Toyota 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section

TOYOTA MOTOR CORPORATION

54

research and development expenses and the increase in

expenses due to business expansion.

• Financial Services Operations Segment

Operating income from Toyota’s financial services operations

decreased by ¥72.0 billion, or 45.4%, to ¥86.5 billion during fis-

cal 2008 compared with the prior year. This decrease is primarily

due to an increase in valuation losses on interest rate swaps

stated at fair value, partially offset by the impact of a higher vol-

ume of financing activities.

• All Other Operations Segment

Operating income from Toyota’s other businesses decreased by

¥6.6 billion, or 16.6% to ¥33.0 billion during fiscal 2008 com-

pared with the prior year.

Other Income and Expenses

Interest and dividend income increased by ¥33.7 billion, or

25.6%, to ¥165.7 billion during fiscal 2008 compared with the

prior year mainly due to an increase in interest income reflecting

an increase in marketable securities.

Interest expense decreased by ¥3.2 billion, or 6.5%, to ¥46.1

billion during fiscal 2008 compared with the prior year due to a

decrease in borrowings in the automotive operations segment.

Foreign exchange gains, net decreased by ¥23.8 billion, or

72.2%, to ¥9.2 billion during fiscal 2008 compared with the prior

year. Foreign exchange gains and losses include the differences

between the value of foreign currency denominated sales trans-

lated at prevailing exchange rates and the value of the sales

amounts settled during the year, including those settled using

forward foreign currency exchange contracts.

Other income, net increased by ¥9.9 billion, or 35.1%, to ¥38.1

billion during fiscal 2008 compared with the prior year.

Income Taxes

The provision for income taxes increased by ¥13.2 billion, or

1.5%, to ¥911.5 billion during fiscal 2008 compared with the

prior year primarily due to the increase in income before income

taxes. The effective tax rate for fiscal 2008 remained relatively

unchanged compared to the rate for fiscal 2007.

Minority Interest in Consolidated Subsidiaries

and Equity in Earnings of Affi liated Companies

Minority interest in consolidated subsidiaries increased by ¥28.3

billion, or 56.9%, to ¥78.0 billion during fiscal 2008 compared

with the prior year. This increase was mainly due to an increase

in net income attributable to favorable results of operations at

consolidated subsidiaries.

Equity in earnings of affiliated companies during fiscal 2008

increased by ¥60.6 billion, or 28.9%, to ¥270.1 billion compared

with the prior year. This increase was mainly due to an increase

in net income attributable to favorable results of operations at

the affiliated companies.

Net Income

Toyota’s net income increased by ¥73.8 billion, or 4.5%, to

¥1,717.8 billion during fiscal 2008 compared with the prior year.

Other Comprehensive Income and Loss

Other comprehensive income decreased by ¥1,115.5 billion, to

losses of ¥942.5 billion for fiscal 2008 compared with the prior

year. This decrease resulted primarily from a decrease in foreign

currency translation adjustments in fiscal 2008 to losses of

¥461.1 billion compared with gains of ¥130.7 billion in the prior

year and a decrease in unrealized holding gains on securities in

fiscal 2008 to losses of ¥347.8 billion reflecting the decline in the

Japanese stock market compared with unrealized holding gains

of ¥38.8 billion in the prior year.

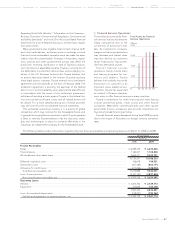

Outlook

Toyota perceives a risk of a further downturn in the world econ-

omy during fiscal 2010 resulting from a weakened economy

coupled with the financial crisis.

Although Toyota expects that the automotive market is

expected to expand over the medium- to long-term particularly

in resource-rich countries and emerging countries, the automo-

tive market is currently undergoing a rapid contraction because

of the worldwide economic deceleration. In addition, the com-

petition in the automotive market is more intense globally, as

shown in the fierce competition with respect to compact cars

and low-price cars, and the acceleration in the development of

technologies and introduction of new products while environ-

mental awareness is growing throughout the world. For purpos-

es of this discussion, Toyota is assuming an average exchange

rate of ¥95 to the U.S. dollar and ¥125 to the euro. With the

foregoing external factors in mind, Toyota expects that net reve-

nues for fiscal 2010 will decrease compared with fiscal 2009 as a

result of a decrease in vehicle unit sales and the assumed

exchange rate of a stronger Japanese yen against the U.S. dol-

lar and the euro. Factors decreasing operating income include a

decrease in vehicle unit sales and the assumed exchange rate of

a stronger Japanese yen against the U.S. dollar and the euro.

The foregoing factors are partially offset by factors increasing

operating income including cost reduction efforts and decreas-

es in fixed costs and expenses. As a result, Toyota expects that

operating loss will increase in fiscal 2010 compared with fiscal

2009. Also, Toyota expects loss before income taxes and net

loss will increase in fiscal 2010. Exchange rate fluctuations can

materially affect Toyota’s operating results. In particular, a

strengthening of the Japanese yen against the U.S. dollar can

have a material adverse effect on Toyota’s operating results.

Please see “Operating and Financial Review and Prospects—

Operating Results—Overview—Currency Fluctuations.” for fur-

ther discussion.