Toyota 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 89

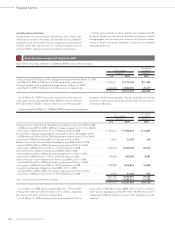

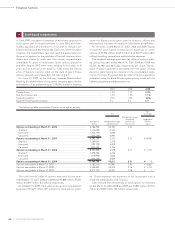

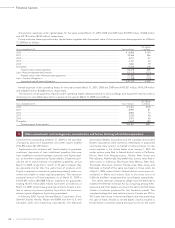

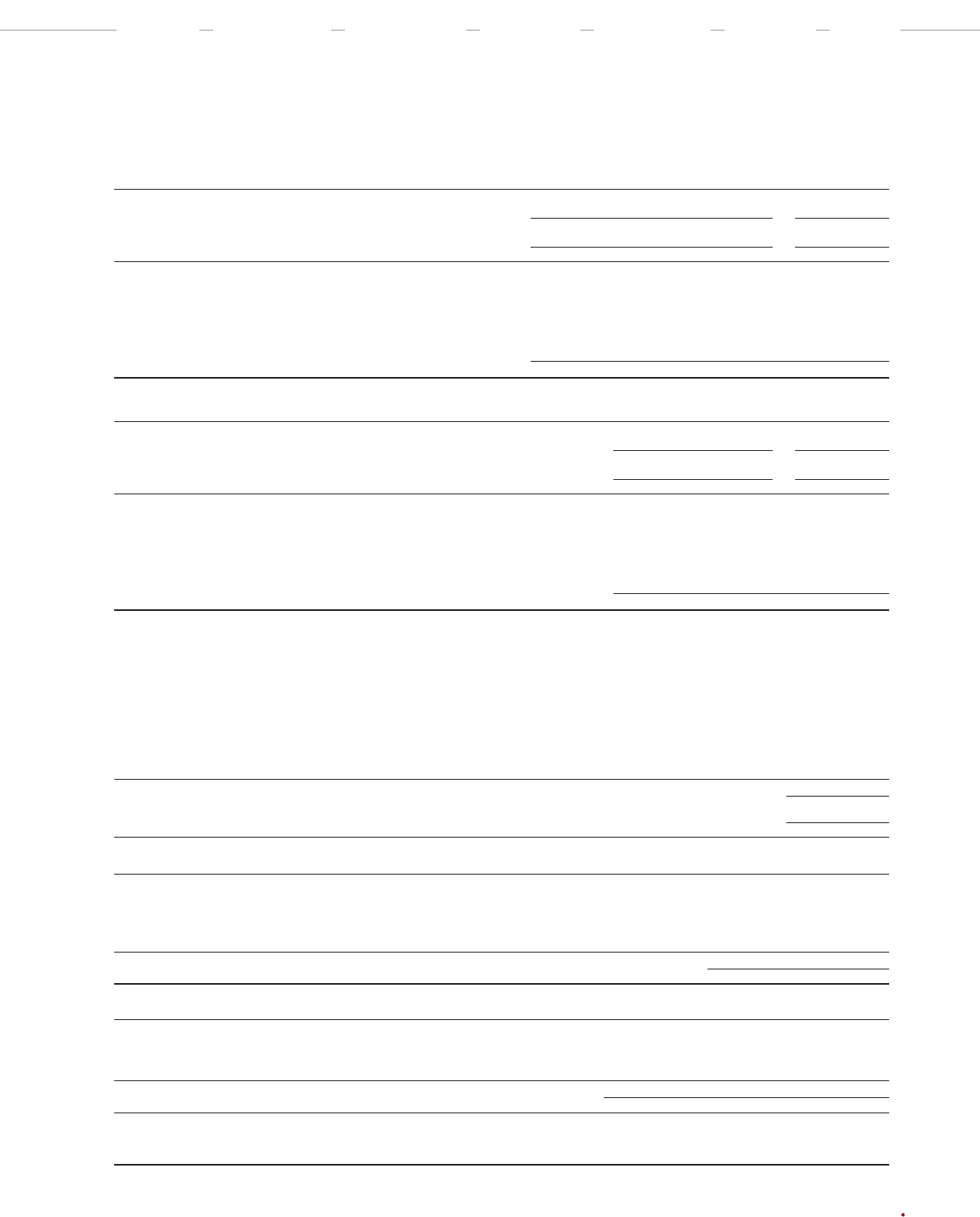

Components of the net periodic pension cost are as follows:

U.S. dollars

Yen in millions in millions

For the year ended

For the years ended March 31, March 31,

2007 2008 2009 2009

Service cost ......................................................................................................... ¥ 80,414 ¥ 96,454 ¥ 84,206 $ 857

