Toyota 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section

TOYOTA MOTOR CORPORATION

68

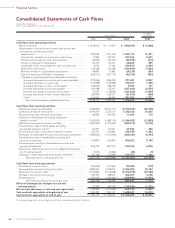

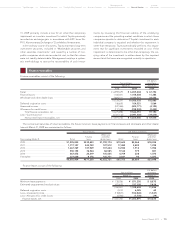

Consolidated Statements of Cash Flows

U.S. dollars

Yen in millions in millions

2007 2008 2009 2009

Cash flows from operating activities

Net income (loss) ............................................................................... ¥ 1,644,032 ¥ 1,717,879 ¥ (436,937) $ (4,448)

Adjustments to reconcile net income (loss) to net cash

provided by operating activities

Depreciation ................................................................................... 1,382,594 1,491,135 1,495,170 15,221

Provision for doubtful accounts and credit losses ...................... 71,862 122,790 257,433 2,621

Pension and severance costs, less payments .............................. (32,054) (54,341) (20,958) (213)

Losses on disposal of fixed assets ................................................ 50,472 45,437 68,682 699

Unrealized losses on available-for-sale securities, net ................ 4,614 11,346 220,920 2,249

Deferred income taxes .................................................................. 132,308 81,458 (194,990) (1,985)

Minority interest in consolidated subsidiaries ............................. 49,687 77,962 (24,278) (247)

Equity in earnings of affiliated companies ................................... (209,515) (270,114) (42,724) (435)

Changes in operating assets and liabilities, and other

(Increase) decrease in accounts and notes receivable ............ (212,856) (206,793) 791,481 8,057

(Increase) decrease in inventories ............................................. (133,698) (149,984) 192,379 1,958

(Increase) decrease in other current assets .............................. (108,767) (82,737) 9,923 101

Increase (decrease) in accounts payable .................................. 104,188 62,241 (837,402) (8,525)

Increase (decrease) in accrued income taxes .......................... 74,255 (118,030) (251,868) (2,564)

Increase (decrease) in other current liabilities ......................... 264,490 206,911 (41,819) (426)

Other ........................................................................................... 156,561 46,464 291,893 2,972

Net cash provided by operating activities ........................... 3,238,173 2,981,624 1,476,905 15,035

Cash flows from investing activities

Additions to finance receivables ...................................................... (7,489,096) (8,647,717) (7,700,459) (78,392)

Collection of finance receivables ..................................................... 6,190,661 7,223,573 7,232,152 73,625

Proceeds from sale of finance receivables ...................................... 84,083 109,124 11,290 115

Additions to fixed assets excluding equipment

leased to others ............................................................................... (1,425,814) (1,480,570) (1,364,582) (13,892)

Additions to equipment leased to others ....................................... (1,264,381) (1,279,405) (960,315) (9,776)

Proceeds from sales of fixed assets excluding

equipment leased to others............................................................ 64,421 67,551 47,386 482

Proceeds from sales of equipment leased to others ...................... 321,761 375,881 528,749 5,383

Purchases of marketable securities and security investments ....... (1,068,205) (1,151,640) (636,030) (6,475)

Proceeds from sales of marketable securities and

security investments ........................................................................ 148,442 165,495 800,422 8,148

Proceeds upon maturity of marketable securities and

security investments ........................................................................ 676,729 821,915 675,455 6,876

Payment for additional investments in affiliated companies,

net of cash acquired ........................................................................ (1,651) (4,406) (45) (0)

Changes in investments and other assets, and other ..................... (51,328) (74,687) 135,757 1,382

Net cash used in investing activities ..................................... (3,814,378) (3,874,886) (1,230,220) (12,524)

Cash flows from financing activities

Purchase of common stock ............................................................... (295,699) (311,667) (70,587) (719)

Proceeds from issuance of long-term debt ..................................... 2,890,000 3,349,812 3,506,990 35,702

Payments of long-term debt ............................................................. (1,726,823) (2,310,008) (2,704,078) (27,528)

Increase in short-term borrowings ................................................... 353,397 408,912 406,507 4,138

Dividends paid ................................................................................... (339,107) (430,860) (439,991) (4,479)

Net cash provided by financing activities ............................ 881,768 706,189 698,841 7,114

Effect of exchange rate changes on cash and

cash equivalents ................................................................................. 25,429 (84,759) (129,793) (1,321)

Net increase (decrease) in cash and cash equivalents ................... 330,992 (271,832) 815,733 8,304

Cash and cash equivalents at beginning of year ............................ 1,569,387 1,900,379 1,628,547 16,579

Cash and cash equivalents at end of year ....................................... ¥ 1,900,379 ¥ 1,628,547 ¥ 2,444,280 $ 24,883

The accompanying notes are an integral part of these consolidated financial statements.

Toyota Motor Corporation

For the years ended March 31, 2007, 2008 and 2009