Time Warner Cable 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

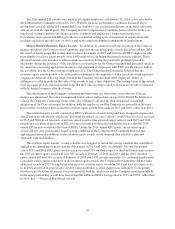

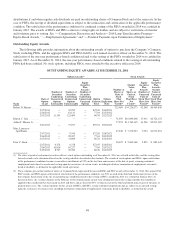

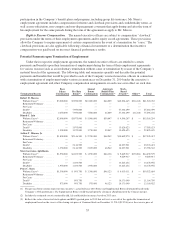

agreement. Mr. Stern received additional retention equity awards in August 2014 to reflect an increase in his target compensation with a

vesting schedule consistent with the retention equity awards made in February 2014. The vesting dates for the unvested RSU and PBU

awards are as follows as of December 31, 2014:

Number of

RSUs

and PBUs

That Have

Not Vested

Date of

Grant Vesting Dates

Robert D. Marcus ........................................ 13,230 2/17/2011 2/17/2015

46,200 2/16/2012 2/16/2015 and 2/16/2016

25,320 2/13/2013 2/13/2016 and 2/13/2017

70,914 2/12/2014 2/12/2017 and 2/12/2018

55,984 2/12/2014 2/12/2018 and 2/12/2019

55,984 2/12/2014 2/12/2019 and 2/12/2020

Dinesh C. Jain. .......................................... 29,858 2/12/2014 2/12/2017 and 2/12/2018

29,858 2/12/2014 2/12/2018 and 2/12/2019

29,858 2/12/2014 2/12/2019 and 2/12/2020

Arthur T. Minson, Jr. ...................................... 19,128 5/31/2013 5/31/2016 and 5/31/2017

24,260 2/12/2014 2/12/2017 and 2/12/2018

24,260 2/12/2014 2/12/2018 and 2/12/2019

24,260 2/12/2014 2/12/2019 and 2/12/2020

Marc Lawrence-Apfelbaum ................................ 3,764 2/17/2011 2/17/2015

8,820 2/16/2012 2/16/2015 and 2/16/2016

6,647 2/13/2013 2/13/2016 and 2/13/2017

11,757 2/12/2014 2/12/2017 and 2/12/2018

11,757 2/12/2014 2/12/2018 and 2/12/2019

11,757 2/12/2014 2/12/2019 and 2/12/2020

Peter C. Stern ............................................ 2,573 2/17/2011 2/17/2015

5,040 2/16/2012 2/16/2015 and 2/16/2016

5,486 2/13/2013 2/13/2016 and 2/13/2017

9,705 2/12/2014 2/12/2017 and 2/12/2018

9,705 2/12/2014 2/12/2018 and 2/12/2019

9,705 2/12/2014 2/12/2019 and 2/12/2020

1,008 8/1/2014 2/12/2018 and 2/12/2019

1,008 8/1/2014 2/12/2019 and 2/12/2020

(3) Calculated using the NYSE closing price on December 31, 2014 of $152.06 per share of Common Stock.

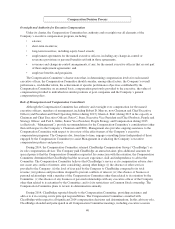

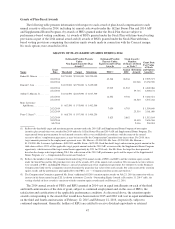

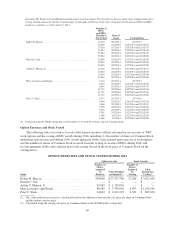

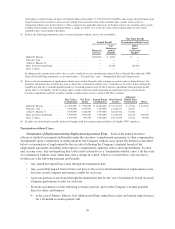

Option Exercises and Stock Vested

The following table sets forth as to each of the named executive officers information on exercises of TWC

stock options and the vesting of RSU awards during 2014, including: (i) the number of shares of Common Stock

underlying options exercised during 2014; (ii) the aggregate dollar value realized upon exercise of such options;

(iii) the number of shares of Common Stock received from the vesting of awards of RSUs during 2014; and

(iv) the aggregate dollar value realized upon such vesting (based on the stock price of Common Stock on the

vesting dates).

OPTION EXERCISES AND STOCK VESTED DURING 2014

Option Awards Stock Awards

Name

Number of

Shares

Acquired

on

Exercise

Value Realized

on Exercise(1)

Number of

Shares

Acquired

on

Vesting

Value

Realized on

Vesting(2)

Robert D. Marcus ................................. 304,000 $ 23,533,740 27,206 $ 3,822,662

Dinesh C. Jain .................................... — $ — — $ —

Arthur T. Minson, Jr. ............................... 25,065 $ 1,328,001 — $ —

Marc Lawrence-Apfelbaum .......................... 80,585 $ 5,769,069 8,497 $ 1,189,956

Peter C. Stern ..................................... 24,663 $ 2,012,207 6,320 $ 882,654

(1) The value realized on exercise is calculated based on the difference between the sale price per share of Common Stock

and the option exercise price.

(2) Calculated using the closing sale price of Common Stock on the NYSE on the vesting date.

49