Time Warner Cable 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

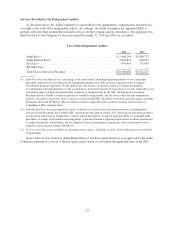

Services Provided by the Independent Auditor

As described above, the Audit Committee is responsible for the appointment, compensation, retention and

oversight of the work of the independent auditor. Accordingly, the Audit Committee has appointed E&Y to

perform audit and other permissible non-audit services for the Company and its subsidiaries. The aggregate fees

billed by E&Y to the Company for the years ended December 31, 2014 and 2013 are as follows:

Fees of the Independent Auditor

2014 2013

Audit Fees(1) ............................................... $ 5,406,294 $5,868,773

Audit-Related Fees(2) ......................................... 4,202,813 960,621

Tax Fees(3) ................................................. 959,495 793,059

All Other Fees .............................................. — —

Total Fees for Services Provided ............................... $10,568,602 $7,622,453

(1) Audit Fees were for audit services, including (a) the annual audit (including required quarterly reviews) and other

procedures required to be performed by the independent auditors to be able to form an opinion on the Company’s

consolidated financial statements; (b) the audit of the effectiveness of internal control over financial reporting;

(c) consultation with management as to the accounting or disclosure treatment of transactions or events and/or the actual

or potential impact of final or proposed rules, standards or interpretations by the SEC, the Financial Accounting

Standards Board (“FASB”) or other regulatory or standard-setting bodies; and (d) services that only the independent

auditors reasonably can provide, such as services associated with SEC registration statements, periodic reports and other

documents filed with the SEC or other documents issued in connection with securities offerings and assistance in

responding to SEC comment letters.

(2) Audit-Related Fees were principally for services related to (a) audit services and other procedures, including those

associated with documents filed with the SEC and related to the audit of certain carve-out financial statements prepared

in connection with Comcast Corporation’s merger-related divestitures; (b) agreed-upon procedures or expanded audit

procedures to comply with contractual arrangements, regulatory/franchise reporting requirements or other requirements;

(c) audits of employee benefit plans; (d) due diligence services pertaining to acquisitions; and (e) attestation services

related to certain internal controls (SSAE 16).

(3) Tax Fees were for services related to tax planning and tax advice, including, in 2013, advice with respect to an internal

reorganization.

None of the services related to Audit-Related Fees or Tax Fees presented above was approved by the Audit

Committee pursuant to a waiver of the pre-approval provisions as set forth in the applicable rules of the SEC.

22