Time Warner Cable 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

would have received under the Time Warner Pension Plan if eligible compensation were limited to $350,000 and

there were no payment restrictions. Messrs. Marcus, Minson and Stern have ceased to be active participants in

the TW Pension Plan and participate in the TWC Pension Plans.

Forms of Benefit Payments

The benefits under the Time Warner Cable Pension Plan are payable as (i) a single life annuity, (ii) a 50%,

75% or 100% joint and survivor annuity, (iii) a life annuity that is guaranteed for 10 years (with certain

participants in the Time Warner Cable Pension Plan eligible for 5- and 15-year guaranteed periods), or (iv) as of

January 1, 2015, a lump sum. Spousal consent is required in certain cases. The participant may elect the form of

benefit payment at the time of retirement. In the case of a single life annuity, the amount of the annuity is based

on the applicable formulas described above. In the case of a joint and survivor annuity, the amount of the annuity

is based on the single life annuity amount but is reduced to take into account the ages of the participant and

beneficiary at the time the annuity payments begin and the percentage elected by the participant. In the case of a

life annuity that is guaranteed for a period of time, the amount of the annuity is based on the single life annuity

amount but is reduced to take into account the guaranteed period. Benefits under the Excess Benefit Plan are

payable only as a lump sum, unless the participant elected to receive monthly installments over 10 years by the

applicable deadline.

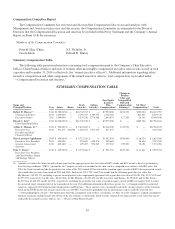

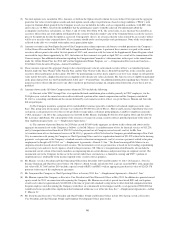

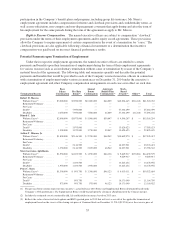

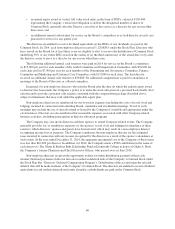

Pension Benefits Table

Set forth in the table below is each named executive officer’s years of credited service and the present value

of his accumulated benefit under the TWC Pension Plans computed as of December 31, 2014, the pension plan

measurement date used for financial statement reporting purposes in the Company’s audited consolidated

financial statements for the year ended December 31, 2014. The estimated amounts are based on the assumption

that payments under the TWC Pension Plans will commence upon normal retirement (generally age 65), that the

TWC Pension Plans will continue in force in their forms as of December 31, 2014, that the maximum annual

covered compensation is $350,000 and that no joint and survivor annuity will be payable (which would on an

actuarial basis reduce benefits to the employee but provide benefits to a surviving beneficiary). Amounts

calculated under the pension formula that exceed Internal Revenue Code limits will be paid under the Excess

Benefit Plan from TWC’s assets and are included in the present values shown in the table.

PENSION BENEFITS FOR 2014

Name Plan Name

Number

of Years

Credited

Service(1)

Present

Value of

Accumulated

Benefit(2)

Payments

During

2014

Robert D. Marcus ................. Time Warner Cable Pension Plan 9.4 $ 253,910 $ —

Excess Benefit Plan 9.4 110,280 —

Total 9.4 $ 364,190 $ —

Dinesh C. Jain ................... Time Warner Cable Pension Plan — $ — $ —

Excess Benefit Plan — — —

Total — $ — $ —

Arthur T. Minson, Jr.(3). ............ Time Warner Cable Pension Plan 5.3 $ 109,150 $ —

Excess Benefit Plan 5.3 56,160 —

Total 5.3 $ 165,310 $ —

Marc Lawrence-Apfelbaum ......... Time Warner Cable Pension Plan 24.5 $ 993,680 $ —

Excess Benefit Plan 24.5 423,430 —

Total 24.5 $1,417,110 $ —

Peter C. Stern .................... Time Warner Cable Pension Plan 10.8 $ 221,140 $ —

Excess Benefit Plan 10.8 96,750 —

Total 10.8 $ 317,890 $ —

51