Time Warner Cable 2015 Annual Report Download - page 45

Download and view the complete annual report

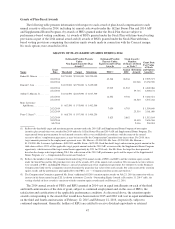

Please find page 45 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The 2014 annual LTI awards were made to all eligible employees on February 12, 2014, a date selected by

the Compensation Committee in October 2013. With the financial performance conditions discussed above

having been satisfied, all the 2014 annual RSUs are eligible to vest in equal installments on the third and fourth

anniversaries of the date of grant. The Company and the Compensation Committee believe that the multi-year,

time-based vesting schedules encourage executive retention and emphasize a longer-term perspective.

Outstanding stock options and RSUs provide for accelerated vesting upon a termination of employment after

reaching a specified age and years of service and upon certain involuntary terminations of employment.

Merger-Related Retention Equity Awards. In addition, in connection with the execution of the Comcast

merger agreement, the Compensation Committee approved the retention equity awards that advanced into 2014

the award of equity grants that would otherwise have been made in 2015 and 2016 for all TWC employees who

were eligible to receive equity awards (over 1,800 employees), including the named executive officers. These

advanced awards were intended to address employee retention during the potentially prolonged period of

uncertainty during the pendency of the regulatory review process for the Comcast merger and thereafter, while at

the same time preserving appropriate incentives and alignment of employees with TWC stockholders in light of

the possibility that the Comcast merger might not close. The Compensation Committee believed that the

retention equity awards needed to be sufficiently meaningful to the employees so that forfeiture would represent

a significant deterrent to leaving employment at the Company and also limit other employers’ ability or

willingness to offer to make up the value of the awards to entice their departures. The vesting terms of the awards

were also appropriately structured in the event that the Comcast merger failed to close or an executive remained

with the merged company after the closing.

The effectiveness of the Company’s planning has been borne out. More than a year after the Comcast

merger was announced, the senior management team is intact and has been successful in driving the business to

achieve the Company’s operating results while also working to advance the then anticipated closing and

integration of the Comcast merger. In addition, both the employees and the Company are generally in the same

position they would have been in had the retention equity awards been made in 2015 and 2016, rather than 2014.

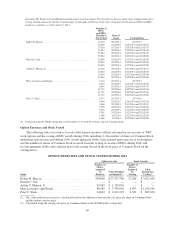

The retention equity awards consisted of RSUs with service-based vesting and were designed to replace the

annual equity awards that the employees, including the named executive officers, would otherwise have received

in 2015 and 2016. Each retention award was valued to reflect the expected target value of such 2015 and 2016

awards and was made in the form of RSUs for reasons similar to those that guided the decision that the 2014

annual LTI awards would take the form of RSUs. Unlike the 2014 annual RSU grants, the retention equity

awards did not carry performance-based vesting conditions as the Compensation Committee believed that

applying performance conditions to the retention equity awards would diminish their retentive value and

alignment with stockholders.

The retention equity awards’ vesting schedule was designed to mirror the vesting schedule that would have

applied to the annual equity grants had they been made in 2015 and 2016. Accordingly, because the normal

course 2015 and 2016 RSU grants would each have vested 50% on their respective third and fourth anniversaries,

the 2015 retention equity award will vest 50% in each of February of 2018 and 2019 and the 2016 retention

equity award will vest 50% in each of February of 2019 and 2020, in each case subject to continued employment.

Consistent with its intent at the time of the retention equity awards, the Compensation Committee did not make

additional awards in 2015 to employees who received retention equity awards in 2014 and does not expect to do

so in 2016, absent an increase in an executive’s responsibilities or other changed circumstances. Consequently,

whether or not the Comcast merger was consummated, both the employees and the Company would generally be

in the same position they would have been in had the additional RSUs been granted in 2015 and 2016, rather than

in 2014. See “—Grants of Plan-Based Awards.”

39