Time Warner Cable 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

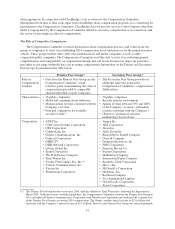

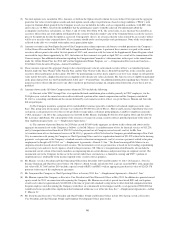

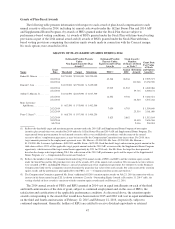

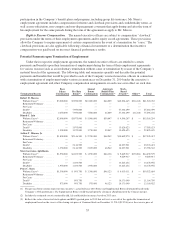

Grants of Plan-Based Awards

The following table presents information with respect to each award of plan-based compensation to each

named executive officer in 2014, including (a) annual cash awards under the 162(m) Bonus Plan and 2014 AIP

and Supplemental Bonus Program, (b) awards of PBUs granted under the Stock Plan that are subject to

performance-based vesting conditions, (c) awards of RSUs granted under the Stock Plan with time-based vesting

provisions as part of the 2014 annual award and (d) awards of RSUs granted under the Stock Plan with time-

based vesting provisions comprising the retention equity awards made in connection with the Comcast merger.

No stock options were awarded in 2014.

GRANTS OF PLAN-BASED AWARDS DURING 2014

Name

Grant

Date

Estimated Possible Payouts

Under

Non-Equity Incentive Plan

Awards(1)

Estimated Possible

Payouts Under

Equity Incentive Plan

Awards

Stock Awards:

Number

of Shares of Stock

or Units(2)

Grant Date

Fair Value

of Stock

and Option

Awards(2)

Threshold Target Maximum PBU(2)

Annual

RSU

Retention

Awards

Robert D. Marcus ......... $3,750,000 $7,500,000 $11,250,000

2/12/2014 42,548 28,366 $ 9,595,373

2/12/2014 111,968 15,150,390

Dinesh C. Jain ............ $1,875,000 $3,750,000 $ 5,625,000

2/12/2014 17,915 11,943 $ 4,040,086

2/12/2014 59,716 8,080,172

Arthur T. Minson, Jr. ....... $1,012,500 $2,025,000 $ 3,037,500

2/12/2014 14,556 9,704 $ 3,282,621

2/12/2014 48,520 6,565,242

Marc Lawrence-

Apfelbaum ............. $ 487,500 $ 975,000 $ 1,462,500

2/12/2014 7,054 4,703 $ 1,590,840

2/12/2014 23,514 3,181,680

Peter C. Stern(3) ........... $ 468,750 $ 937,500 $ 1,406,250

2/12/2014 5,823 3,882 $ 1,313,184

2/12/2014 19,410 2,626,368

8/1/2014 2,016 294,094

(1) Reflects the threshold, target and maximum payout amounts under the 2014 AIP and Supplemental Bonus Program of non-equity

incentive plan awards that were awarded for 2014 under the 162(m) Bonus Plan and 2014 AIP and Supplemental Bonus Program. The

target annual bonus payout amount for each named executive officer was established in accordance with the terms of the named

executive officer’s employment agreement, as may be increased by the Compensation Committee from time to time. For 2014, these

target amounts pursuant to the employment agreement were: Mr. Marcus—$5,000,000; Mr. Jain—$2,500,000; Mr. Minson—

$1,350,000; Mr. Lawrence-Apfelbaum—$650,000; and Mr. Stern—$625,000. Each threshold, target and maximum payout amount in the

table above reflects 150% of this applicable target payout amount under the 2014 AIP, as increased by the Supplemental Bonus Program

opportunity, which increased the target annual bonus opportunity by 50% for 2014 only. For Mr. Stern, the target has been prorated

based on the change in his targets during 2014. For a discussion of the 2014 AIP performance goals and the impact of the Supplemental

Bonus Program, see “—Compensation Discussion and Analysis.”

(2) Reflects the number of shares of Common Stock underlying 2014 annual awards of PBUs and RSUs and the retention equity awards

under the Stock Plan and the full grant date fair value of the awards. 60% of the annual stock awards in 2014 to named executive officers

were awarded as PBUs, including Mr. Marcus’s special award pursuant to his employment agreement. See footnote (1) to the Summary

Compensation Table for the assumptions used to determine the grant-date fair value of the stock awards. For a discussion of the retention

equity awards and the performance goal applicable to the PBUs, see “—Compensation Discussion and Analysis.”

(3) The Compensation Committee approved Mr. Stern’s additional 8/1/2014 retention equity awards on July 23, 2014 in connection with an

increase in his future annual target LTI. As shown in footnote (2) to the “Outstanding Equity Awards at December 31, 2014” table, the

vesting schedule of these awards is consistent with the retention equity awards made on February 12, 2014.

The 2014 annual awards of PBUs and RSUs granted in 2014 vest in equal installments on each of the third

and fourth anniversaries of the date of grant, subject to continued employment and, in the case of PBUs, the

satisfaction and certification of the applicable performance condition. As discussed above, the retention equity

awards corresponding to the awards that would have been made in 2015 and 2016 will vest in equal installments

on the third and fourth anniversaries of February 12, 2015 and February 12, 2016, respectively, subject to

continued employment. Generally, holders of RSUs are entitled to receive dividend equivalents or retained

47