Time Warner Cable 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

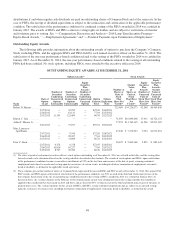

stock options and the closing sale price of Common Stock on December 31, 2014 ($152.06) for RSUs and assumes the performance goal

for performance-based awards is achieved and certified. Pursuant to the terms of the retention equity awards, in the event of a

termination without cause on December 31, 2014, or prior to the applicable anniversary of the date of grant, the retention equity awards

would be forfeited unless the termination follows a change in control. As a result, the value of the retention equity awards is only

included in the event of death or disability.

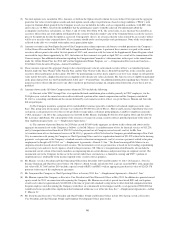

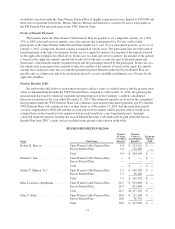

(4) Reflects the following components in the event of termination without cause or due to disability:

One-Time Benefit

Annual Benefit Termination without Cause

Financial

Services

Life

Insurance-

related

Benefits

Office

Space/

Secretarial

Support

Robert D. Marcus ..................................... $100,000 $ 8,064 $ —

Dinesh C. Jain ........................................ — — —

Arthur T. Minson, Jr. .................................. — — —

Marc Lawrence-Apfelbaum ............................. — 16,355 120,960

Peter C. Stern ........................................ — — —

In addition to the amount shown above, the executive would also receive distributions under the Excess Benefit Plan and/or the TWE

Deferral Plan following termination, as described under “—Pension Plans” and “—Nonqualified Deferred Compensation.”

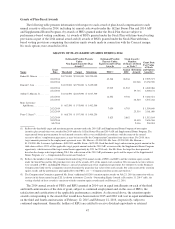

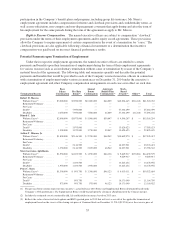

(5) In the event of a termination of employment without cause within 24 months after a change-in-control event (as defined below), the

payments and benefits due would be the same as shown for a termination without cause, except that (a) the salary, bonus and benefits

would be payable for a 36-month period instead of a 24-month period (except for Mr. Lawrence-Apfelbaum whose payment period

shown above is 36 months), (b) the retention equity awards would vest upon termination of employment and (c) each of Messrs.

Lawrence-Apfelbaum and Stern would be entitled to outplacement services valued at $90,000, as follows:

Base Salary

Continuation

Pro Rata

Bonus

Annual Bonus

Continuation

Stock-Based

Awards

Aggregate

Benefit Plan

Continuation Other

Robert D. Marcus ................ $ 4,500,000 $ 7,950,000 $ 15,000,000 $ 57,334,499 $ 71,964 $ 324,192

Dinesh C. Jain .................. 3,000,000 3,975,000 7,500,000 13,620,623 78,025 —

Arthur T. Minson, Jr. ............. 2,700,000 2,146,500 4,050,000 18,227,921 76,368 —

Marc Lawrence-Apfelbaum ........ 1,950,000 1,033,500 1,950,000 13,245,456 66,138 260,024

Peter C. Stern ................... 1,950,000 993,750 1,950,000 10,171,049 72,136 90,000

(6) Excludes any death benefits payable under the Company-paid life insurance plan provided to all eligible TWC employees.

Termination without Cause

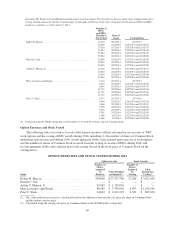

Termination of Employment during Employment Agreement Term. Each of the named executive

officers is entitled to payments and benefits under the executive’s employment agreement or other compensation

arrangements upon a termination of employment by the Company without cause (generally defined as described

below) or termination of employment by the executive following the Company’s material breach of the

employment agreement, including with respect to compensation, authority, duties and responsibilities, location

and, in some cases, title and reporting line (collectively referred to as a “termination without cause”). In the event

of a termination without cause (other than after a change in control, which is covered below), the executives

would receive the following payment and benefits:

• Any earned but unpaid base salary through the termination date.

• Any accrued but unpaid bonus for the year prior to the year in which termination of employment occurs,

based on actual Company performance results for such year.

• A pro rata portion of any bonus through the termination date for the year of termination, based on actual

Company performance results for such year.

• Severance payments over the following severance periods, paid on the Company’s normal payment

dates for salary and bonuses:

➢in the case of Messrs. Marcus, Jain, Minson and Stern, annual base salary and annual target bonuses

for a 24-month severance period; and

56