Time Warner Cable 2015 Annual Report Download - page 60

Download and view the complete annual report

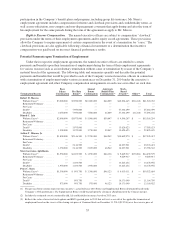

Please find page 60 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.provides Mr. Minson with (a) a minimum annual base salary of $900,000; (b) an annual discretionary bonus with

a target amount established each year; and (c) annual long-term incentive compensation eligibility, which may be

in the form of stock options, RSUs, other equity-based awards, any of which may include performance-based

vesting conditions, cash or other components, or any combination of such forms, as may be determined by the

Company in its sole discretion, with the sum of the target annualized value of the three elements equal to at least

$5,500,000 (based on a valuation method established by the Company). The employment agreement provides for

participation in the Company’s benefit plans and programs, including group life insurance. Mr. Minson’s

employment agreement includes compensation forfeiture and clawback provisions and confidentiality terms, as

well as non-solicitation, non-compete and non-disparagement covenants that apply during and after the term of

his employment for the same periods during the term of the agreement as apply to Mr. Marcus.

In addition, in connection with rejoining the Company, the Company agreed to make certain one-time

payments and equity awards to Mr. Minson in 2013 in part to compensate for certain forfeited compensation

from his prior employer: (a) a cash payment of $500,000 and (b) special time-based RSU and stock option

awards each valued at approximately $1,000,000 at the time of grant pursuant to the Company’s valuation

methodology with standard vesting terms, subject to his continued employment by the Company on the

applicable payment and vesting dates and the terms of the award agreements.

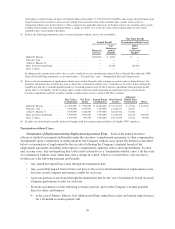

Marc Lawrence-Apfelbaum. During 2014, Mr. Lawrence-Apfelbaum served as the Company’s Executive

Vice President, General Counsel and Secretary pursuant to an employment agreement effective as of

February 16, 2012, which was renewed through December 31, 2016 in August 2014, unless earlier terminated or

extended pursuant to its terms. If the employment agreement is not extended or renewed at or before its

expiration date, Mr. Lawrence-Apfelbaum’s employment will continue thereafter on an at-will basis. The

agreement further provides Mr. Lawrence-Apfelbaum with (a) a minimum annual base salary of $650,000, (b) an

annual discretionary bonus with a minimum target amount of $650,000, and (c) annual long-term incentive

compensation eligibility, which may be in the form of stock options, RSUs, other equity-based awards, any of

which may include performance-based vesting conditions, cash or other components, or any combination of such

forms, as may be determined by the Company in its sole discretion, with the sum of the target annualized value

of the three elements equal to at least $2,875,000 (based on a valuation method established by the Company).

Consistent with his previous agreement, the 2012 agreement provides that all equity awards granted by the

Company to Mr. Lawrence-Apfelbaum will be eligible for “retirement” treatment (within the meaning of the

respective equity award agreements) as a result of his having attained age 55 with more than ten years of service

with the Company or its affiliates regardless of any other definition of retirement in the related equity award

agreements. The employment agreement provides for participation in the Company’s benefit plans and programs,

including group life insurance. Mr. Lawrence-Apfelbaum also receives an annual payment equal to the premium

cost for life insurance with a death benefit equivalent to three times his annual base salary and target bonus

pursuant to the agreement, as determined by the Company based on its GUL insurance program. Mr. Lawrence-

Apfelbaum’s employment agreement includes compensation forfeiture and “clawback” provisions and

confidentiality terms, as well as non-solicitation, non-compete and non-disparagement covenants that apply

during and after the term of his employment.

Peter C. Stern. Mr. Stern served as the Company’s Executive Vice President and Chief Product, People

and Strategy Officer from July 2014, having served as Executive Vice President and Chief Strategy, People and

Corporate Development Officer prior to that, pursuant to a fixed-term employment agreement that provides that

Mr. Stern will serve the Company in such capacity until October 31, 2014 (subsequently extended until

December 31, 2016), unless earlier terminated or extended pursuant to its terms. If the employment agreement is

not extended or renewed at or before its expiration date, Mr. Stern’s employment will continue thereafter on an

at-will basis. The agreement further provides Mr. Stern with (a) a minimum annual base salary of $495,000

(increased to $600,000 for 2014 and to $650,000 during 2014); (b) an annual discretionary bonus with a target

amount established each year; and (c) annual long-term incentive compensation eligibility, which may be in the

form of stock options, RSUs, other equity-based awards, any of which may include performance-based vesting

conditions, cash or other components, or any combination of such forms, as may be determined by the Company

in its sole discretion, with the sum of the target annualized value of the three elements equal to at least

$1,745,000 (based on a valuation method established by the Company). The employment agreement provides for

54