Toyota 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 67

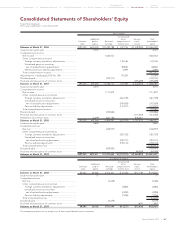

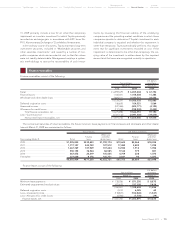

Consolidated Statements of Shareholders’ Equity

Yen in millions

Accumulated

Additional other Treasury Total

Common paid-in Retained comprehensive stock, shareholders’

stock capital earnings income (loss) at cost equity

Balances at March 31, 2006 ............................................... ¥397,050 ¥495,250 ¥10,459,788 ¥ 437,316 ¥(1,228,955) ¥10,560,449

Issuance during the year ....................................................... 2,343 2,343

Comprehensive income

Net income ......................................................................... 1,644,032 1,644,032

Other comprehensive income

Foreign currency translation adjustments .................... 130,746 130,746

Unrealized gains on securities,

net of reclassification adjustments ............................. 38,800 38,800

Minimum pension liability adjustments ....................... 3,499 3,499

Total comprehensive income ............................................ 1,817,077

Adjustment to initially apply FAS No. 158 ........................... 91,029 91,029

Dividends paid ....................................................................... (339,107) (339,107)

Purchase and reissuance of common stock ........................ (295,699) (295,699)

Balances at March 31, 2007 ............................................... 397,050 497,593 11,764,713 701,390 (1,524,654) 11,836,092

Issuance during the year ....................................................... 3,475 3,475

Comprehensive income

Net income ......................................................................... 1,717,879 1,717,879

Other comprehensive income (loss)

Foreign currency translation adjustments .................... (461,189) (461,189)

Unrealized losses on securities,

net of reclassification adjustments ............................. (347,829) (347,829)

Pension liability adjustments ......................................... (133,577) (133,577)

Total comprehensive income ............................................ 775,284

Dividends paid ....................................................................... (430,860) (430,860)

Purchase and reissuance of common stock ........................ (314,464) (314,464)

Retirement of common stock ............................................... (3,499) (643,182) 646,681 —

Balances at March 31, 2008 ............................................... 397,050 497,569 12,408,550 (241,205) (1,192,437) 11,869,527

Issuance during the year ....................................................... 3,642 3,642

Comprehensive loss

Net loss ............................................................................... (436,937) (436,937)

Other comprehensive income (loss)

Foreign currency translation adjustments .................... (381,303) (381,303)

Unrealized losses on securities,

net of reclassification adjustments ............................. (293,101) (293,101)

Pension liability adjustments ......................................... (192,172) (192,172)

Total comprehensive loss .................................................. (1,303,513)

Dividends paid ....................................................................... (439,991) (439,991)

Purchase and reissuance of common stock ........................ (68,458) (68,458)

Balances at March 31, 2009 ...............................................

