Time Warner Cable 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

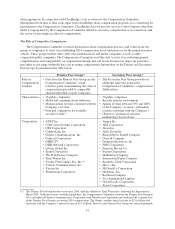

OPI “score” of 116%, based on the unadjusted straight-line interpolation of each applicable component and the

appropriately weighted aggregate of each of the four principal areas, as shown in the table below. This

determination reflected the Compensation Committee’s view of the Company’s accomplishments during the year

(as outlined above and under “2014 Highlights: Company Performance”) to set the foundation for achievements

under the long-term plan and in light of the difficult competitive environment and the distractions of the Comcast

merger regulatory review process and planning for post-closing integration.

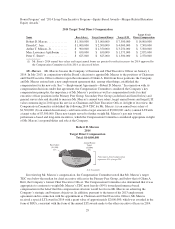

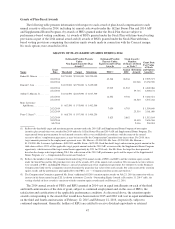

The table below sets out each of the threshold/maximum interpolated scores for each of the Profit

Participation Program and the OPI components of the 2014 annual bonus program and the ultimate scores

assigned by the Compensation Committee for use in the bonus determinations.

2014 Company Performance

Percentage

Allocation X

Threshold/

Maximum

Interpolation =

Final

Score

Profit Participation Program

(50% of 2014 annual bonus target payment) ........... 50% 96% 48%

Operational Performance Incentive

(50% of 2014 annual bonus target payment)

Residential customer experience .................. 12.5% 124% 15.5%

Plant reliability and expansion .................... 12.5% 122% 15.25%

TWC Maxx deployment ........................ 12.5% 117% 14.5%

Financial and operating performance .............. 12.5% 102% 12.75%

Total weighted aggregate score ................... 50% 116% 58%

Weighted Aggregate Annual Bonus Score ............. 100% 106% 106%

2014 Annual Incentive Plan and Supplemental Bonus Payments.

The table below indicates the total amount awarded to each named executive officer under the 2014 annual

bonus programs, including the (a) 2014 AIP and (b) Supplemental Bonus Program, based on a 106% overall

performance score, alongside each officer’s aggregate annual bonus target under the 2014 AIP and Supplemental

Bonus Program. The named executive officers were paid a portion of these annual bonus awards before the end

of the first quarter of 2015 and, consistent with the terms of the Supplemental Bonus Program, were paid the

balance in April 2015 as a result of the abandonment of the Comcast merger. These bonus amounts are also

included under the heading “Non-Equity Incentive Plan Compensation” in the Summary Compensation Table

below.

Executive Officer

2014

Annual Bonus Award Target

2014 AIP and

Supplemental

Bonus(2)

2014 AIP

Supplemental

Bonus

Program

Total 2014

Annual Bonus

Award(1)

Robert D. Marcus ................ $ 5,300,000 $ 2,650,000 $ 7,950,000 $ 7,500,000

Dinesh C. Jain ................... $ 2,650,000 $ 1,325,000 $ 3,975,000 $ 3,750,000

Arthur T. Minson, Jr. .............. $ 1,431,000 $ 715,500 $ 2,146,500 $ 2,025,000

Marc Lawrence-Apfelbaum ........ $ 689,000 $ 344,500 $ 1,033,500 $ 975,000

Peter C. Stern .................... $ 662,500 $ 331,250 $ 993,750 $ 937,500

(1) Aggregate of amounts awarded under the 2014 AIP and Supplemental Bonus Program.

(2) The 2014 AIP bonus target for each of the named executive officers is set forth in the table above titled “2014

Target Total Direct Compensation.” The Supplemental Bonus Program effectively increased each AIP participant’s

bonus target by 50%.

Section 162(m) Compliance. In order to structure the short-term incentive awards as potentially

deductible amounts under Section 162(m) of the Internal Revenue Code (“Section 162(m)”), additional

conditions and limitations on awards were imposed under the Time Warner Cable Inc. 2012 Annual Bonus Plan

(the “162(m) Bonus Plan”), which was approved by the Company’s stockholders in May 2012. Pursuant to the

162(m) Bonus Plan, a subcommittee of the Compensation Committee, whose members are “outside directors” as

37