Toyota 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 87

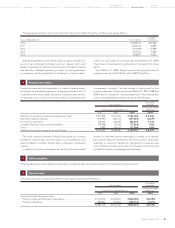

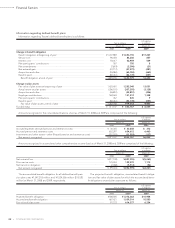

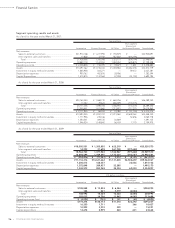

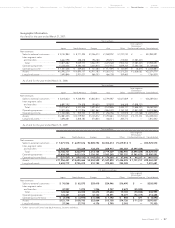

Pension and severance plans

Upon terminations of employment, employees of the parent

company and subsidiaries in Japan are entitled, under the

retirement plans of each company, to lump-sum indemnities or

pension payments, based on current rates of pay and lengths of

service or the number of “points” mainly determined by those.

Under normal circumstances, the minimum payment prior to

retirement age is an amount based on voluntary retirement.

Employees receive additional benefits on involuntary retirement,

including retirement at the age limit.

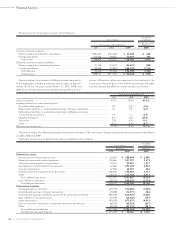

Effective October 1, 2004, the parent company amended its

retirement plan to introduce a “point” based retirement benefit

plan. Under the new plan, employees are entitled to lump-sum

or pension payments determined based on accumulated

“points” vested in each year of service.

There are three types of “points” that vest in each year of ser-

vice consisting of “service period points” which are attributed

to the length of service, “job title points” which are attributed

to the job title of each employee, and “performance points”

which are attributed to the annual performance evaluation of

each employee. Under normal circumstances, the minimum pay-

ment prior to retirement age is an amount reflecting an adjust-

ment rate applied to represent voluntary retirement. Employees

receive additional benefits upon involuntary retirement, includ-

ing retirement at the age limit.

Effective October 1, 2005, the parent company partly amend-

ed its retirement plan and introduced the quasi cash-balance

plan under which benefits are determined based on the vari-

able-interest crediting rate rather than the fixed-interest credit-

ing rate as was in the pre-amended plan.

The parent company and most subsidiaries in Japan have

contributory funded defined benefit pension plans, which are

pursuant to the Corporate Defined Benefit Pension Plan Law

(CDBPPL). The contributions to the plans are funded with sever-

al financial institutions in accordance with the applicable laws

and regulations. These pension plan assets consist principally of

investments in government obligations, equity and fixed income

securities, and insurance contracts.

Most foreign subsidiaries have pension plans or severance

indemnity plans covering substantially all of their employees

under which the cost of benefits are currently invested or

accrued. The benefits for these plans are based primarily on

lengths of service and current rates of pay.

Toyota uses a March 31 measurement date for its benefit

plans.

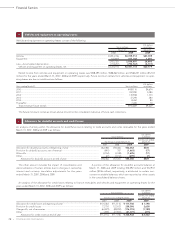

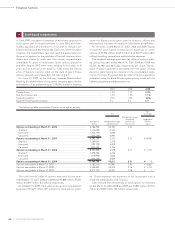

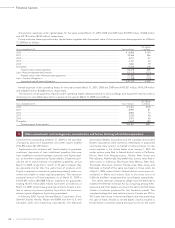

The impact of adopting FAS 158

Toyota adopted the provisions regarding recognition of funded

status and disclosure under FAS 158 as of March 31, 2007.

Toyota recognized the overfunded or underfunded status of its

defined benefit postretirement plans as prepaid pension and

severance costs or accrued pension and severance costs on its

consolidated balance sheet, with corresponding adjustments to

accumulated other comprehensive income, net of tax. The

impacts of adopting the provisions of FAS 158 on Toyota’s con-

solidated balance sheet as of March 31, 2007 are as follows. The

adoption of the provisions had no impact on Toyota’s consoli-

dated statement of income for the year ended March 31, 2007.

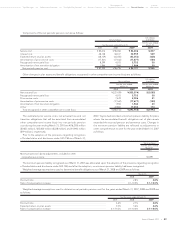

Employee benefit plans:

19

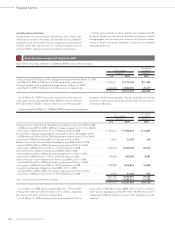

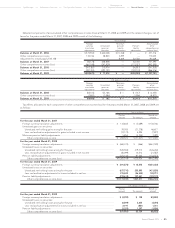

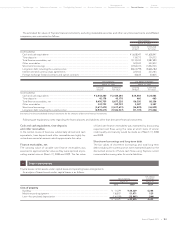

The following table summarizes information for options outstanding and options exercisable at March 31, 2009:

Outstanding Exercisable

Exercise Weighted-average Weighted-average Weighted-average Weighted-average Weighted-average

price range Number of exercise price exercise price remaining life Number of exercise price exercise price

Yen shares Yen Dollars Years shares Yen Dollars

¥3,116–5,000 5,690,700 ¥4,546 $46 5.18 2,220,700 ¥4,264 $43

5,001–7,278 5,650,000 6,724 68 5.85 2,751,000 6,140 63

3,116–7,278 11,340,700 5,631 57 5.51 4,971,700 5,302 54

Yen in millions

Amount before Amount after

adoption of FAS 158 adoption of

FAS 158 Adjustment FAS 158

Investments and other assets—other (Prepaid pension and severance costs) ....................... ¥246,499 ¥142,520 ¥389,019

Accrued expenses (Accrued pension and severance costs) ..................................................... — 30,951 30,951

Accrued pension and severance costs ....................................................................................... 672,154 (31,568) 640,586

Accumulated other comprehensive income (loss) (Pre-tax amount) ........................................ (26,337) 133,437 107,100

Accumulated other comprehensive income (loss) (Net-of-tax amount) .................................. (8,270) 91,029 82,759