Time Warner Cable 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

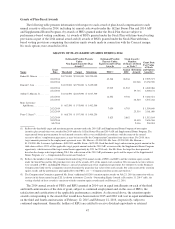

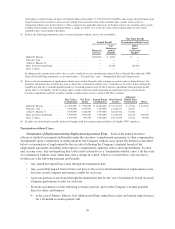

(1) Consists of the number of years of service credited to the executive officers as of December 31, 2014 for the purpose of

determining benefit service under the TWC Pension Plans.

(2) The present values of accumulated benefits for the TWC Pension Plans as of December 31, 2014 were calculated using a

4.32% discount and lump-sum rate and the RP-2000 Mortality Table with 5.5% adjustment factor, projected with

generational improvements using Scale BB (with no collar adjustment), consistent with the assumptions used in the

calculation of the Company’s benefit obligations as disclosed in Note 14 to the audited consolidated financial statements

of the Company included in the 2014 Form 10-K. The present values also assume all benefits are payable at the earliest

retirement age at which unreduced benefits are assumed to be payable (which is age 65) under the TWC Pension Plans

valued as if paid as a life annuity.

(3) Mr. Minson’s years of credited service include service to the Company prior to his rehire date in May 2013. Mr. Minson

received a distribution from the Excess Plan in April 2010 upon his termination of service to the Company. Upon the

first anniversary of his rehire date, he retroactively accrued benefit service from his rehire date.

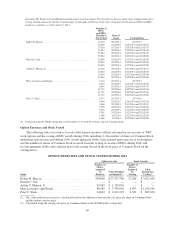

Nonqualified Deferred Compensation

Prior to 2003, the Time Warner Entertainment Deferred Compensation Plan, an unfunded deferred

compensation plan (the “TWE Deferral Plan”), permitted certain employees of the Company and its affiliates

(including certain named executive officers) to defer receipt of all or a portion of their annual bonus until a

specified future date on which a lump-sum or installment distribution would be made based on the participant’s

election. During the deferral period, the participant selects a crediting rate or rates to be applied to the deferred

amount from certain of the third party investment vehicles then offered under the TWC Savings Plan and may

change that selection quarterly. Since March 2003, deferrals may no longer be made under the TWE Deferral

Plan but amounts previously credited under the Plan continue to track the available crediting rate elections. The

TWE Deferral Plan does not provide a guaranteed rate of return on deferred amounts.

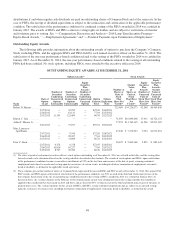

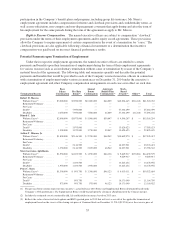

Set forth in the table below is information about the earnings, if any, credited to the accounts maintained by

the named executive officers under the TWE Deferral Plan and any withdrawal or distributions therefrom during

2014 and the balance in the account on December 31, 2014.

NONQUALIFIED DEFERRED COMPENSATION FOR 2014

Name

Executive

Contributions

in 2014

Registrant

Contributions

in 2014

Aggregate

Earnings

in 2014(1)

Aggregate

Withdrawals/

Distributions

Aggregate

Balance at

December 31,

2014

Robert D. Marcus ...................... $ — $ — $ — $ — $ —

Dinesh C. Jain ........................ — — — — —

Arthur T. Minson, Jr. ................... — — — — —

Marc Lawrence-Apfelbaum .............. — — 425 — 55,350

Peter C. Stern ......................... — — — — —

(1) None of the amounts reported in this column is required to be reported as compensation for fiscal year 2014 in the

Summary Compensation Table.

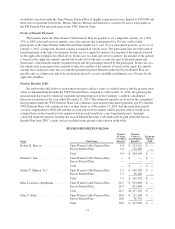

Employment Agreements

The material terms of the compensation provided to the Company’s named executive officers during the

term of their employment pursuant to employment agreements between the Company and each executive are

described below. See “—Compensation Discussion and Analysis—2014 Base Salary and Target Incentive

Compensation Determinations” for a discussion of 2014 compensation determinations and “—Potential

Payments upon Termination of Employment” and “—Potential Payments upon a Change in Control” for a

description of the payments and benefits that would be provided to the Company’s named executive officers in

connection with a termination of their employment or a change in control of the Company.

52