Time Warner Cable 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

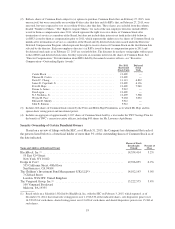

(2) Reflects shares of Common Stock subject to (a) options to purchase Common Stock that, on February 27, 2015, were

unexercised, but were exercisable on or within 60 days after that date and (b) RSUs that, on February 27, 2015, were

unvested, but were expected to vest on or within 60 days after that date. These shares are excluded from the column

headed “Number of Shares.” The “Right to Acquire Shares” for each of the non-employee directors includes RSUs

issued to them as compensation since 2011, which represent the right to receive shares of Common Stock after

termination of service as a member of the Board, but does not include their interests set forth in the table below in

(a) RSUs issued to them as compensation prior to 2011, which represent the right to receive shares of Common Stock six

months after termination of service as a member of the Board and (b) deferred stock units issued under the Directors’

Deferred Compensation Program, which represent the right to receive shares of Common Stock on the distribution date

selected by the director. Each non-employee director’s (a) RSUs issued to them as compensation prior to 2011 and

(b) deferred stock units as of February 27, 2015 are set forth below. The directors do not have voting rights with respect

to these RSUs and deferred stock units, but they represent an economic interest in the shares of Common Stock. See

“Director Compensation.” For information about RSUs held by the named executive officers, see “Executive

Compensation—Outstanding Equity Awards.”

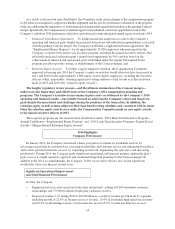

Pre-2011

Restricted

Stock Units

Deferred

Stock

Units

Carole Black .................................................. 12,409 —

Thomas H. Castro .............................................. 12,409 —

David C. Chang ................................................ 11,113 6,832

James E. Copeland, Jr. ........................................... 12,409 6,126

Peter R. Haje .................................................. 12,409 7,940

Donna A. James ................................................ 5,912 —

Don Logan .................................................... 12,409 —

N.J. Nicholas, Jr. ............................................... 12,409 7,568

Wayne H. Pace ................................................ 9,204 3,052

Edward D. Shirley .............................................. 5,912 —

John E. Sununu ................................................ 5,912 —

(3) Includes 666 shares of Common Stock owned by the Peter and Helen Haje Foundation, as to which Mr. Haje and his

spouse share voting power and investment power.

(4) Includes an aggregate of approximately 1,037 shares of Common Stock held by a trust under the TWC Savings Plan for

the benefit of TWC’s current executive officers, including 845 shares for Mr. Lawrence-Apfelbaum.

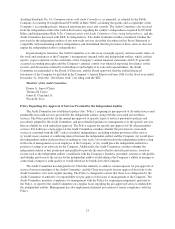

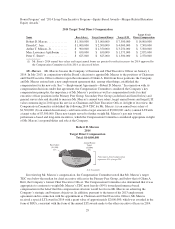

Security Ownership of Certain Beneficial Owners

Based on a review of filings with the SEC, as of March 31, 2015, the Company has determined that each of

the persons listed below is a beneficial holder of more than 5% of the outstanding shares of Common Stock as of

the date indicated.

Name and Address of Beneficial Owner

Shares of Stock

Beneficially

Owned

Percent of

Class

BlackRock, Inc.(1) ....................................................... 14,554,414 5.2%

55 East 52nd Street

New York, NY 10022

Dodge & Cox(2) ........................................................ 19,396,055 6.9%

555 California Street, 40th Floor

San Francisco, CA 94104

The Children’s Investment Fund Management (UK) LLP(3) ...................... 14,102,143 5.0%

7 Clifford Street

London, W1S 2FT, United Kingdom

The Vanguard Group, Inc.(4) .............................................. 15,222,575 5.4%

100 Vanguard Boulevard

Malvern, PA 19355

(1) Based solely on a Schedule 13G filed by BlackRock, Inc. with the SEC on February 3, 2015, which reported, as of

December 31, 2014, that it had sole voting power over 11,916,330 of the indicated shares, sole dispositive power over

14,539,054 of such shares, shared voting power over 13,628 of such shares and shared dispositive power over 15,360 of

such shares.

19