¥397,050 ¥501,211 ¥11,531,622 ¥(1,107,781) ¥(1,260,895) ¥10,061,207

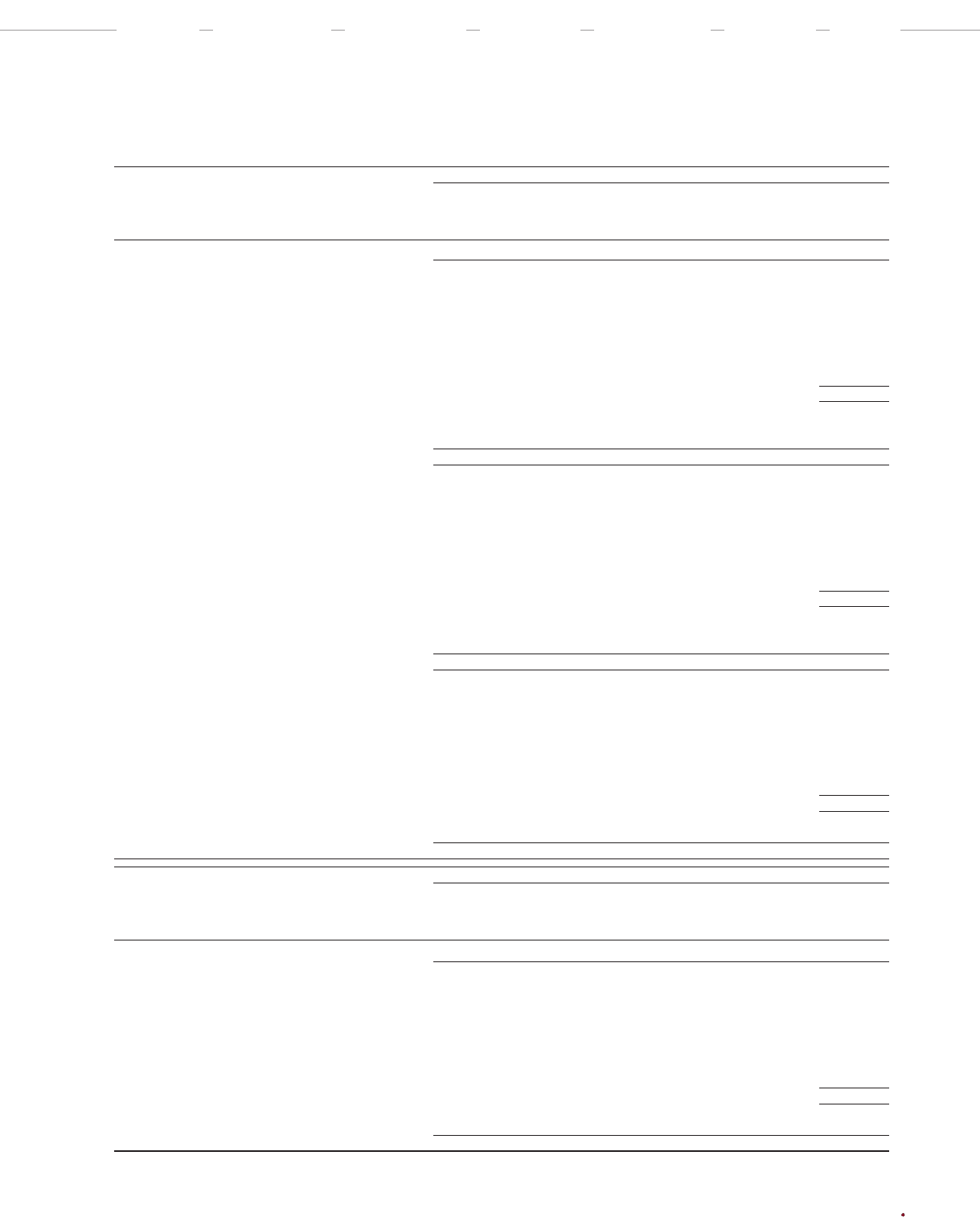

U.S. dollars in millions

Accumulated

Additional other Treasury Total

Common paid-in Retained comprehensive stock, shareholders’

stock capital earnings income (loss) at cost equity

Balances at March 31, 2008 ............................................... $4,042 $5,065 $126,321 $ (2,455) $(12,139) $120,834

Issuance during the year ....................................................... 37 37

Comprehensive loss

Net loss ............................................................................... (4,448) (4,448)

Other comprehensive income (loss)

Foreign currency translation adjustments .................... (3,882) (3,882)

Unrealized losses on securities,

net of reclassification adjustments ............................. (2,984) (2,984)

Pension liability adjustments ......................................... (1,956) (1,956)

Total comprehensive loss .................................................. (13,270)

Dividends paid ....................................................................... (4,479) (4,479)

Purchase and reissuance of common stock ........................ (697) (697)

Balances at March 31, 2009 ...............................................

$4,042 $5,102 $117,394 $(11,277) $(12,836) $102,425

The accompanying notes are an integral part of these consolidated financial statements.

Toyota Motor Corporation

For the years ended March 31, 2007, 2008 and 2009