Time Warner Cable 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.performance) and (b) a lump-sum payment equal to three times the sum of his annual base salary and target

annual bonus.

Pursuant to the terms of the equity award agreements, the executive’s stock options and RSUs, including the

retention equity awards, would vest as a result of the disability.

If the executive obtains other full-time employment during the period the executive is receiving disability

payments, the executive would no longer be eligible to participate in the Company’s benefit plans and programs

effective upon the commencement of such employment or such time as the executive becomes eligible for

comparable coverage with the new employer.

Potential Payments upon a Change in Control

In the event of a change in control of the Company, if the named executive officer’s employment is not

terminated, the executive is not entitled to accelerated vesting of equity awards or other payments as a result of a

change in control, other than the Supplemental Bonus, which would have been paid upon the closing of the

Comcast merger.

Pursuant to their employment agreements, if a named executive officer’s employment is terminated without

cause or for “good reason” during the term of the agreement within 24 months following a change in control (as

defined in the Stock Plan) or following the Company’s execution of a merger, acquisition, sale or other

agreement providing for a change in control but before the end of the 24-month period after a change in control

(or if earlier, before the expiration or termination of such agreement without a change in control) (collectively, a

“change-in-control event”), the executive would be entitled to the severance benefits described in the

Termination without Cause section above, except that severance benefits, including annual base salary and

annual target bonuses, would be paid and continued benefits would be provided for 36 months rather than 24

months in the case of Messrs. Marcus, Jain, Minson and Stern. Furthermore, under the terms of the retention

equity awards, the awards would become fully vested even if the termination of employment without cause

occurs before the applicable anniversary of the date of grant. See footnote (5) in the Potential Payments upon

Termination of Employment table above.

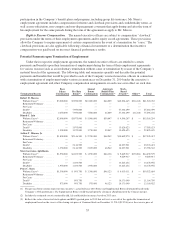

Pursuant to the terms of the named executive officers’ employment agreements, if the officer’s employment

is terminated without cause or he resigns for “good reason,” as defined in the employment agreement, within 24

months following a change-in-control event, the officer is entitled to the payments and benefits described above.

Depending on their respective titles, roles and responsibilities, as applicable, immediately after the change-in-

control event, each named executive officer may have the right to assert “good reason,” resign and be entitled to

the severance benefits discussed above following such time. The closing of the Comcast merger would have been

considered a “change-in-control event.”

In addition, the named executive officers’ employment agreements provide that if the severance payments

and vesting described above would be a “parachute payment” resulting in a lost tax deduction for the Company

and excise tax to the executive under Sections 280G and 4999 of the Internal Revenue Code, the payments and

vesting would be reduced to the extent that it results in the executive receiving a greater after-tax amount.

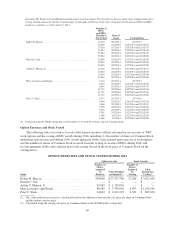

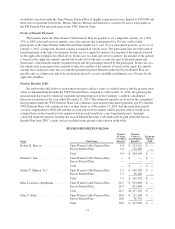

DIRECTOR COMPENSATION

The table below sets out the compensation for 2014 that was paid to or earned by the Company’s directors

who were not active employees of the Company or its affiliates (“non-employee directors”). Directors who are

active employees of the Company are not separately compensated for their Board activities. The compensation

remains unchanged for 2015.

The Company compensates non-employee directors with a combination of equity and cash that it believes is

comparable to and consistent with approximately the median compensation provided to independent directors of

similarly sized public entities. During 2014, each non-employee director received a total annual director

compensation package consisting of:

• a cash retainer of $90,000;

59