Time Warner Cable 2015 Annual Report Download - page 26

Download and view the complete annual report

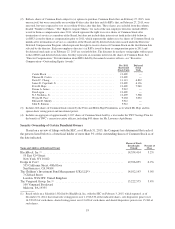

Please find page 26 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Based solely on Amendment No. 1 to Schedule 13G filed by Dodge & Cox with the SEC on February 13, 2015, which

reported, as of December 31, 2014, that it had sole voting power over 18,325,253 of the indicated shares and sole

dispositive power over all of the indicated shares.

(3) Based solely on a Schedule 13G filed by The Children’s Investment Fund Management (UK) LLP with the SEC on

March 16, 2015, which reported, as of March 6, 2015, that it had shared voting and dispositive power over all of the

indicated shares.

(4) Based solely on Amendment No. 1 to Schedule 13G filed by The Vanguard Group, Inc. with the SEC on February 10,

2015, which reported, as of December 31, 2014, that it had sole voting power over 482,186 of the indicated shares, sole

dispositive power over 14,763,896 of the indicated shares and shared dispositive power over 458,679 of the indicated

shares.

AUDIT-RELATED MATTERS

Report of the Audit Committee

In accordance with its charter, the Audit Committee of the Company’s Board of Directors assists the Board

of Directors in fulfilling responsibilities in a number of areas. These responsibilities include, among others:

(i) the appointment and oversight of the Company’s independent registered public accounting firm (“independent

auditor”), as well as the evaluation of the independent auditor’s qualifications, performance and independence;

(ii) the oversight of the Company’s internal audit function; (iii) the review of the Company’s financial statements

and the results of each external audit; (iv) the review of other matters with respect to the Company’s accounting,

auditing and financial reporting practices and procedures as the Audit Committee may find appropriate or may be

brought to its attention; and (v) the oversight of the Company’s compliance program. To assist it in fulfilling its

oversight and other duties, the Audit Committee regularly meets separately with the internal auditor, the

independent auditor and management.

Independent Auditor and Internal Audit Matters. The Audit Committee discusses with the Company’s

independent auditor its plan for the audits of the Company’s annual consolidated financial statements and the

effectiveness of the Company’s internal control over financial reporting, as well as reviews of the Company’s

quarterly financial statements. During 2014, the Audit Committee met regularly with the independent auditor,

with and without management present, to discuss the results of its audits and quarterly reviews of the Company’s

financial statements and the overall quality of the Company’s accounting principles. The Audit Committee has

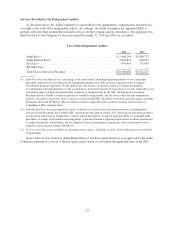

also appointed, subject to stockholder ratification, Ernst & Young LLP (“E&Y”) as the Company’s independent

auditor for 2015, and the Board concurred in its appointment.

The Audit Committee reviews and approves the annual internal audit plan and meets regularly with the

representatives of the Company’s internal audit group, with and without management present, to review and

discuss the internal audit reports, including reports relating to operational, financial and compliance matters.

Financial Statements as of December 31, 2014. Management has the primary responsibility for the

financial statements and the reporting process, including its systems of internal and disclosure controls (including

internal control over financial reporting). The independent auditor is responsible for performing an independent

audit of the Company’s consolidated financial statements and expressing opinions on the conformity of the

consolidated financial statements with U.S. generally accepted accounting principles and on the Company’s

internal control over financial reporting.

In this context, the Audit Committee has met and held discussions with management and the independent

auditor with respect to the Company’s audited financial statements for the fiscal year ended December 31, 2014.

Management represented to the Audit Committee that the Company’s consolidated financial statements were

prepared in accordance with U.S. generally accepted accounting principles.

In connection with its review of the Company’s year-end financial statements, the Audit Committee has

reviewed and discussed with management and the independent auditor the consolidated financial statements and

the independent auditor’s evaluation of the Company’s internal control over financial reporting. The Audit

Committee also discussed with the independent auditor the matters required to be discussed by the Statement on

20