Time Warner Cable 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

result of Management’s report on its and Compensation Committee members’ engagement with the Company’s

stockholders in connection with the 2014 say-on-pay vote and generally, the Compensation Committee believes

that this vote indicates stockholders’ general support of the Company’s approach to executive compensation, but

a lower level of enthusiasm for the special retention equity awards made in connection with the Comcast merger.

As discussed above, the Compensation Committee viewed these awards as part of a critical retention program to

support the Company’s ongoing business needs and goals during the pendency of the Comcast merger and not as

a component of the Company’s regular annual compensation. The Committee believes that these programs

reflect the Company’s philosophy and goals and have been effective at creating value for the Company’s

stockholders by motivating and retaining executives to achieve the Company’s objectives. As a result, the

Compensation Committee did not change its compensation approach in 2014 in light of these vote results. The

Compensation Committee will continue to consider the outcome of the Company’s say-on-pay vote when

making future compensation decisions for the named executive officers.

Additional Executive

Compensation Information

Ownership and Retention Requirements; Hedging Policy

Beginning in 2011, the Company adopted stock ownership requirements that, following a five-year phase-in

period, require that covered officers hold stock (including in the form of unvested RSUs (other than those then

subject to satisfaction of performance criteria)) in an amount equal to or exceeding a multiple of their annual base

salary. As of January 31, 2015, each of the named executive officers would have met his or her ownership

requirement if the phase-in period had expired.

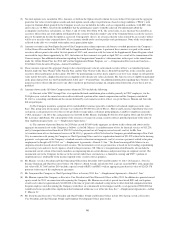

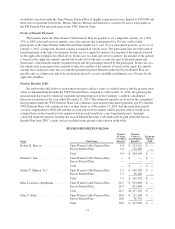

Title

Stock Ownership Requirement

Multiple of Annual Base Salary

Chief Executive Officer ....................................... 6.0X

Chief Operating Officer ....................................... 3.5X

Chief Financial Officer ........................................ 3.5X

Other Executive Officers (and Executive Vice Presidents) ............ 2.0X

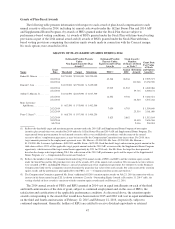

Under the ownership requirements, the Company will review covered officers’ compliance on January 31 of

each calendar year. If an officer is not in compliance with the requirement within a five-year phase-in period

(January 31, 2016 for all named executive officers other than Messrs. Jain and Minson), he or she will be

required to retain at least 50% of any stock received upon exercise of stock options or vesting of RSUs (after

shares used to cover exercise costs, taxes, etc.). Prior to the full implementation of the requirements, the

executive officers must obtain consent from the Chief Executive Officer if a sale of Common Stock would cause

the executive to no longer satisfy the ownership requirement. The Compensation Committee will also consider

the executive officers’ compliance with the ownership and retention requirements in determining compensation.

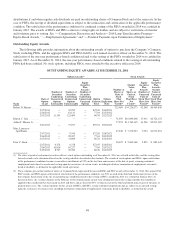

Under the Company’s securities trading policies, executive officers and directors of the Company may not

engage in hedging strategies using puts, calls, straddles, collars or other similar instruments involving the

Company’s securities, except under very limited circumstances with the Company’s approval. None of the

Company’s executive officers has pledged Company Common Stock.

Risk Assessment

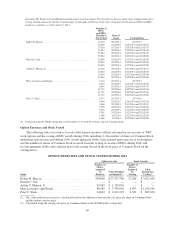

During 2014, the Compensation Committee conducted a risk assessment of the named executive officers’

compensation. As part of the risk assessment, the Compensation Committee reviewed the key design features of

the Company’s 2014 incentive programs, the nature of the risks that these features might give rise to and certain

mitigating factors.

The Compensation Committee concluded that the Company’s executive incentive programs do not

incentivize excessive risk-taking or inappropriate conservatism in behavior and decisionmaking. Among the

factors giving rise to the Compensation Committee’s determination were the following:

• The Company’s compensation programs for the named executive officers provide a balanced mix of

cash and equity and annual and longer-term incentives.

43