Time Warner Cable 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.defined in Section 162(m) (the “Subcommittee”), established objective performance criteria for 2014 that

determined the maximum bonus pool from which the named executive officers’ bonuses can be paid and a

percentage allocation of the pool for each named executive officer. Under the objective criteria established by the

Subcommittee, an aggregate 2014 maximum bonus pool was established equal to 7.5% of the amount by which

the Company’s 2014 Operating Income before depreciation of tangible assets and amortization of intangible

assets (as adjusted) of at least $8.15 billion exceeded $6.723 billion. Each annual bonus payment was subject in

all cases to a 162(m) Bonus Plan cap equal to the lesser of (i) 250% of the officer’s annual bonus target and

(ii) $15 million, in addition to an overall cap under the annual bonus program of 150% of the individual’s target

annual bonus (as increased by the Supplemental Bonus Program opportunity). In awarding 2014 bonuses to each

named executive officer, the Subcommittee exercised its discretion to reduce the maximum amount available for

each executive officer under the 162(m) Bonus Plan’s pool. The basis for this exercise of negative discretion was

the Company’s performance score under the Profit Participation Program and the operational performance under

the OPI as described above.

2014 Long-Term Incentive Program—Equity-Based Awards

As the Compensation Committee considered the 2014 LTI program, it also realized that additional retention

incentives would be essential in light of the possible protracted regulatory review process that is typical for

significant mergers in the cable industry and various uncertainties related to the Comcast merger. As a result, in

addition to the standard annual LTI awards, it approved advancing into 2014 equity awards that would have

otherwise been made in 2015 and 2016 as special retention equity awards.

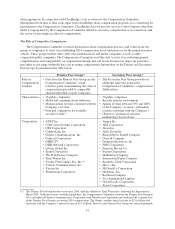

2014 Standard Annual Equity Awards.The Company’s 2014 Annual LTI program consisted of RSUs

awarded under the Company’s 2011 Stock Incentive Plan (the “Stock Plan”), 60% of which was subject to

complete forfeiture if specified performance-based vesting conditions were not satisfied. The 2014 annual LTI

program represented a change from the Company’s practices in recent years, which had also included stock

options as part of its standard mix. The Compensation Committee believed that granting RSUs with a

combination of performance-based and service-based vesting would provide the best mix of LTI vehicles to

motivate key executives to drive business results against the Company’s goals and retain the senior management

team during the pendency of the Comcast merger and better aligned executives’ interests with those of the

Company’s stockholders. In addition, the Compensation Committee was aware that stock options, which had

historically been granted with a ten-year term, might not have, or be perceived to have, the opportunity to reach

their full anticipated value in light of the various circumstances related to the Comcast merger. As a result, stock

options were not considered to be as effective as RSUs in achieving all of the Company’s business and

compensation objectives under the circumstances.

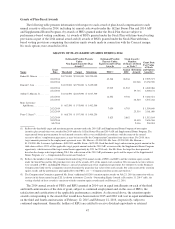

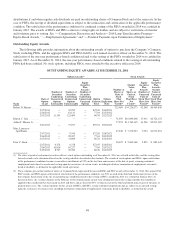

2014 Equity Awards—Determinations. The number of RSUs awarded to each named executive officer in

connection with the 2014 LTI program and the retention equity awards, described below, was determined by

reference to the target LTI value for such executive and the average closing price of the Company’s Common

Stock over a ten-day period prior to the date of grant selected in advance by the Compensation Committee.

2014 Standard Annual Equity Awards—Performance-Based Conditions and Other Terms. Consistent

with the Company’s LTI programs since 2011, 60% of the value of the 2014 annual LTI award to each executive

officer was subject to complete forfeiture if the Company failed to satisfy specified performance goals. For 2014,

the Compensation Committee established a one-year measurement period for this performance-based vesting

condition and set 2014 Operating Income (as adjusted) of $4.5 billion (the threshold performance level under the

Profit Participation Program under the 2014 AIP) as the 2014 LTI award performance threshold. The

Compensation Committee believed that utilizing this one-year performance threshold for 60% of the target value

of the 2014 annual LTI awards was appropriate in light of general market practice, the inherent performance

aspects of equity awards, the types of vehicles and mix used by the peer groups and the challenges associated

with setting multi-year performance goals, particularly in light of the pending Comcast merger. In conjunction

with the determination of the performance score under the 2014 Profit Participation Program component of the

annual bonus program in early 2015, the Compensation Committee certified the satisfaction of the one-year

performance condition, which permitted the awards to vest on their designated time-based vesting schedules, as

described below.

38