Time Warner Cable 2015 Annual Report Download - page 64

Download and view the complete annual report

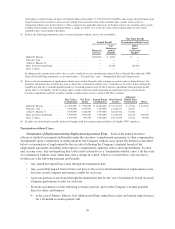

Please find page 64 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mr. Lawrence-Apfelbaum was eligible for retirement under his employment agreement and other Company

compensation arrangements as of December 31, 2014. Upon his retirement, the Company would have no further

obligations other than (a) to pay his base salary through the effective date of his retirement and (b) to satisfy any

rights pursuant to any insurance and other benefit plans of the Company. His stock options and RSUs, subject to

the terms of the retention equity awards, would become fully vested upon retirement, with an exercise period

continuing for five years thereafter (or until the original expiration date if sooner) and subject to delayed

distribution of RSUs if required by tax rules.

Messrs. Marcus, Jain, Minson and Stern were not eligible for retirement on December 31, 2014. Upon their

voluntary resignation, the Company would have no further obligations to these executives other than (a) to pay

base salary through the effective date of termination and (b) to satisfy any rights the executive has pursuant to

any insurance or other benefit plans of the Company. Any unvested stock options and RSUs would be forfeited.

Termination for Cause

Generally, if the Company terminates an executive’s employment for cause (described below), the Company

would have no further obligations to the executive other than (a) to pay base salary through the effective date of

termination; (b) to pay any bonus for a prior year that has been determined but not yet paid in certain situations;

and (c) to satisfy any rights the executive has pursuant to any insurance or other benefit plans or arrangements of

the Company.

With respect to equity awards, the executive would forfeit unvested stock options and RSUs upon a

termination of employment for cause. The executive would have one month to exercise any vested stock options,

unless the termination of employment is a result of fraud, embezzlement, misappropriation or certain other

specified reasons in the case of awards made in and after 2010, in which case, the exercise period would be

eliminated.

In addition, the Company has a “clawback” right to certain elements of compensation and equity awards in

the event of certain terminations for cause.

Under the employment agreements, “cause” includes certain felony convictions and willful actions resulting

in substantial adverse effects on the Company, as well as other actions including willful failure to perform

material duties and material breach of restrictive covenants regarding confidentiality, non-competition and non-

solicitation of customers and employees. In the event of a change in control, termination of employment under

certain of these circumstances would not constitute “cause.”

Termination by Reason of Death

Generally, if an executive dies during the term of the employment agreement, the executive’s estate (or a

designated beneficiary) would be entitled to receive (a) the executive’s earned and unpaid base salary through the

date of death and (b) a prorated bonus for the year in which the executive’s death occurs, plus any bonus

compensation for the year prior to death that has not yet been paid, in each case based on actual Company

performance results. The executive’s unvested stock options and RSUs, including the retention equity awards,

would vest upon death.

Termination by Reason of Disability

In the event Messrs. Marcus, Jain, Minson or Stern becomes disabled (as defined in the applicable

employment agreement), the Company would pay the executive a pro rata bonus for the year in which the

disability occurs (based on actual Company performance results) and disability benefits for period of 24 months

in an annual amount equal to 75 percent of (a) base salary and (b) target annual bonus, as well as continued

participation in the Company’s benefit plans and programs during such period. These amounts are reduced by

disability payments from workers’ compensation, Social Security and the Company’s disability insurance

policies.

In the event Mr. Lawrence-Apfelbaum becomes disabled (as defined in his employment agreement), the

Company would pay him (a) pro-rata bonus for the year in which the disability occurs (based on actual Company

58