Toyota 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The worldwide financial services industry is highly competitive.

The worldwide financial services industry is highly competitive. Increased

competition in automobile financing may lead to decreased margins. A decline

in Toyota’s vehicle unit sales, an increase in residual value risk due to lower

used vehicle price, increase in the ratio of credit losses and increased funding

costs are factors which may impact Toyota’s financial services operations. The

likelihood of these factors materializing has increased as a result of the

ongoing rapid worldwide economic deterioration, and competition in

automobile financing has intensified. If Toyota is unable to adequately

respond to the changes and competition in automobile financing, Toyota’s

financial services operations may adversely affect its financial condition and

results of operations.

Financial Market and Economic Risks

Toyota’s operations are subject to currency and interest rate

fluctuations.

Toyota is sensitive to fluctuations in foreign currency exchange rates and is

principally exposed to fluctuations in the value of the Japanese yen, the U.S.

dollar and the euro and, to a lesser extent, the Australian dollar, the Canadian

dollar and the British pound. Toyota’s consolidated financial statements, which

are presented in Japanese yen, are affected by foreign currency exchange

fluctuations through both translation risk and transaction risk. Changes in

foreign currency exchange rates may affect Toyota’s pricing of products sold

and materials purchased in foreign currencies. In particular, strengthening of

the Japanese yen against the U.S. dollar can have an adverse effect on

Toyota’s operating results. The fluctuation of the Japanese yen against other

currencies including the U.S. dollar has been particularly great in the past year.

If the Japanese yen further rapidly appreciates against other currencies,

including the U.S. dollar, Toyota’s financial condition and results of operations

may be adversely affected.

Toyota believes that its use of certain derivative financial instruments

including interest rate swaps and increased localized production of its

products have reduced, but not eliminated, the effects of interest rate and

foreign currency exchange rate fluctuations. Nonetheless, a negative impact

resulting from fluctuations in foreign currency exchange rates and changes in

interest rates may adversely affect Toyota’s financial condition and results of

operations. For a further discussion of currency and interest rate fluctuations

and the use of derivative financial instruments, see “Operating and Financial

Review and Prospects — Operating Results — Overview — Currency

Fluctuations”, “Quantitative and Qualitative Disclosures About Market Risk”,

and notes 20 and 21 to Toyota’s consolidated financial statements.

High prices of raw materials and strong pressure on Toyota’s

suppliers could negatively impact Toyota’s profitability.

Increase in prices for raw materials that Toyota and Toyota’s suppliers use in

manufacturing their products or parts and components such as steel, precious

metals, non-ferrous alloys including aluminum, and plastic parts, may lead to

higher production costs for parts and components. This could, in turn,

negatively impact Toyota’s future profitability because Toyota may not be able

to pass all those costs on to its customers or require its suppliers to absorb

such costs.

The downturn in the financial markets could adversely affect

Toyota’s ability to raise capital.

Financial markets worldwide have been significantly disrupted in the wake of

the global financial crisis. A number of financial institutions and investors have

been facing difficulties providing capital to the financial markets due to their

deteriorated financial conditions. As a result, there is a risk that companies may

not be able to raise capital under terms that they would expect to receive with

their creditworthiness. If Toyota is unable to raise the necessary capital under

appropriate conditions on a timely basis, Toyota’s financial condition and

results of operations may be adversely affected.

Political, Regulatory and Legal Risks

The automotive industry is subject to various governmental

regulations.

The worldwide automotive industry is subject to various laws and

governmental regulations including those related to vehicle safety and

environmental matters such as emission levels, fuel economy, noise and

pollution. Many governments also impose tariffs and other trade barriers, taxes

and levies, and enact price or exchange controls. Toyota has incurred, and

expects to incur in the future, significant costs in complying with these

regulations. New legislation or changes in existing legislation may also subject

Toyota to additional expenses in the future.

Toyota may become subject to various legal proceedings.

As an automotive manufacturer, Toyota may become subject to legal

proceedings in respect of various issues, including product liability and

infringement of intellectual property, and Toyota is in fact currently subject to a

number of pending legal proceedings. A negative outcome in one or more of

these pending legal proceedings could adversely affect Toyota’s future

financial condition and results of operations. For a further discussion of

governmental regulations, see “Information on the Company — Business

Overview — Governmental Regulation, Environmental and Safety Standards”

and for legal proceedings, please see “Information on the Company —

Business Overview — Legal Proceedings”.

Toyota may be adversely affected by political instabilities, fuel

shortages or interruptions in transportation systems, natural

calamities, wars, terrorism and labor strikes.

Toyota is subject to various risks associated with conducting business

worldwide. These risks include political and economic instability, natural

calamities, fuel shortages, interruption in transportation systems, wars,

terrorisms, labor strikes and work stoppages. The occurrence of any of these

events in the major markets in which Toyota purchases materials, parts and

components and supplies for the manufacture of its products or in which its

products are produced, distributed or sold, may result in disruptions and

delays in the operations of Toyota’s business. Significant or prolonged

disruptions and delays in Toyota’s business operations may adversely affect

Toyota’s financial condition and results of operations.

Toyota

Milestones

Corporate

Philosophy

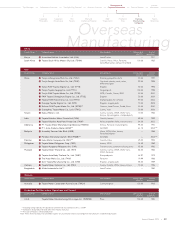

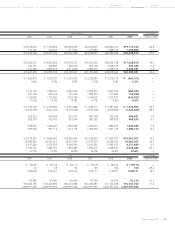

Overseas

Manufacturing

Companies

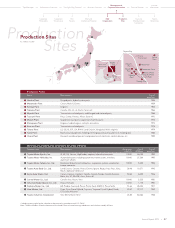

Production

Sites

R&D

Organization

R&D and

Intellectual Property

Risk

Factors

Corporate

Governance

The Right Way ForwardPerformance Overview Financial Section

Investor

Information

Top Messages Business Overview

Management &

Corporate Information

Annual Report 2009 33