Toyota 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section

TOYOTA MOTOR CORPORATION

48

Toyota’s finance receivables are subject to collectibility risks.

These risks include consumer and dealer insolvencies and insuf-

ficient collateral values (less costs to sell) to realize the full carry-

ing values of these receivables. See discussion in the Critical

Accounting Estimates section regarding “Allowance for Doubtful

Accounts and Credit Losses” and note 11 to the consolidated

financial statements regarding the allowance for credit losses.

Toyota continues to originate leases to finance new Toyota

vehicles. These leasing activities are subject to residual value

risk. Residual value risk could arise when the lessee of a vehicle

does not exercise the option to purchase the vehicle at the end

of the lease term. See discussion in the Critical Accounting

Estimates section regarding “Investment in Operating Leases”

and note 2 to the consolidated financial statements regarding

the allowance for residual values losses.

Toyota primarily enters into interest rate swap agreements

and cross currency interest rate swap agreements to convert its

fixed-rate debt to variable-rate functional currency debt. A por-

tion of the derivative instruments are entered into to hedge

interest rate risk from an economic perspective and are not

de signated to specific assets or liabilities on Toyota’s consolidat-

ed balance sheet and accordingly, unrealized gains or losses

related to derivatives that are not designated are recognized cur-

rently in operations. See discussion in the Critical Accounting

Estimates section regarding “Derivatives and Other Contracts at

Fair Value”, further discussion in the Market Risk Disclosures

section and note 20 to the consolidated financial statements.

In addition, aggregated funding costs can affect the profit-

ability of Toyota’s financial services operations. Funding costs

are affected by a number of factors, some of which are not in

Toyota’s control. These factors include general economic condi-

tions, prevailing interest rates and Toyota’s financial strength.

Funding costs increased during fiscal 2008 as a result of an

increase in borrowings. Funding costs decreased during fiscal

2009 mainly as a result of lower interest rate.

Toyota launched its credit card business in Japan at the

beginning of fiscal 2002. As of March 31, 2008, Toyota had 6.6

million cardholders, an increase of 0.5 million cardholders com-

pared with March 31, 2007, and as of March 31, 2009, Toyota

had 7.1 million cardholders, an increase of 0.5 million cardhold-

ers compared with March 31, 2008. The credit card receivables

at March 31, 2008 increased by ¥24.5 billion from March 31, 2007

to ¥225.7 billion. The credit card receivables at March 31, 2009

decreased by ¥1.1 billion from March 31, 2008 to ¥224.6 billion.

Other Business Operations

Toyota’s other business operations consist of housing, including the

manufacture and sale of prefabricated homes; information technol-

ogy related businesses, including information technology and tele-

communications, intelligent transport systems, GAZOO; others.

Toyota does not expect its other business operations to mate-

rially contribute to Toyota’s consolidated results of operations.

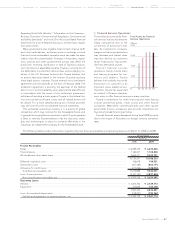

Currency Fluctuations

Toyota is sensitive to fluctuations in foreign currency exchange

rates. In addition to the Japanese yen, Toyota is principally

exposed to fluctuations in the value of the U.S. dollar and the

euro and, to a lesser extent, the Australian dollar, the Canadian

dollar and the British pound. Toyota’s consolidated financial

statements, which are presented in Japanese yen, are affected

by foreign currency exchange fluctuations through both transla-

tion risk and transaction risk.

Translation risk is the risk that Toyota’s consolidated financial

statements for a particular period or for a particular date will be

affected by changes in the prevailing exchange rates of the cur-

rencies in those countries in which Toyota does business com-

pared with the Japanese yen. Even though the fluctuations of

currency exchange rates to the Japanese yen can be substantial,

and, therefore, significantly impact comparisons with prior peri-

ods and among the various geographic markets, the translation

risk is a reporting consideration and does not reflect Toyota’s

underlying results of operations. Toyota does not hedge against

translation risk.

Transaction risk is the risk that the currency structure of

Toyota’s costs and liabilities will deviate from the currency struc-

ture of sales proceeds and assets. Transaction risk relates primarily

to sales proceeds from Toyota’s non-domestic operations from

vehicles produced in Japan.

Toyota believes that the location of its production facilities in

different parts of the world has significantly reduced the level of

transaction risk. As part of its globalization strategy, Toyota has

continued to localize production by constructing production

facilities in the major markets in which it sells its vehicles. In cal-

endar 2007 and 2008, Toyota produced 61.4% and 64.1% of

Toyota’s non-domestic sales outside Japan, respectively. In

North America, 57.2% and 57.4% of vehicles sold in calendar

2007 and 2008 were produced locally, respectively. In Europe,

64.0% and 60.9% of vehicles sold in calendar 2007 and 2008

were produced locally, respectively. Localizing production

enables Toyota to locally purchase many of the supplies and

resources used in the production process, which allows for a

better match of local currency revenues with local currency

expenses.

Toyota also enters into foreign currency transactions and

other hedging instruments to address a portion of its transac-

tion risk. This has reduced, but not eliminated, the effects of for-

eign currency exchange rate fluctuations, which in some years

can be significant. See notes 20 and 21 to the consolidated

financial statements for additional information regarding the

extent of Toyota’s use of derivative financial instruments to

hedge foreign currency exchange rate risks.

Generally, a weakening of the Japanese yen against other cur-

rencies has a positive effect on Toyota’s revenues, operating

income and net income. A strengthening of the Japanese yen

against other currencies has the opposite effect. In fiscal 2008,

the Japanese yen was on average and at the end of the fiscal

year stronger against the U.S. dollar in comparison to the prior

fiscal year. In fiscal 2008, the Japanese yen was on average and

at the end of the fiscal year weaker against the euro in compari-

son to the prior fiscal year. In fiscal 2009, the Japanese yen was

on average and at the end of the fiscal year stronger against the

U.S. dollar and the euro in comparison to the prior fiscal year.

See further discussion in the Market Risk Disclosures section

regarding “Foreign Currency Exchange Rate Risk”.