Toyota 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Right Way Forward Business OverviewPerformance Overview Financial Section

Investor

Information

Management &

Corporate Information

Top Messages

Annual Report 2009 57

pension liabilities relate primarily to the parent company and its

Japanese subsidiaries. The unfunded amounts will be funded

through future cash contributions by Toyota or in some cases

will be funded on the retirement date of each covered employ-

ee. The unfunded pension liabilities increased in fiscal 2009

compared to the prior year primarily due to a decrease in the

market value of plan assets. See note 19 to the consolidated

financial statements for further discussion.

Toyota’s treasury policy is to maintain controls on all expo-

sures, to adhere to stringent counterparty credit standards, and

to actively monitor marketplace exposures. Toyota remains cen-

tralized, and is pursuing global efficiency of its financial services

operations through Toyota Financial Services Corporation.

The key element of Toyota’s financial policy is maintaining a

strong financial position that will allow Toyota to fund its

research and development initiatives, capital expenditures and

financing operations on a cost effective basis even if earnings

experience short-term fluctuations. Toyota believes that it main-

tains sufficient liquidity for its present requirements and that by

maintaining its high credit ratings, it will continue to be able to

access funds from external sources in large amounts and at rela-

tively low costs. Toyota’s ability to maintain its high credit ratings

is subject to a number of factors, some of which are not within

Toyota’s control. These factors include general economic condi-

tions in Japan and the other major markets in which Toyota does

business, as well as Toyota’s successful implementation of its

business strategy.

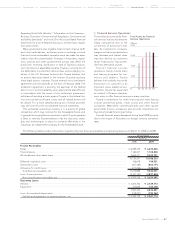

Shareholders’ Equity

and Equity Ratio

0

3,000

6,000

9,000

12,000

15,000

(¥ Billion)

’08’07 ’09’06’05FY

0

20

40

60

80

100

(%)

Equit

y

ratio (Ri

g

ht scale)