Time Warner Cable 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

distributions if and when regular cash dividends are paid on outstanding shares of Common Stock and at the same rate. In the

case of PBUs, the receipt of dividend equivalents is subject to the satisfaction and certification of the applicable performance

condition. The satisfaction of the performance condition for continued vesting of the PBUs awarded in 2014 was certified in

January 2015. The awards of RSUs and PBUs confer no voting rights on holders and are subject to restrictions on transfer

and forfeiture prior to vesting. See “—Compensation Discussion and Analysis—2014 Long-Term Incentive Program—

Equity-Based Awards,” “—Employment Agreements” and “—Potential Payments upon Termination of Employment.”

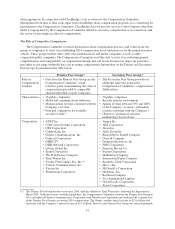

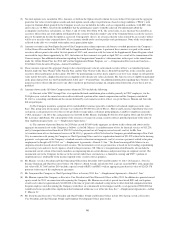

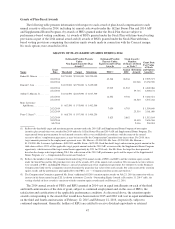

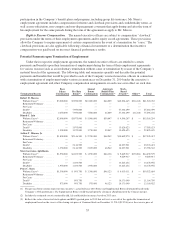

Outstanding Equity Awards

The following table provides information about the outstanding awards of options to purchase the Company’s Common

Stock, including PBOs, and the aggregate RSUs and PBUs held by each named executive officer on December 31, 2014. The

satisfaction of the one-year performance-based condition related to the vesting of the PBUs awarded in 2014 was certified in

January 2015. As of December 31, 2014, the one-year performance-based conditions related to the vesting of all outstanding

PBOs had been certified. No stock options, including PBOs, were awarded to the executive officers in 2014.

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2014

Option Awards(1) Stock Awards

Name

Date of

Option

Grant

Number of

Securities

Underlying

Unexercised

Options

Exercisable

Number of

Securities

Underlying

Unexercised

Options

Unexercisable

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

Option

Exercise

Price

Option

Expiration

Date

Number of

Shares or

Units of

Stock

That

Have Not

Vested(2)

Market

Value

of

Shares or

Units of

Stock

That Have

Not

Vested(3)

Equity

Incentive

Plan

Awards:

Number of

Unearned

Units of

Stock That

Have Not

Vested(2)

Equity

Incentive

Plan

Awards:

Market

Value of

Unearned

Units of

Stock That

Have Not

Vested(3)

Robert D. Marcus ...... 225,084 $34,226,273 42,548 $6,469,849

2/17/2011 — 32,799 — $72.05 2/16/2021

2/16/2012 — 81,131 — 77.04 2/15/2022

2/13/2013 11,339 121,404 — 86.76 2/12/2023

Dinesh C. Jain ........ — — — — — 71,659 $10,896,468 17,915 $2,724,155

ArthurT.Minson,Jr. ....

77,352 $11,762,145 14,556 $2,213,385

5/31/2013 — 75,197 — $95.51 5/30/2023

Marc Lawrence-

Apfelbaum ......... 47,448 $ 7,214,943 7,054 $1,072,631

2/17/2011 — 9,330 — $72.05 2/16/2021

2/16/2012 — 28,397 — 77.04 2/15/2022

2/13/2013 — 31,869 — 86.76 2/12/2023

Peter C. Stern ......... 38,407 $ 5,840,168 5,823 $ 885,445

2/17/2011 6,376 6,378 — $72.05 2/16/2021

2/16/2012 10,816 16,227 — 77.04 2/15/2022

2/13/2013 8,767 26,306 — 86.76 2/12/2023

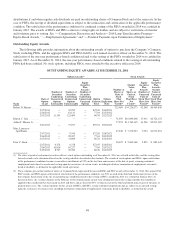

(1) The dates of grant of each named executive officer’s stock options outstanding as of December 31, 2014 are set forth in the table, and the vesting dates

for each award can be determined based on the vesting schedules described in this footnote. The awards of stock options and PBOs, upon certification

of the performance condition, become exercisable in installments of 25% on the first four anniversaries of the date of grant, assuming continued

employment and subject to accelerated vesting upon the occurrence of certain events, including involuntary termination of employment, retirement,

death or disability, as defined in the applicable award agreement.

(2) These columns present the number of shares of Common Stock represented by unvested RSU and PBU awards at December 31, 2014. The annual 2014

RSU awards, and PBUs upon certification of satisfaction of the performance condition, vest 50% on each of the third and fourth anniversaries of the

date of grant. Satisfaction of the one-year performance condition related to the vesting of PBUs awarded in 2014 was certified in January 2015. As

discussed above, the vesting schedules of the February 2014 retention equity awards were designed to mirror the vesting schedule that would have

applied to the awards had they been made in 2015 and 2016, and are based on 50% vesting on each of the third and fourth anniversaries of the dates of

grant in those years. The vesting schedules for the awards of RSUs and PBUs assume continued employment and are subject to accelerated vesting

upon the occurrence of certain events, including involuntary termination of employment, retirement, death or disability, as defined in the award

48