Time Warner Cable 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• an annual equity award of vested, full value stock units, in the form of RSUs, valued at $150,000

representing the Company’s unsecured obligation to deliver the designated number of shares of

Common Stock, generally after the Director ceases his or her service as a director for any reason other

than cause; and

• an additional annual cash retainer for service on the Board’s committees or as lead director, in each case

prorated for service for any partial year.

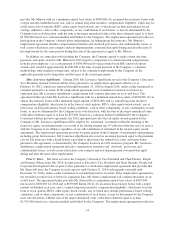

The directors are entitled to receive dividend equivalents on the RSUs, if any dividends are paid on the

Common Stock. In 2014, each non-employee director received 1,120 RSUs under the Stock Plan. Directors who

have served on the Board for at least three years are eligible to elect to receive the distribution of Common Stock

underlying 50% of any future RSU award on the earlier of (a) the third anniversary of the award date or (b) after

the director ceases to serve as a director for any reason other than cause.

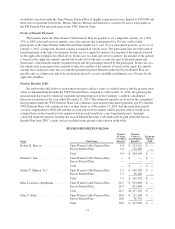

The following additional annual cash retainers were paid in 2014 for service on the Board’s committees:

(i) $15,000 per year for each member of the Audit Committee and Compensation Committee, with $30,000 for

each chair and (ii) $7,500 per year for each member of the Nominating and Governance Committee, Finance

Committee and Marketing and Customer Care Committee, with $15,000 for each chair. The lead director

received an additional annual cash retainer of $30,000. No additional compensation is paid for attendance at

meetings of the Board of Directors or a Board committee.

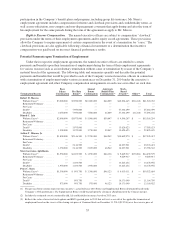

In general, for non-employee directors who join the Board after the date on which the annual equity award

to directors has been made, the Company’s policy is to make the stock unit grant on a prorated basis shortly after

election and to provide a prorated cash retainer consistent with the compensation package described above,

subject to limitations that may exist under the applicable equity plan.

Non-employee directors are reimbursed for out-of-pocket expenses (including the costs of travel, food and

lodging) incurred in connection with attending Board, committee and stockholder meetings. Travel to such

meetings may include the use of aircraft owned or leased by the Company if available and appropriate under the

circumstances. Directors are also reimbursed for reasonable expenses associated with other Company-related

business activities, including participation in director education programs.

The Company may also invite directors and their spouses to attend Company-related events. The Company

generally provides for, or reimburses expenses of, the spouses’ travel, food and lodging for attendance at these

events to which directors’ spouses and guests have been invited, which may result in a non-employee director

recognizing income for tax purposes. The Company reimburses the non-employee director for the estimated

taxes incurred in connection with any income recognized by the director as a result of the spouse’s attendance at

such events. In the year ended December 31, 2014, the aggregate incremental cost to the Company of these items

was less than $10,000 per director. In addition, for 2014, the Company made a $500 contribution in the name of

each director to The Glenn & Barbara Britt Scholarship Fund at Dartmouth College in honor of Glenn A. Britt,

the Company’s former Chairman and Chief Executive Officer, who passed away in June 2014.

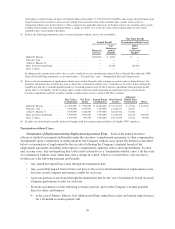

Non-employee directors are given the opportunity to defer for future distribution payment of their cash

retainer. Deferred payments of director fees are recorded as deferred units of the Company’s Common Stock under

the Stock Plan (the “Directors’ Deferred Compensation Program”). Distributions of the account upon the selected

deferral date will be made in shares of the Company’s Common Stock. The directors are entitled to receive dividend

equivalents in cash on their deferred stock units if regular cash dividends are paid on the Common Stock.

60