Toyota 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 51

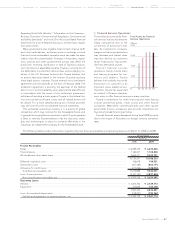

Operating Income and Loss

Toyota’s operating income

decreased by ¥2,731.3 billion to

an operating loss of ¥461.0 bil-

lion during fiscal 2009 compared

with the prior year. This operat-

ing loss was unfavorably affected

by the decrease in vehicle unit

sales, the changes in sales mix,

the increased expenses and the

impact of the decrease in parts

sales, partially offset by the

decrease in research and devel-

opment expenses.

During fiscal 2009, operating

income (before the elimination of

intersegment profits) for signifi-

cant geographic regions

decreased by ¥1,677.8 billion in

Japan, decreased by ¥695.5 bil-

lion in North America, decreased

by ¥284.8 billion in Europe, decreased by ¥80.3 billion, or 31.3%,

in Asia, and decreased by ¥56.3 billion, or 39.1% in Other com-

pared with the prior year. The decrease in Japan was mainly due

to decreases in both production volume and vehicle unit sales in

the export markets, partially offset by the decrease in research

and development expenses. The decrease in North America

was mainly due to decreases in both production volume and

vehicle unit sales, the increases in the provision for credit losses,

net charge-offs and allowance for residual value losses in sales

finance subsidiaries in the United States, partially offset by the

impact of the fluctuations in foreign currency translation rates.

The decrease in Europe was mainly due to decreases in both

production volume and vehicle unit sales, partially offset by the

impact of fluctuations in foreign currency translation rates. The

decrease in Asia was mainly due to decreases in both produc-

tion volume and vehicle unit sales, and the impact of the fluctu-

ations in foreign currency translation rates. The decrease in

Other was primarily due to the decrease in vehicle unit sales.

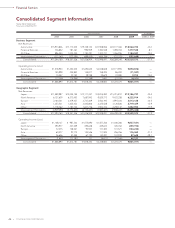

The following is a discussion of operating income for each of

Toyota’s business segments. The operating income amounts

discussed are before the elimination of intersegment profits.

• Automotive Operations Segment

Operating income from Toyota’s automotive operations

decreased by ¥2,566.7 billion to an operating loss of ¥394.8 bil-

lion during fiscal 2009 compared with the prior year. This

decrease was primarily attributed to the decrease in vehicle unit

sales, the changes in sales mix, the increased expenses, and the

impact of the decrease in parts sales, partially offset by the

decrease in research and development expenses.

• Financial Services Operations Segment

Operating income from Toyota’s financial services operations

decreased by ¥158.5 billion to an operating loss of ¥72.0 billion

during fiscal 2009 compared with the prior year. This decrease

was primarily due to the increases in the provision for credit

losses, net charge-offs and allowance for residual value losses,

and the increase in valuation losses on interest rate swaps stated

at fair value in sales finance subsidiaries, partially offset by the

impact of a higher volume of financing activities.

• All Other Operations Segment

Operating income from Toyota’s other operations segment

decreased by ¥23.1 billion, or 70.0% to ¥9.9 billion during fiscal

2009 compared with the prior year.

Other Income and Expenses

Interest and dividend income decreased by ¥27.3 billion, or

16.4%, to ¥138.4 billion during fiscal 2009 compared with the

prior year mainly due to a decrease in interest income from mar-

ketable securities.

Interest expense increased by ¥0.8 billion, or 1.7%, to ¥46.9

billion during fiscal 2009 compared with the prior year.

Foreign exchange gains, net decreased by ¥11.0 billion to a

loss of ¥1.8 billion during fiscal 2009 compared with the prior

year. Foreign exchange gains and losses include the differences

between the value of foreign currency denominated sales trans-

lated at prevailing exchange rates and the value of the sales

amounts settled during the year, including those settled using

forward foreign currency exchange contracts.

Other income, net decreased by ¥227.2 billion to a loss of

¥189.1 billion during fiscal 2009 compared with the prior year.

This decrease was mainly due to the recognition of impairment

losses on available-for sale securities.

Income Taxes

The provision for income taxes decreased by ¥968.0 billion to a

tax benefit of ¥56.5 billion during fiscal 2009 compared with the

prior year primarily due to the decrease in income before

income taxes. The effective tax rate was 10.1%, which was lower

than its statutory tax rate in Japan primarily due to a recognition

of valuation allowance for deferred tax assets at domestic and

overseas subsidiaries.

Minority Interest in Consolidated Subsidiaries and

Equity in Earnings of Affi liated Companies

Minority interest in consolidated subsidiaries decreased by

¥102.2 billion to a loss of ¥24.2 billion during fiscal 2009 com-

pared with the prior year. This decrease was mainly due to a

decrease in net income at consolidated subsidiaries.

Equity in earnings of affiliated companies during fiscal 2009

decreased by ¥227.4 billion, or 84.2%, to ¥42.7 billion compared

with the prior year. This decrease was due to a decrease in net

income at the affiliated companies.

Operating Income (Loss)

(¥ Billion)

’08’07 ’09’06’05FY

2,500

2,000

1,500

500

-500

1,000

0

20

(%)

16

12

4

-4

8

0

% of net revenues (Ri

g

ht scale)