Toyota 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 73

December 15, 2008. The presentation and disclosure require-

ments shall be applied retrospectively for all periods presented

in the consolidated financial statements in which FAS 160 is ini-

tially applied. Management is evaluating the impact of adopting

FAS 160 on Toyota’s consolidated financial statements.

In December 2008, FASB issued FSP No. FAS 132(R)-1,

Employers’ Disclosures about Postretirement Benefit Plan Assets

(“FSP FAS 132(R)-1”). FSP FAS 132(R)-1 requires additional dis-

closures about postretirement benefit plan assets including

investment policies and strategies, categories of plan assets, fair

value measurements of plan assets, and significant concentra-

tions of risk. FSP FAS 132(R)-1 is effective for fiscal year ending

after December 15, 2009. Management does not expect this

FSP to have a material impact on Toyota’s consolidated financial

statements.

In April 2009, FASB issued FSP No. FAS 115-2 and FAS 124-2,

Recognition and Presentation of Other-Than-Temporary

Impairments (“FSP FAS 115-2 and FAS 124-2”). FSP FAS 115-2

and FAS 124-2 revises the recognition and presentation require-

ments for other-than-temporary impairments of debt securities,

and contains additional disclosure requirements related to debt

and equity securities. FSP FAS 115-2 and FAS 124-2 is effective

for interim period and fiscal year ending after June 15, 2009.

Management does not expect this FSP to have a material

impact on Toyota’s consolidated financial statements.

In May 2009, FASB issued FAS No. 165, Subsequent Events

(“FAS 165”). FAS 165 is intended to establish general standards of

accounting for and disclosure of events that occur after the bal-

ance sheet date but before financial statements are issued. FAS

165 is effective for interim period or fiscal year ending after June

15, 2009. Management does not expect this Statement to have a

material impact on Toyota’s consolidated financial statements.

Reclassifi cations

Certain prior year amounts have been reclassified to conform to

the presentations as of and for the year ended March 31, 2009.

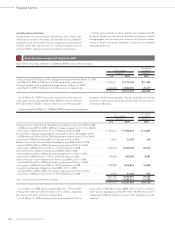

During the year ended March 31, 2008, certain leases that his-

torically have been accounted for as operating leases, were cor-

rected to be accounted for as finance leases. This resulted in the

recognition of current and noncurrent finance receivables and

revenue from financing operations related to finance leases, and

the derecognition of vehicles and equipment on operating leas-

es, accumulated depreciation, revenue from financing opera-

tions related to operating leases, cost of financing operations

including depreciation expense, cash provided by operating

activities and cash used in investing activities, as of and for the

year ended March 31, 2008. At March 31, 2007, the adjustments

resulted in an increase in current assets and a decrease in non-

current assets. For the year ended March 31, 2007, the adjust-

ments resulted in decreases to both additions to equipment

leased to others and proceeds from sales of equipment leased

to others, and increases to both additions to finance receivables

and collection of finance receivables. These adjustments are

immaterial to Toyota’s consolidated financial statements for all

periods presented.

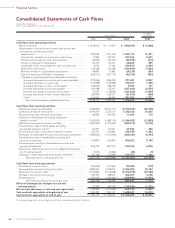

U.S. dollar amounts presented in the consolidated financial

statements and related notes are included solely for the conve-

nience of the reader and are unaudited. These translations

should not be construed as representations that the yen

amounts actually represent, or have been or could be converted

into, U.S. dollars. For this purpose, the rate of ¥98.23 = U.S. $1,

the approximate current exchange rate at March 31, 2009, was

used for the translation of the accompanying consolidated

financial amounts of Toyota as of and for the year ended March

31, 2009.

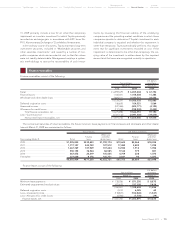

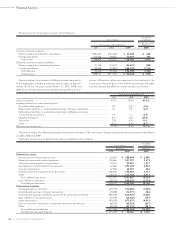

Cash payments for income taxes were ¥741,798 million, ¥921,798

million and ¥563,368 million ($5,735 million) for the years ended

March 31, 2007, 2008 and 2009, respectively. Interest payments

during the years ended March 31, 2007, 2008 and 2009 were

¥550,398 million, ¥686,215 million and ¥614,017 million ($6,251

million), respectively.

Capital lease obligations of ¥6,559 million, ¥7,401 million and

¥28,953 million ($295 million) were incurred for the years ended

March 31, 2007, 2008 and 2009, respectively.

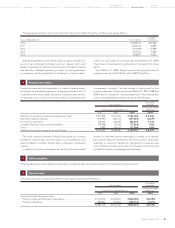

During the years ended March 31, 2007, 2008 and 2009, Toyota

made several acquisitions, however the assets acquired and lia-

bilities assumed were not material.

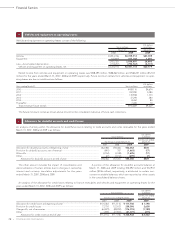

U.S. dollar amounts:

3

Supplemental cash flow information:

4

Acquisitions and dispositions:

5