Time Warner Cable 2015 Annual Report Download - page 48

Download and view the complete annual report

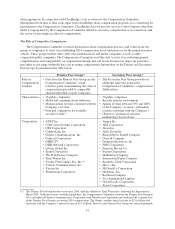

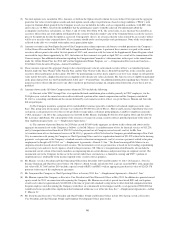

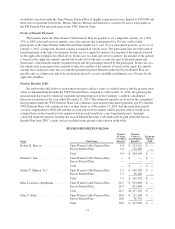

Please find page 48 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.based on the Company’s beliefs regarding its competitors for executive talent, not based on the companies’ size relative to

the Company.

(2) In 2008, the Compensation Committee established criteria and processes for selecting and reviewing the appropriate

companies for inclusion in the Secondary Peer Group so that it represents companies from a broad range of industries

(effectively all industries except financial services, healthcare and those covered by the Primary Peer Group) with annual

revenue between 50% and 200% of the Company’s 2010 annual revenue ($9.5 billion to $37.8 billion when the criteria

were established) and median annual revenue generally consistent with the Company’s. During 2011, consistent with its

established process, the Compensation Committee conducted its triennial review of its Secondary Peer Group and

reconstituted it for compensation determinations for 2012 through 2014 using the established criteria. The companies listed

in the table reflect the results of this review, except that in 2013, Tyco International Limited was removed for purposes of

reviewing 2014 compensation since it no longer met the asset value criteria as a result of a corporate reorganization.

(3) To assist the Committee in selecting and validating the Primary Peer Group members, two analyses were undertaken in

initially establishing the Group: (i) a “peer of peers” analysis to review which companies and industry groups include the

Company as a peer in their respective peer group and (ii) an internal review of the companies and industry groups to which

the Company lost executive talent or from which the Company sourced executive talent in recent years.

(4) As a result of News Corporation’s June 2013 separation into two independent publicly-traded companies, its cable and

broadcasting networks and properties are held by Twenty-First Century Fox, Inc., which replaced News Corporation in the

Primary Peer Group.

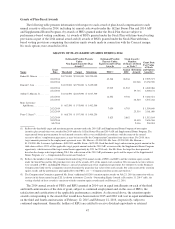

Market Surveys. In addition to the Peer Groups, Management and the Compensation Committee

considered, as a general reference, market compensation survey data available through a number of nationally-

recognized compensation consulting firms. This data covers companies roughly comparable in size (median

annual revenue of approximately $18 billion) to the Company from a broad range of industries, including the

cable/satellite, telecommunications and media industries.

The Use of Pay Tallies

The Compensation Committee periodically reviews “pay tallies” for the named executive officers (i.e.,

analyses of the executives’ annual pay and long-term compensation with potential severance payments under

various termination scenarios, including involuntary termination scenarios, pursuant to the negotiated

employment agreements) to help ensure that the design of the compensation program is consistent with the

Company’s compensation philosophy and key principles and that the amount of compensation is within

appropriate competitive parameters.

Based on the Compensation Committee’s review of 2014 pay tallies, the Compensation Committee concluded

that the total compensation of the named executive officers (and, in the case of involuntary termination or change-

in-control scenarios, potential payouts) continues to be appropriate in light of the Company’s compensation

philosophy and guiding principles and is consistent with relevant competitive marketplace data.

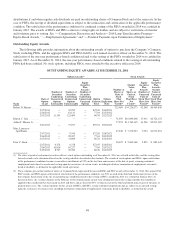

The Role of Employment Agreements

Each of the named executive officers is employed pursuant to a multi-year employment agreement that

reflects the individual negotiations with the relevant named executive officer. The Company has long used such

agreements to foster retention, to be competitive and to protect the business with restrictive covenants, such as

non-competition, non-solicitation and confidentiality provisions, and, in some cases, “clawback” rights (i.e.,

rights to recover compensation paid to an executive if the Company subsequently determines that the

compensation was not properly earned). The employment agreements provide for severance pay in the event of

the involuntary termination of the executive’s employment without cause, which serves as consideration for the

restrictive covenants, provides financial security to the executive and allows the executive to remain focused on

the Company’s interests at all times.

The employment agreement for each named executive officer is described in detail in this Proxy Statement

under “—Employment Agreements,” “—Potential Payments upon Termination of Employment” and

“—Potential Payments upon a Change in Control,” below.

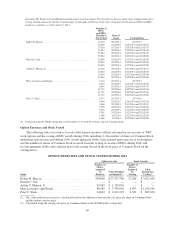

The Role of Stockholder Advisory Vote on Executive Compensation

The Company provides its stockholders with the opportunity to cast an annual advisory vote on executive

compensation (a “say-on-pay vote”). At the Company’s annual meeting of stockholders in June 2014,

approximately 62% of the votes cast on the say-on-pay vote were voted in favor of management’s proposal. As a

42