Time Warner Cable 2015 Annual Report Download - page 52

Download and view the complete annual report

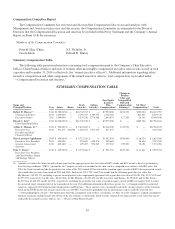

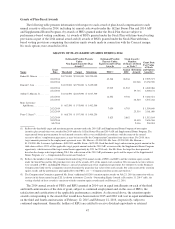

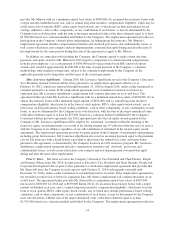

Please find page 52 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) No stock options were awarded in 2014. Amounts set forth in the Option Awards column for years before 2014 represent the aggregate

grant date fair value of stock option awards and stock option awards subject to performance-based vesting conditions (“PBOs”) with

respect to Common Stock granted by the Company in each year included in the table, each as computed in accordance with SEC rules

and, in the case of PBOs, based on the probability that the performance targets would be achieved. For information about the

assumptions used in these calculations, see Notes 3 and 13 to the 2014 Form 10-K. The actual value, if any, that may be realized by an

executive officer from any stock option will depend on the extent to which the market value of the Common Stock exceeds the exercise

price of the option on the date the option is exercised. Consequently, there is no assurance that the value realized by an executive officer

will be at or near the value estimated above. These amounts should not be used to predict stock performance. None of the stock options

reflected in the table was awarded with tandem stock appreciation rights.

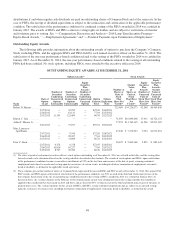

(3) Amounts set forth in the Non-Equity Incentive Plan Compensation column represent cash bonuses awarded pursuant to the Company’s

162(m) Bonus Plan and both the 2014 AIP and the Supplemental Bonus Program. A portion of these amounts was paid to the named

executive officers prior to the end of the first quarter of 2015, and, consistent with the terms of the Supplemental Bonus Program, which

increased the target bonus opportunity by 50%, the balance of these amounts was paid in April 2015 as a result of the termination of the

Comcast merger. For additional information regarding the Compensation Committee’s determinations with respect to the annual bonus

under the 162(m) Bonus Plan, the 2014 AIP and the Supplemental Bonus Program, see “—Compensation Discussion and Analysis—

2014 Short-Term Incentive Program—Annual Cash Bonus.”

(4) These amounts represent the aggregate change in the actuarial present value of each named executive officer’s accumulated pension

benefits under the Time Warner Cable Pension Plan, and the Time Warner Cable Excess Benefit Pension Plan, to the extent the named

executive officer participates in these plans. For 2013, the participating executives had a negative year-over-year change in such pension

value mainly driven by a higher discount rate assumption used in the present value calculation. Mr. Jain was not yet eligible to participate

in the plans during 2014. See the Pension Benefits Table and “—Pension Plans” for additional information regarding these benefits. The

named executive officers did not receive any above-market or preferential earnings on compensation deferred on a basis that is not tax

qualified.

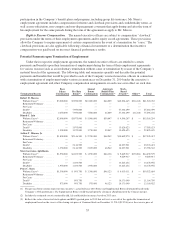

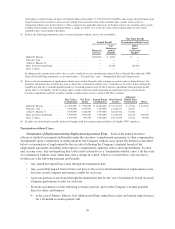

(5) Amounts shown in the All Other Compensation column for 2014 include the following:

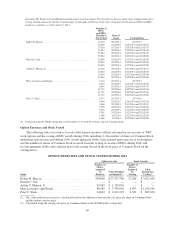

(a) Pursuant to the TWC Savings Plan, a tax-qualified defined contribution plan available generally to TWC employees, for the

2014 plan year, each of the named executive officers deferred a portion of his annual compensation and the Company contributed

$11,667 as a matching contribution on the amount deferred by each named executive officer, except for Messrs. Minson and Jain who

did not participate.

(b) The Company maintains a program of life and disability insurance generally available to all salaried employees on the same

basis. This group term life insurance coverage was reduced to $50,000 for each of Messrs. Marcus and Lawrence-Apfelbaum who were

each given a cash payment to cover the cost of specified coverage under a voluntary group program available to employees generally

(“GUL insurance”). In 2014, this cash payment was $11,088 for Mr. Marcus (including $3,024 for 2013 paid in 2014) and $16,469 for

Mr. Lawrence-Apfelbaum. For a description of life insurance coverage for certain executive officers provided pursuant to the terms of

their employment agreements, see “—Employment Agreements.”

(c) The amounts of personal benefits for 2014 that exceed $10,000 in the aggregate are shown in this column and consist of the

aggregate incremental cost to the Company as follows: (i) for Mr. Marcus, (x) reimbursement of fees for financial services of $13,230;

and (y) transportation-related benefits of $249,519 related to personal use of Company-owned aircraft; and (ii) for Mr. Jain,

(x) reimbursement of fees for financial services of $8,330; (y) payments of $86,564 related to Company-provided housing in New York

City in connection with joining the Company as Chief Operating Officer and a tax equalization benefit of $51,929 related to the housing

payments, each pursuant to the Company’s standard executive relocation arrangements; and (z) severance payments related to his prior

employment by Insight of $742,283, see “—Employment Agreements—Dinesh C. Jain.” The Board encouraged Mr. Marcus to use

corporate-owned or leased aircraft for security reasons. The incremental cost of any personal use is based on fuel, landing, repositioning

and catering costs and crew travel expenses related to the personal use. Mr. Marcus’s transportation-related benefits also include the

incremental cost of certain of his family members accompanying him on certain business and personal trips on corporate aircraft. The

incremental cost to the Company for the use of the aircraft under these circumstances is limited to catering and TWC’s portion of

employment taxes attributable to the income imputed to the executive for tax purposes.

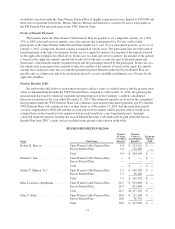

(6) Mr. Marcus served as President and Chief Operating Officer from December 2010 until December 31, 2013. On January 1, 2014, he

became Chairman and Chief Executive Officer. Mr. Marcus’s Stock Awards include for 2012 a special award of PBUs with a grant date

fair value of $1,617,840 and for 2014 include a special award of RSUs and PBUs with an aggregate grant date fair value of $2,020,178

pursuant to the terms of his employment agreement.

(7) Mr. Jain joined the Company as Chief Operating Officer in January 2014. See “—Employment Agreements—Dinesh C. Jain.”

(8) Mr. Minson rejoined the Company as Executive Vice President and Chief Financial Officer in May 2013. In addition to a prorated annual

equity award for 2013, in connection with rejoining the Company, Mr. Minson received (a) special time-based RSU and stock option

awards each valued at approximately $1,000,000 at the time of grant with standard vesting terms to offset forfeited compensation from

his prior employer such that joining the Company would have an economically neutral impact and (b) a cash payment of $500,000 that

would have been repayable if his employment had terminated within one year of his hire date. See “—Employment Agreements—Arthur

T. Minson, Jr.”

(9) Mr. Stern became Executive Vice President and Chief Product, People and Strategy Officer in July 2014 having served as Executive

Vice President and Chief Strategy, People and Corporate Development Officer prior to that.

46