥ 235,941 $ 2,402

Other current liabilities .................................................................................................................................... ¥ (61,593) $ (627)

Other long-term liabilities ............................................................................................................................... (236,877) (2,412)

Total ............................................................................................................................................................... ¥(298,470) $(3,039)

Foreign exchange forward and option contracts

Prepaid expenses and other current assets ................................................................................................... ¥ 32,443 $ 330

Investments and other assets—Other ............................................................................................................ 250 3

Total ............................................................................................................................................................... ¥ 32,693 $ 333

Other current liabilities .................................................................................................................................... ¥ (25,675) $ (261)

Total ............................................................................................................................................................... ¥ (25,675) $ (261)

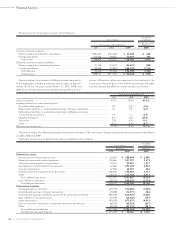

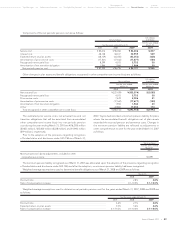

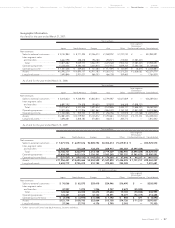

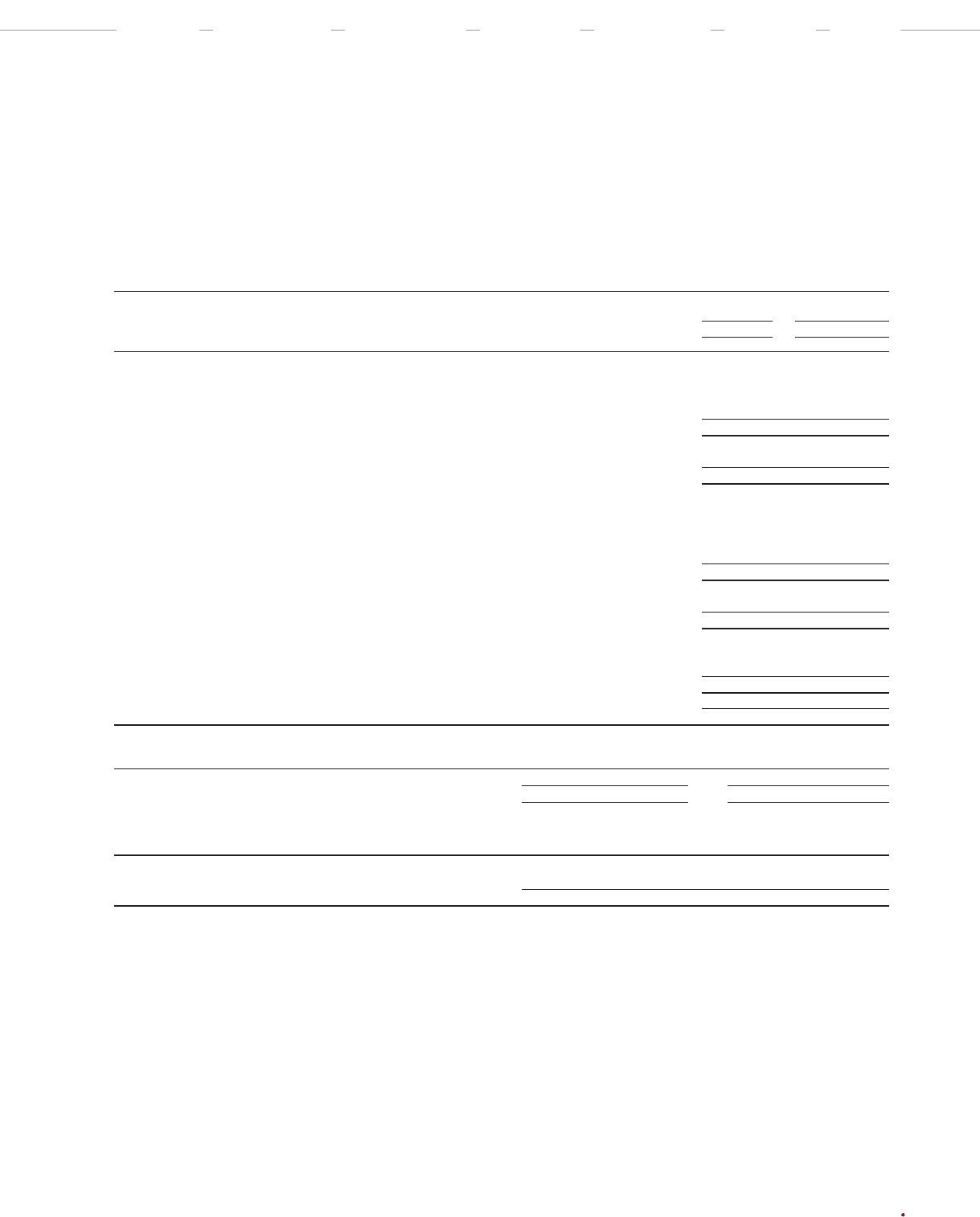

The following table summarizes the notional amounts of derivative financial instruments at March 31, 2009:

Yen in millions U.S. dollars in millions

March 31, 2009 March 31, 2009

Designated Undesignated Designated Undesignated

derivative derivative derivative derivative

financial financial financial financial

instruments instruments instruments instruments

Interest rate and currency swap agreements .................................................. ¥1,907,927 ¥12,472,179 $19,423 $126,969

Foreign exchange forward and option contracts ........................................... — 1,562,876 — 15,911

Total ................................................................................................................ ¥1,907,927 ¥14,035,055 $19,423 $142,880