Toyota 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 71

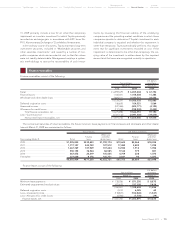

Property, plant and equipment

Property, plant and equipment are stated at cost. Major renew-

als and improvements are capitalized; minor replacements,

maintenance and repairs are charged to current operations.

Depreciation of property, plant and equipment is mainly

computed on the declining-balance method for the parent com-

pany and Japanese subsidiaries and on the straight-line method

for foreign subsidiary companies at rates based on estimated

useful lives of the respective assets according to general class,

type of construction and use. The estimated useful lives range

from 2 to 65 years for buildings and from 2 to 20 years for

machinery and equipment.

Vehicles and equipment on operating leases to third parties

are originated by dealers and acquired by certain consolidated

subsidiaries. Such subsidiaries are also the lessors of certain

property that they acquire directly. Vehicles and equipment on

operating leases are depreciated primarily on a straight-line

method over the lease term, generally 5 years, to the estimated

residual value.

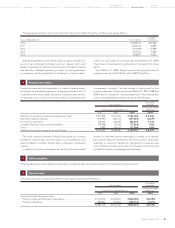

Long-lived assets

Toyota reviews its long-lived assets for impairment whenever

events or changes in circumstances indicate that the carrying

amount of an asset group may not be recoverable. An impair-

ment loss would be recognized when the carrying amount of an

asset group exceeds the estimated undiscounted cash flows

expected to result from the use of the asset and its eventual dis-

position. The amount of the impairment loss to be recorded is

calculated by the excess of the carrying value of the asset group

over its fair value. Fair value is determined mainly using a dis-

counted cash flow valuation method.

Goodwill and intangible assets

Goodwill is not material to Toyota’s consolidated balance

sheets.

Intangible assets consist mainly of software. Intangible assets

with a definite life are amortized on a straight-line basis with

estimated useful lives mainly of 5 years. Intangible assets with

an indefinite life are tested for impairment whenever events or

circumstances indicate that a carrying amount of an asset (asset

group) may not be recoverable. An impairment loss would be

recognized when the carrying amount of an asset exceeds the

estimated undiscounted cash flows used in determining the fair

value of the asset. The amount of the impairment loss to be

recorded is generally determined by the difference between the

fair value of the asset using a discounted cash flow valuation

method and the current book value.

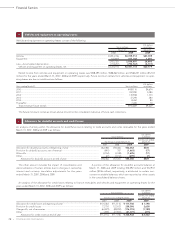

Employee benefi t obligations

Toyota has both defined benefit and defined contribution plans

for employees’ retirement benefits. Retirement benefit obliga-

tions are measured by actuarial calculations in accordance with

a Statement of Financial Accounting Standards (“FAS”) No. 87

Employers’ Accounting for Pensions (“FAS 87”). Toyota adopted

the provisions regarding recognition of funded status and dis-

closure under FAS No. 158, Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans—an amend-

ment of FASB Statements No. 87, 88, 106, and 132(R) (“FAS 158”)

as of March 31, 2007. Under the provisions of FAS 158, the over-

funded or underfunded status of the defined benefit postretire-

ment plans is recognized on the consolidated balance sheets as

prepaid pension and severance costs or accrued pension and

severance costs, and the funded status change is recognized in

the year in which it occurs through comprehensive income. Prior

to the adoption of FAS 158, a minimum pension liability had

been recorded for plans where the accumulated benefit obliga-

tion net of plan assets exceeded the accrued pension and sev-

erance costs. After the adoption of FAS 158, a minimum pension

liability is not recorded.

Environmental matters

Environmental expenditures relating to current operations are

expensed or capitalized as appropriate. Expenditures relating to

existing conditions caused by past operations, which do not

contribute to current or future revenues, are expensed. Liabilities

for remediation costs are recorded when they are probable and

reasonably estimable, generally no later than the completion of

feasibility studies or Toyota’s commitment to a plan of action.

The cost of each environmental liability is estimated by using

current technology available and various engineering, financial

and legal specialists within Toyota based on current law. Such

liabilities do not reflect any offset for possible recoveries from

insurance companies and are not discounted. There were no

material changes in these liabilities for all periods presented.

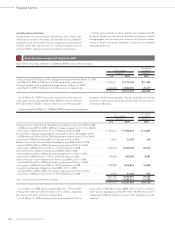

Income taxes

The provision for income taxes is computed based on the pre-

tax income included in the consolidated statement of income.

The asset and liability approach is used to recognize deferred

tax assets and liabilities for the expected future tax consequenc-

es of temporary differences between the carrying amounts and

the tax bases of assets and liabilities. Valuation allowances are

recorded to reduce deferred tax assets when it is more likely

than not that a tax benefit will not be realized.

Derivative fi nancial instruments

Toyota employs derivative financial instruments, including for-

ward foreign currency exchange contracts, foreign currency

options, interest rate swaps, interest rate currency swap agree-

ments and interest rate options to manage its exposure to fluc-

tuations in interest rates and foreign currency exchange rates.

Toyota does not use derivatives for speculation or trading pur-

poses. Changes in the fair value of derivatives are recorded

each period in current earnings or through other comprehensive

income, depending on whether a derivative is designated as

part of a hedge transaction and the type of hedge transaction.

The ineffective portion of all hedges is recognized currently in

operations.