Time Warner Cable 2015 Annual Report Download - page 59

Download and view the complete annual report

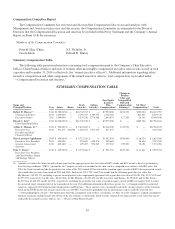

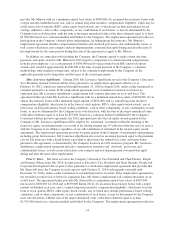

Please find page 59 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Robert D. Marcus. In July 2013, the Company and Mr. Marcus entered into a new employment

agreement, effective July 25, 2013, pursuant to which Mr. Marcus continued to serve as President and Chief

Operating Officer until January 1, 2014 at which time Mr. Marcus began serving as the Company’s Chairman of

the Board and Chief Executive Officer through December 31, 2016, subject to earlier termination pursuant to its

terms. If the employment agreement is not extended or renewed at or before its expiration date, Mr. Marcus’s

employment will continue thereafter on an at-will basis. The agreement currently provides Mr. Marcus with (a) a

minimum annual base salary of $1,500,000; (b) an annual discretionary bonus with a target amount $5,000,000;

and (c) annual long-term incentive compensation with a target value of approximately $7,500,000 (based on a

valuation method established by the Company), which may be in the form of stock options, RSUs, other equity-

based awards, any of which may include performance-based vesting conditions, cash or other components, or any

combination of such forms, as may be determined by the Compensation Committee, in its sole discretion but

consistent with the general vesting and other terms as determined for the other “named executive officers” of the

Company. The employment agreement provides for participation in the Company’s benefit plans and programs,

including $50,000 of group life insurance and reimbursement of financial services. Mr. Marcus also receives an

annual payment equal to two times the premium cost for $4,000,000 of life insurance as determined by the

Company based on its GUL insurance program. Mr. Marcus’s employment agreement includes compensation

forfeiture and “clawback” provisions and confidentiality terms, as well as non-solicitation, non-compete and non-

disparagement covenants that apply during and after the term of his employment. If his employment terminates

during the term of his employment agreement, the confidentiality and non-disparagement covenants apply

indefinitely, the non-solicitation covenant survives for one year and the non-compete survives for 24 months. In

addition, pursuant his employment agreement, in 2014, Mr. Marcus received a special RSU award with a grant

value of approximately $2,000,000 reflecting the same terms as the annual long-term incentive award made to

the Company’s other senior executives.

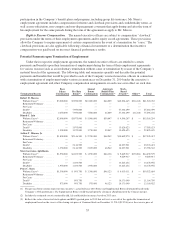

Dinesh C. Jain. Mr. Jain joined the Company as its Chief Operating Officer, effective as of January 13,

2014 and is employed pursuant to a fixed-term employment agreement that provides that Mr. Jain will serve the

Company in such capacity until January 12, 2017, unless earlier terminated or extended pursuant to its terms. If

the employment agreement is not extended or renewed at or before its expiration date, Mr. Jain’s employment

will continue thereafter on an at-will basis. The agreement further provides Mr. Jain with (a) a minimum annual

base salary of $1,000,000; (b) an annual discretionary bonus with a minimum target amount of $1,250,000; and

(c) annual long-term incentive compensation eligibility, which may be in the form of stock options, RSUs, other

equity-based awards, any of which may include performance-based vesting conditions, cash or other

components, or any combination of such forms, as may be determined by the Company in its sole discretion, with

the sum of the target annualized value of the three elements equal to at least $7,500,000 (based on a valuation

method established by the Company). The employment agreement provides for participation in the Company’s

benefit plans and programs, including group life insurance. Mr. Jain’s employment agreement includes

compensation forfeiture and clawback provisions and confidentiality terms, as well as non-solicitation, non-

compete and non-disparagement covenants that apply during and after the term of his employment for the same

periods during the term of the agreement as apply to Mr. Marcus.

In addition, prior to the closing of the Company’s acquisition of Insight Communications Company, Inc. in

February 2012, Mr. Jain’s Insight employment was terminated. Pursuant to Mr. Jain’s severance arrangements

with Insight, which is now a wholly-owned subsidiary of the Company, Mr. Jain received the following

severance payments and benefits: (a) base salary continuation payments of $1,457,637, payable beginning on

March 9, 2012 through February 9, 2014, in substantially equal installments on the Company’s regular payroll

dates; (b) payments attributable to his 2011 bonus of $1,225,260, payable in three installments—$510,525 paid in

January 2013, $612,630 paid in January 2014, and $102,105 paid in January 2015; and (c) a payment attributable

to his 2012 bonus (prorata) of $100,706 paid in January 2013.

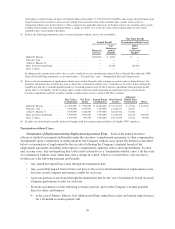

Arthur T. Minson, Jr. Mr. Minson rejoined the Company as its Executive Vice President and Chief

Financial Officer effective May 2, 2013 and is employed pursuant to a fixed-term employment agreement that

provides that Mr. Minson will serve the Company in such capacity until May 1, 2016, unless earlier terminated

or extended pursuant to its terms. If the employment agreement is not extended or renewed at or before its

expiration date, Mr. Minson’s employment will continue thereafter on an at-will basis. The agreement further

53