Time Warner Cable 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pension Plans

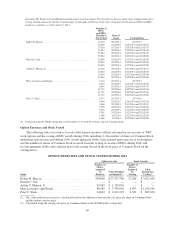

Pension Benefits

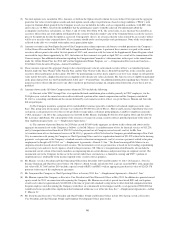

Eligible employees of the Company participate in the Time Warner Cable Pension Plan, a tax qualified

defined benefit pension plan, and the Time Warner Cable Excess Benefit Pension Plan (the “Excess Benefit

Plan”), a nonqualified defined benefit pension plan (collectively, the “TWC Pension Plans”), which are

sponsored by the Company. Messrs. Marcus, Minson, Lawrence-Apfelbaum and Stern participate in the TWC

Pension Plans. Mr. Jain becomes eligible to participate once he attains one year of service with the Company.

Federal tax law limits both the amount of compensation that is eligible for the calculation of benefits and the

amount of benefits that may be paid to participants under a tax-qualified plan, such as the Time Warner Cable

Pension Plan. However, as permitted under Federal tax law, the Company has adopted the Excess Benefit Plan

that is designed to provide for supplemental payments by the Company of an amount that eligible employees

would have received under the Time Warner Cable Pension Plan if eligible compensation were subject to a

higher limit and there were no payment restrictions. The amount of the payment under the Excess Benefit Plan is

calculated based on the differences between (a) the annual benefit that would have been payable under the Time

Warner Cable Pension Plan if the annual eligible compensation limit imposed by the tax laws was $350,000 (the

maximum compensation limit imposed under the Excess Benefit Plan) and (b) the actual benefit payable under

the Time Warner Cable Pension Plan.

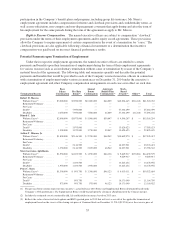

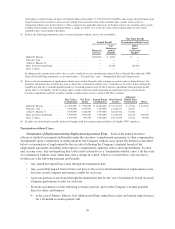

Benefit payments under the TWC Pension Plans are calculated using the highest consecutive five-year

average annual compensation (subject to federal law limits and the $350,000 limit referred to above), which is

referred to as “average compensation.” Compensation covered by the TWC Pension Plans takes into account

salary, bonus, some elective deferrals and other compensation paid, but excludes the payment of deferred or

long-term incentive compensation and severance payments. The annual pension payment under the terms of the

TWC Pension Plans, if the employee is vested, and if paid as a single life annuity, commencing at age 65, is an

amount equal to the sum of:

• 1.25% of the portion of average compensation that does not exceed the average of the Social Security

taxable wage base ending in the year the employee reaches the Social Security retirement age, referred

to as “covered compensation,” multiplied by the number of years of benefit service up to 35 years, plus

• 1.67% of the portion of average compensation that exceeds covered compensation, multiplied by the

number of years of benefit service up to 35 years, plus

• 0.5% of average compensation multiplied by the employee’s number of years of benefit service in

excess of 35 years, plus

• a supplemental benefit in the amount of $60 multiplied by the employee’s number of years of benefit

service up to 30 years, with a maximum supplemental benefit of $1,800 per year.

Special rules apply to various participants who were previously participants in plans that have been merged

into the TWC Pension Plans and to various participants in the TWC Pension Plans prior to January 1, 1994.

Reduced benefits are available in the case of retirement before age 65 and in other optional forms of benefits

payouts, as described below. Eligible employees become vested in benefits under the TWC Pension Plans after

completion of five years of service, including service with Time Warner and its affiliates prior to the Separation.

For employees hired on or after January 1, 2011, benefit service does not start to accrue prior to the date the

employee satisfies the TWC Pension Plans’ eligibility requirements, including one year of eligible service, and

commences participation in the TWC Pension Plans.

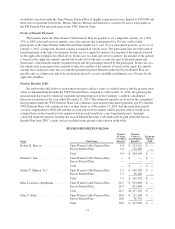

In addition to the benefits to which they are entitled under the TWC Pension Plans, as a result of prior

service at Time Warner or one of its affiliates prior to the Company’s Separation from Time Warner, each of

Messrs. Marcus, Minson and Stern is entitled to vested benefits under the Time Warner Pension Plan (the “TW

Pension Plan”) based on a formula similar to that under the TWC Pension Plans and benefit service of 7.7 years,

1.9 years and 2.9 years, respectively. Time Warner has also adopted an excess benefit pension plan, which, like

the TWC Excess Benefit Plan, provides for payments by Time Warner of certain amounts that eligible employees

50