Time Warner Cable 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

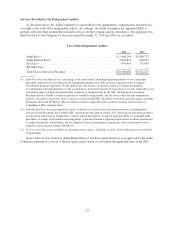

information in the Primary Peer Group and Secondary Peer Group. In October 2013, the Compensation

Committee made no change to Mr. Stern’s target TDC for 2014. In July 2014, the Compensation Committee

determined to increase Mr. Stern’s target TDC by 10% to reflect an increase in Mr. Stern’s responsibilities,

internal and market compensation practices, his experience and the importance of his position and retaining him

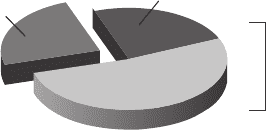

in that position. In light of its review, the Compensation Committee determined to make the following target

TDC changes for Mr. Stern, which were prorated for 2014 as reflected in the table above and the chart below:

(a) increase his annual base salary from $600,000 to $650,000; (b) increase the target amount of his annual

discretionary cash bonus from $600,000 to $650,000; and (c) increase the annual target value of his LTI from

$1,300,000 to $1,450,000 (with no adjustment made to his 2014 annual LTI award).

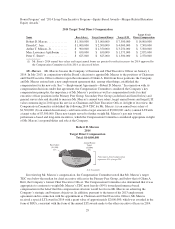

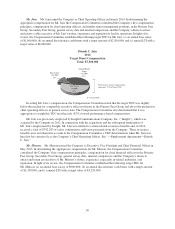

Peter C. Stern

2014

Target Direct Compensation

Total: $2,550,000

Annual Bonus

Target

($625)

25%

Base Salary

($625)

25%

(

$ in thousands

)

Performance-based compensation

represents 75% of target TDC

LTI Target

($1,300)

50%

In setting Mr. Stern’s compensation, the Compensation Committee noted that his 2014 target TDC was

reflective of his diverse and important responsibilities. The Compensation Committee also determined that it was

appropriate to continue to weight Mr. Stern’s target TDC most heavily (75%) toward performance-based

compensation. See “—Employment Agreements—Peter C. Stern.”

2014 Short-Term Incentive Program—Annual Cash Bonus

The Company’s annual cash bonus payments to the named executive officers for 2014 were based on three

components:

• the 2014 Time Warner Cable Annual Incentive Plan (the “2014 AIP”), based 50% on a Profit

Participation Program (“Profit Participation Program”) tied to Company financial performance and 50%

on a new Operational Performance Incentive (“OPI”) feature introduced for 2014 tied to achievement of

specified operational and financial goals;

• a residential video subscriber additions bonus opportunity equal to 5% of the 2014 AIP target bonus in

the event of a net increase in residential video subscribers in any 2014 fiscal quarter (the “Residential

Video Subscriber Additions Bonus”); and

• a special Supplemental Bonus Program award opportunity approved as an additional incentive in

connection with the Comcast merger, that served to increase the target bonus opportunity by 50% (see

“—Supplemental Bonus Program,” below).

Unlike past years in which the named executive officers’ cash incentive was based predominantly on the

Company’s financial performance, the Compensation Committee believed that the 2014 mix of financial and

operational goals would align executives with the Company’s ambitious three-year plan to revitalize its

residential services, expand and improve its network and drive growth in business services to lead to longer-term

shareholder returns.

2014 Profit Participation Program. Management proposed the use of Operating Income to determine

Company financial performance under the 2014 Profit Participation Program component of the AIP, which

accounted for 50% of the 2014 AIP opportunity. In adopting Management’s proposal for the 2014 Profit Participation

32