Time Warner Cable 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

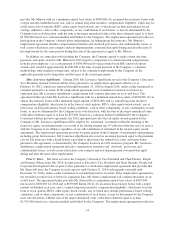

participation in the Company’s benefit plans and programs, including group life insurance. Mr. Stern’s

employment agreement includes compensation forfeiture and clawback provisions and confidentiality terms, as

well as non-solicitation, non-compete and non-disparagement covenants that apply during and after the term of

his employment for the same periods during the term of the agreement as apply to Mr. Marcus.

Right to Recover Compensation. The named executive officers are subject to compensation “clawback”

provisions under the terms of their employment agreements and/or equity award agreements. These provisions

allow the Company to require repayment of certain compensation in the event of a termination for “cause.” The

clawback provisions are also applicable following a financial restatement or a determination that incentive

compensation was paid based on incorrect financial performance results.

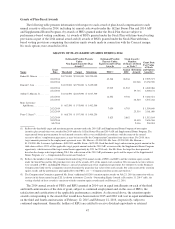

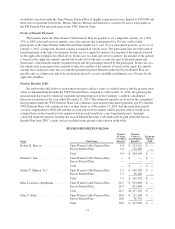

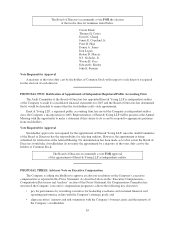

Potential Payments upon Termination of Employment

Under their respective employment agreements, the named executive officers are entitled to certain

payments and benefits upon their termination of employment during the term of their employment agreements

for various reasons (such as an involuntary termination without cause or termination by reason of the Company’s

material breach of the agreement). The following table and summaries quantify and describe the potential

payments and benefits that would be provided to each of the Company’s named executive officers in connection

with a termination of employment under various circumstances on December 31, 2014 under the executive’s

employment agreement and other Company compensation arrangements, in each case as in effect on such date.

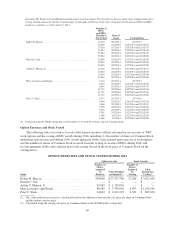

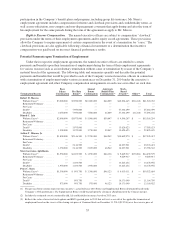

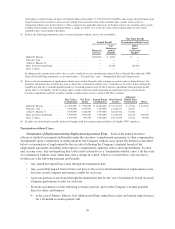

Termination Reason

Base

Salary

Continuation

Pro Rata

Bonus(1)

Annual

Bonus

Continuation

Aggregate

Benefit Plan

Continuation(2)

Stock-

Based

Awards(3) Other(4) Total

Robert D. Marcus

Without Cause(5) ............ $3,000,000 $7,950,000 $10,000,000 $46,009 $40,308,645 $216,128 $61,520,782

Retirement/Voluntary ........ — — — — — — —

For Cause ................. — — — — — — —

Death(6) ................... — 7,950,000 — — 57,334,499 — 65,284,499

Disability .................. 2,250,000 7,950,000 7,500,000 46,009 57,334,499 216,128 75,296,636

Dinesh C. Jain

Without Cause(5) ............ $2,000,000 $3,975,000 $ 5,000,000 $50,047 $ 4,540,207 $ — $15,565,254

Retirement/Voluntary ........ — — — — — — —

For Cause ................. — — — — — — —

Death(6) ................... — 3,975,000 — — 13,620,623 — 17,595,623

Disability .................. 1,500,000 3,975,000 3,750,000 50,047 13,620,623 — 22,895,670

Arthur T. Minson, Jr.

Without Cause(5) ............ $1,800,000 $2,146,500 $ 2,700,000 $48,942 $10,849,970 $ — $17,545,412

Retirement/Voluntary ........ — — — — — — —

For Cause ................. — — — — — — —

Death(6) ................... — 2,146,500 — — 18,227,921 — 20,374,421

Disability .................. 1,350,000 2,146,500 2,025,000 48,942 18,227,921 — 23,798,363

Marc Lawrence-Apfelbaum

Without Cause(5) ............ $1,950,000 $1,033,500 $ 1,950,000 $66,138 $ 9,669,917 $170,024 $14,839,579

Retirement/Voluntary ........ — — — — 9,669,917 — 9,669,917

For Cause ................. — — — — — — —

Death(6) ................... — 1,033,500 — — 13,245,456 — 14,278,956

Disability .................. 1,950,000 1,033,500 1,950,000 — 13,245,456 — 18,178,956

Peter C. Stern

Without Cause(5) ............ $1,300,000 $ 993,750 $ 1,300,000 $46,123 $ 6,913,011 $ — $10,552,884

Retirement/Voluntary ........ — — — — — — —

For Cause ................. — — — — — — —

Death(6) ................... — 993,750 — — 10,171,049 — 11,164,799

Disability .................. 975,000 993,750 975,000 46,123 10,171,049 — 13,160,922

(1) The pro rata bonus amount represents the executive’s actual full-year 2014 bonus and Supplemental Bonus determined based on the

Company’s 2014 performance. The Supplemental Bonus would be paid upon the closing or abandonment of the Comcast merger.

(2) Includes the estimated cost of continued health, life and disability insurance, based on 2015 rates.

(3) Reflects the value of unvested stock options and RSUs granted prior to 2015 that will vest as a result of the applicable termination of

employment based on the excess of the closing sale price of Common Stock on December 31, 2014 ($152.06) over the exercise price of

55