Toyota 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

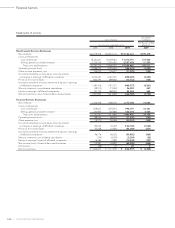

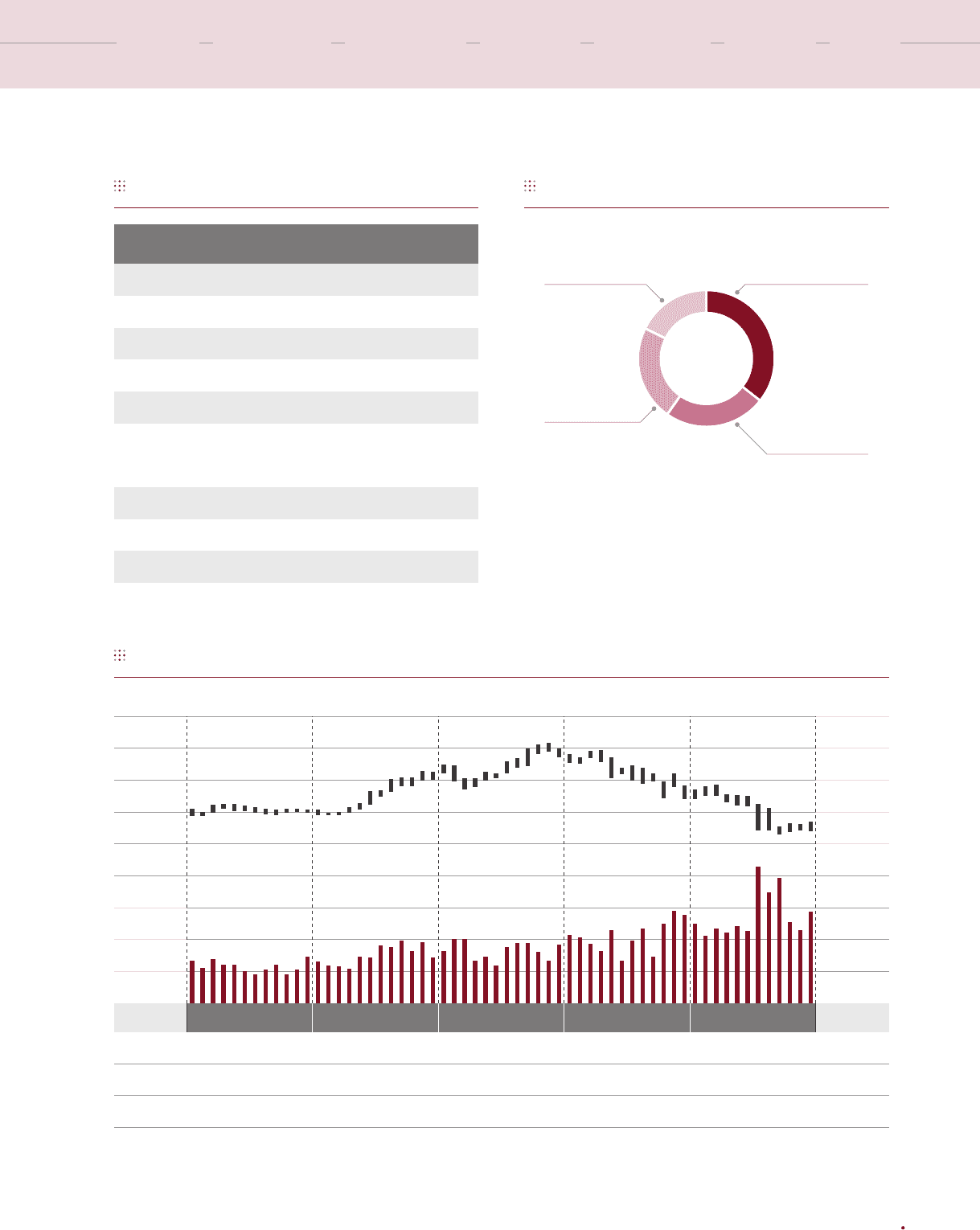

Major Shareholders (Top 10)

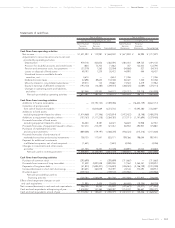

Toyota’s Stock Price and Trading Volume on the Tokyo Stock Exchange

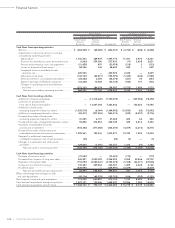

Ownership Breakdown

Japan Trustee Services Bank, Ltd.

Toyota Industries Corporation

The Master Trust Bank of Japan, Ltd.

Nippon Life Insurance Company

State Street Bank and Trust Company

The Bank of New York Mellon

as Depositary Bank

for Depositary Receipt Holders

Trust & Custody Services Bank, Ltd.

Tokio Marine & Nichido Fire Insurance Co., Ltd.

Mitsui Sumitomo Insurance Company, Limited

JPMorgan Chase Bank

353,082

201,195

192,363

130,791

119,887

85,081

84,527

83,821

65,166

60,854

Name Number of Shares Held

(Thousands)

10,000

8,000

6,000

4,000

2,000

0

Stock price (¥)

400

300

200

100

0

Trading volume

(Million shares)

FY 2005 FY 2006 FY 2007 FY 2009FY 2008

4,520 6,560 8,350 7,880 5,710

High (¥)

3,730 3,790 5,430 4,810 2,585

Low (¥)

3,990 6,430 7,550 4,970 3,120

At Year-End (¥)

Note: Individuals, etc. includes shares of 312 million treasury stock.

35.7%

Financial institutions,

Brokerages

17.6%

Other corporate

entities

24.1%

Foreign corporate

entities and others

22.6%

Individuals, etc.

Note: Fiscal years ended March 31

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 109