Time Warner Cable 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Significantly improved customer experience through various initiatives, including:

• Completing the “TWC Maxx” all-digital conversions in New York City and Los Angeles, and the

roll out of Internet speed increases in New York City, Los Angeles and Austin, ahead of schedule.

• Investing in the Company’s network and new set-top boxes and modems.

• Improved customer service, including record “on-time” performance with technicians arriving at more

than 97% of customer appointments within an industry-leading one-hour appointment window during

the fourth quarter of 2014, improved self-help tools and reductions in “rework” and trouble calls.

• Enhanced video, data and voice products such as an improved cloud-based video set-top box

guide, increased capability and availability of the TWC TV app, more WiFi hotspots and free

unlimited calling to Mexico, Hong Kong and China.

• Expanded the Company’s business services reach and opportunity by adding nearly 70,000 commercial

buildings to the Company’s network.

Significant Return of Capital

• Started paying a quarterly dividend on the Common Stock in March 2010; increased it by 20% in 2011,

17% in 2012, 16% in 2013 and 15% in 2014 (dividend yield of 2.3% as of January 29, 2014, the date

the most recent increase was approved).

• Paid $857 million in dividends in 2014; $3.5 billion in aggregate quarterly dividend payments through 2014.

• Repurchased $208 million of Common Stock in 2014, aggregating $7.7 billion since the repurchase

program started in November 2010, representing approximately 26% of the Common Stock then

outstanding, while maintaining the Company’s leverage ratio in its target range. The repurchase program

was suspended in connection with the entry into the Comcast Merger Agreement in February 2014.

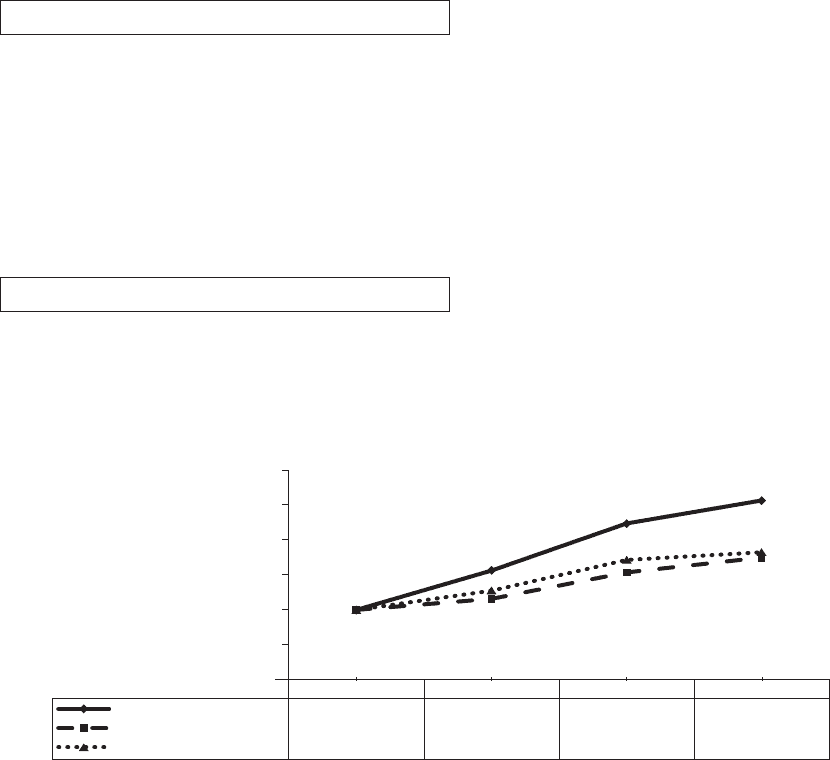

Impressive Total Stockholder Return

• Delivered 15% stockholder return in 2014 and significant total return to stockholders over the longer

term: 157% three-year cumulative total return and 319% five-year cumulative total return through

December 31, 2014.

12/31/2011 12/31/2012 12/31/2013 12/31/2014

Time Warner Cable Inc.

Primary Peer Group Index

S&P 500 Index

$100

$157

$224

$257

$116

$154

$175

$128

$172 $183

$0

$50

$100

$150

$200

$300

$250

Comparison of Cumulative Total Returns

2012 to 2014

$100 $157 $224 $257

$100 $116 $154 $175

$100 $128 $172 $183

This chart compares the performance of the Company’s Common Stock with the performance of the S&P 500 Index and an

index comprised of the companies included in the Primary Peer Group (as defined and listed below) over the last three fiscal

years. The chart assumes $100 was invested on December 31, 2011 and reflects reinvestment of regular dividends and

distributions on a monthly basis and quarterly market capitalization weighting. Source: Capital IQ, a Standard & Poor’s business.

In achieving these results, the executive officers effectively balanced the advancement of the Company’s

ambitious operating and financial goals with the challenges of the then-pending Comcast merger, including complying

with the requests of regulators reviewing the proposed transaction and planning for post-closing integration.

25