Interest cost ......................................................................................................... 48,128 54,417 52,959 539

Expected return on plan assets ......................................................................... (38,139) (43,450) (43,053) (438)

Amortization of prior service costs .................................................................... (17,301) (17,162) (17,677) (180)

Recognized net actuarial loss ............................................................................ 8,299 4,013 5,752 58

Amortization of net transition obligation ......................................................... 1,944 1,944 1,944 20

Net periodic pension cost.............................................................................. ¥ 83,345 ¥ 96,216 ¥ 84,131 $ 856

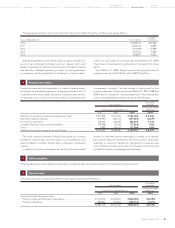

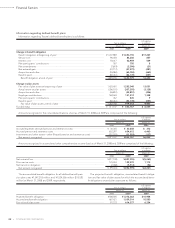

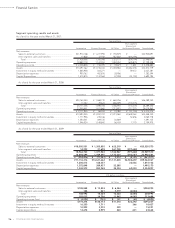

Other changes in plan assets and benefit obligations recognized in other comprehensive income (loss) are as follows:

U.S. dollars

Yen in millions in millions

For the year ended For the year ended

March 31, March 31,

2008 2009 2009

Net actuarial loss .......................................................................................................................... ¥(227,439) ¥(303,074) $(3,085)

Recognized net actuarial loss ...................................................................................................... 4,013 5,752 58

Prior service costs ......................................................................................................................... 7,619 2,096 21

Amortization of prior service costs .............................................................................................. (17,162) (17,677) (180)

Amortization of net transition obligation ................................................................................... 1,944 1,944 20

Other.............................................................................................................................................. 24,882 17,003 173

Total recognized in other comprehensive income (loss) ....................................................... ¥(206,143) ¥(293,956) $(2,993)

The minimum pension liability recognized as of March 31, 2007 was eliminated upon the adoption of the provisions regarding recognition

of funded status and disclosure under FAS 158, and after the adoption, no minimum pension liability had been recognized.

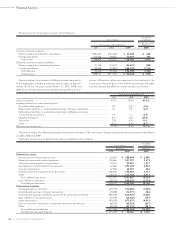

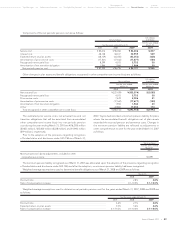

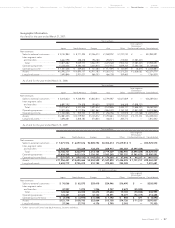

Weighted-average assumptions used to determine benefit obligations as of March 31, 2008 and 2009 are as follows:

March 31,

2008 2009

Discount rate .............................................................................................................................................................. 2.8% 2.8%

Rate of compensation increase ................................................................................................................................ 0.1–10.0% 0.1–10.0%

Weighted-average assumptions used to determine net periodic pension cost for the years ended March 31, 2007, 2008 and 2009 are

as follows:

For the years ended March 31,

2007 2008 2009

Discount rate ............................................................................................................................. 2.6% 2.7% 2.8%

Expected return on plan assets ............................................................................................... 3.0% 3.4% 3.6%

Rate of compensation increase ............................................................................................... 0.1–11.0% 0.1–10.0% 0.1–10.0%

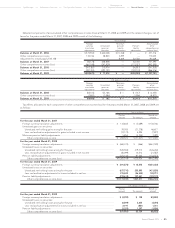

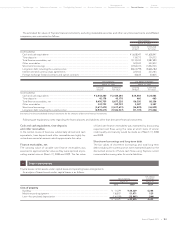

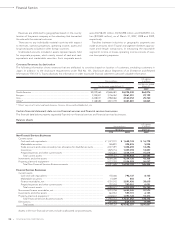

The estimated prior service costs, net actuarial loss and net

transition obligations that will be amortized from accumulated

other comprehensive income (loss) into net periodic pension

cost during the year ending March 31, 2010 are ¥(16,200) million

($(165) million), ¥22,400 million ($228 million) and ¥1,900 million

($19 million), respectively.

Prior to the adoption of the provisions regarding recognition

of funded status and disclosure under FAS 158 as of March 31,

2007, Toyota had recorded a minimum pension liability for plans

where the accumulated benefit obligation net of plan assets

exceeded the accrued pension and severance costs. Changes in

the minimum pension liability are reflected as adjustments in

other comprehensive income for the year ended March 31, 2007

as follows:

Yen in millions

For the years ended

March 31,

2007

Minimum pension liability adjustments, included in other

comprehensive income ................................................................................................................................................................... ¥3,499