Toyota 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section

TOYOTA MOTOR CORPORATION

102

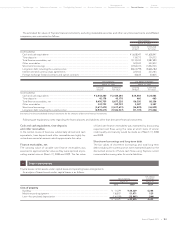

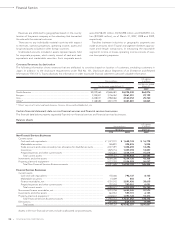

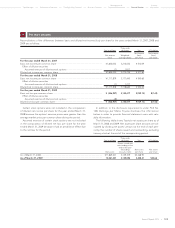

Yen in millions U.S. dollars in millions

For the year ended March 31, 2009 For the year ended March 31, 2009

Non-Financial Financial Non-Financial Financial

Services Services Services Services

Businesses Businesses Consolidated Businesses Businesses Consolidated

Cash flows from operating activities

Net loss .............................................................................. ¥ (368,569) ¥ (68,388) ¥ (436,937) $ (3,752) $ (696) $ (4,448)

Adjustments to reconcile net loss to net cash

provided by operating activities

Depreciation .................................................................. 1,105,233 389,937 1,495,170 11,251 3,970 15,221

Provision for doubtful accounts and credit losses ..... (1,663) 259,096 257,433 (17) 2,638 2,621

Pension and severance costs, less payments ............. (21,428) 470 (20,958) (218) 5 (213)

Losses on disposal of fixed assets ............................... 68,546 136 68,682 698 1 699

Unrealized losses on available-for-sale

securities, net .............................................................. 220,920 — 220,920 2,249 — 2,249

Deferred income taxes ................................................. (132,127) (62,871) (194,990) (1,345) (640) (1,985)

Minority interest in consolidated subsidiaries ............ (26,282) 2,004 (24,278) (267) 20 (247)

Equity in earnings of affiliated companies .................. (53,226) 10,502 (42,724) (542) 107 (435)

Changes in operating assets and liabilities,

and other ..................................................................... (223,101) 186,234 154,587 (2,272) 1,895 1,573

Net cash provided by operating activities .............. 568,303 717,120 1,476,905 5,785 7,300 15,035

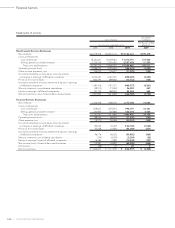

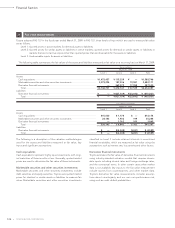

Cash flows from investing activities

Additions to finance receivables ..................................... — (13,318,620) (7,700,459) — (135,586) (78,392)

Collection of and proceeds

from sale of finance receivables .................................... — 13,047,393 7,243,442 — 132,825 73,740

Additions to fixed assets

excluding equipment leased to others ......................... (1,358,518) (6,064) (1,364,582) (13,830) (62) (13,892)

Additions to equipment leased to others ...................... (82,411) (877,904) (960,315) (839) (8,937) (9,776)

Proceeds from sales of fixed assets

excluding equipment leased to others ......................... 41,285 6,101 47,386 420 62 482

Proceeds from sales of equipment leased to others ..... 55,896 472,853 528,749 569 4,814 5,383

Purchases of marketable securities

and security investments ................................................ (418,342) (217,688) (636,030) (4,259) (2,216) (6,475)

Proceeds from sales of and maturity of

marketable securities and security investments ........... 1,295,561 180,316 1,475,877 13,189 1,835 15,024

Payment for additional investments

in affiliated companies, net of cash acquired ............... (45) — (45) (0) — (0)

Changes in investments and other assets,

and other ......................................................................... 129,834 (2,091) 135,757 1,322 (21) 1,382

Net cash used in investing activities ........................ (336,740) (715,704) (1,230,220) (3,428) (7,286) (12,524)

Cash flows from financing activities

Purchase of common stock .............................................. (70,587) — (70,587) (719) — (719)

Proceeds from issuance of long-term debt .................... 545,981 3,030,029 3,506,990 5,558 30,846 35,702

Payments of long-term debt ............................................ (150,097) (2,580,637) (2,704,078) (1,528) (26,271) (27,528)

Increase in short-term borrowings .................................. 138,387 239,462 406,507 1,409 2,438 4,138

Dividends paid .................................................................. (439,991) — (439,991) (4,479) — (4,479)

Net cash provided by financing activities ............... 23,693 688,854 698,841 241 7,013 7,114

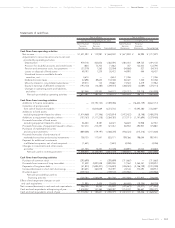

Effect of exchange rate changes on cash

and cash equivalents .......................................................... (80,214) (49,579) (129,793) (816) (505) (1,321)

Net increase in cash and cash equivalents ......................... 175,042 640,691 815,733 1,782 6,522 8,304

Cash and cash equivalents at beginning of year ............... 1,473,101 155,446 1,628,547 14,996 1,583 16,579

Cash and cash equivalents at end of year .......................... ¥ 1,648,143 ¥ 796,137 ¥ 2,444,280 $ 16,778 $ 8,105 $ 24,883