Time Warner Cable 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

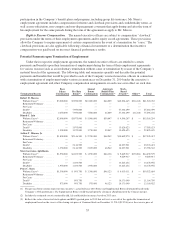

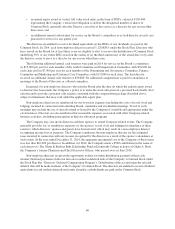

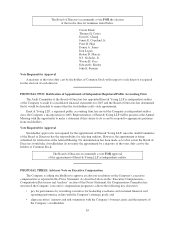

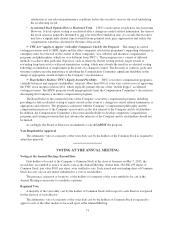

DIRECTOR COMPENSATION FOR 2014

Fees

Earned or

Paid

in Cash(1)

Stock

Awards(2)

Option

Awards

Non-Equity

Incentive

Plan

Compensation

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

All

Other

Compensation(3) Total

Carole Black .......... $120,000 $151,547 $— $— $— $ 500 $272,047

Glenn A. Britt(4) ........ 43,631 151,547 — — — 97,476 292,654

Thomas H. Castro ...... 112,500 151,547 — — — 500 264,547

David C. Chang ........ 105,000 151,547 — — — 500 257,047

James E. Copeland, Jr. . . . 112,500 151,547 — — — 984 265,031

Peter R. Haje .......... 120,000 151,547 — — — 500 272,047

Donna A. James ........ 120,000 151,547 — — — 500 272,047

Don Logan ............ 105,000 151,547 — — — 500 257,047

N.J. Nicholas, Jr. ....... 142,500 151,547 — — — 500 294,547

Wayne H. Pace ........ 120,000 151,547 — — — 2,667 274,214

Edward D. Shirley ...... 112,500 151,547 — — — 1,559 265,606

John E. Sununu ........ 120,000 151,547 — — — 500 272,047

(1) Amounts earned by each non-employee director in 2014 represent (a) an annual cash retainer of $90,000; (b) an annual

additional payment of $15,000 for each member of the Audit Committee and the Compensation Committee, with

$30,000 to each Committee chair and $7,500 for each member of the Nominating and Governance Committee, Finance

Committee and Marketing and Customer Care Committee, with $15,000 to each Committee chair; and (c) a cash

payment of $30,000 for the lead director. Mr. Britt’s payment was prorated for service prior to his death in June 2014.

Messrs. Haje and Nicholas elected to defer all or a portion of their cash retainer under the Directors’ Deferred

Compensation Program for 2014 and received awards of deferred stock units (in July 2014 and January 2015) covering,

in the aggregate, 408 and 970 shares of Common Stock, respectively. The value of these deferred stock units is included

in this column. These deferrals and the related deferred stock units are not reflected in a separate column in the table. The

number of deferred stock units credited to the non-employee directors on December 31, 2014 was: Dr. Chang—6,832;

Mr. Copeland—6,126; Mr. Haje—7,737; Mr. Nicholas—7,086; and Mr. Pace—4,316.

(2) The amounts set forth in the Stock Awards column represent the value of the award to each non-employee director of

RSUs with respect to 1,120 shares of Common Stock, as computed in accordance with FASB ASC Topic 718. The

amounts were calculated based on the grant date fair value per share of $135.31, which was the closing sale price of the

Common Stock on the date of grant (February 12, 2014). On December 31, 2014, each non-employee director held the

following number of RSUs: 18,769 RSUs for each of Ms. Black and Messrs. Copeland, Haje, Logan and Nicholas;

16,555 RSUs for Dr. Chang; 17,850 RSUs for Mr. Castro; 14,646 RSUs for Mr. Pace; and 12,273 RSUs for Ms. James,

Mr. Shirley and Senator Sununu.

(3) Reflects (a) the Company’s commitment to make a charitable contribution of $500 on behalf of each serving director in

memory of Mr. Britt and (b) reimbursement for estimated taxes incurred by each of Messrs. Copeland ($484), Pace

($2,167) and Shirley ($1,059) as a result of his spouse accompanying him to a Company-sponsored event.

(4) Reflects (a) a prorated portion of Mr. Britt’s cash retainer through the date of his death and (b) the incremental cost to the

Company of part-time secretarial services and limited personal transportation services provided to Mr. Britt and his

spouse pursuant to the retirement provisions of his employment agreement with the Company.

Compensation Committee Interlocks and Insider Participation

Mr. Haje, a member of the Compensation Committee, served as Executive Vice President and General

Counsel of TWE from June 1992 until 1999.

61