Time Warner Cable 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Short-term incentives are designed to require the Company to reach “stretch” (but not unrealistic)

targets and provide for a range of potential payout levels depending on performance above a threshold

level.

• Maximum annual bonus payout levels are limited to 150% of target annual bonus (as adjusted for the

Supplemental Bonus Program).

• The Compensation Committee has discretion in determining payouts under the Company’s annual cash

bonus plans and can use its discretion to ensure that neither excessive risk-taking nor inappropriate

conservatism in decisionmaking is rewarded.

Perquisites

The Company provides a very limited number of perquisites to the named executive officers. Where

provided, the Company believes these perquisites facilitate the operation of its business, allow named executive

officers to better focus their time, attention and capabilities on their Company activities, address safety and

security concerns and assist the Company in recruiting and retaining key executives.

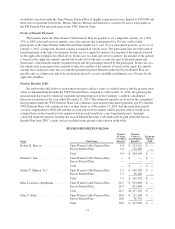

The Company’s perquisites for its named executive officers in 2014 included, in the case of Mr. Marcus,

eligibility for financial services reimbursement (e.g., tax and estate planning), while the Company has generally

discontinued this reimbursement eligibility for other executives. At the request of the Company’s Board, during

2014, Mr. Marcus used Company-owned or leased aircraft for business and personal travel under most

circumstances. In limited instances, with CEO approval, the Company’s other executive officers (as well as

guests of such executive officers) are permitted to join an otherwise scheduled business-purpose Company flight

for personal purposes. The Company imputes income to executive officers who make personal use of Company

aircraft as and when required under applicable tax rules. The perquisites provided to the named executive officers

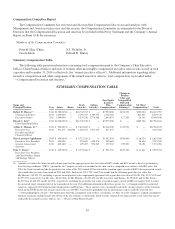

are noted in the Summary Compensation Table, below.

Benefits

The Company maintains defined benefit and defined contribution retirement programs for its employees in

which the Company’s named executive officers participate, subject to satisfaction of eligibility requirements. The

objective of these programs is to help provide financial security into retirement, reward and motivate tenure and

recruit and retain talent in a competitive market. In addition to the Company’s tax-qualified defined benefit plan,

the Company maintains a nonqualified defined benefit plan in which the named executive officers participate.

The tax-qualified defined benefit plan has a maximum compensation limit and a maximum annual benefit

imposed by the tax laws, which limit the benefit under the plan for certain participants. In order to provide a

retirement benefit more commensurate with salary levels, the nonqualified defined benefit plan provides benefits

to key salaried employees, including the named executive officers, using the same formula for calculating

benefits as is used under the tax-qualified defined benefit plan but taking into account compensation in excess of

the compensation limitations for the tax-qualified defined benefit plan up to a cap of $350,000 per year and

determined without regard to the maximum annual benefit under the tax-qualified plan. See “—Pension Plans.”

The Company also maintains a nonqualified deferred compensation plan to which contributions by the

Company or employees are no longer permitted. See “—Nonqualified Deferred Compensation.”

Tax Deductibility of Compensation

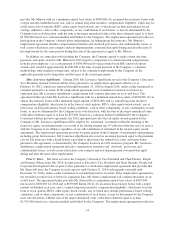

Section 162(m) generally disallows a tax deduction to public corporations for compensation in excess of $1

million in any one year with respect to each of its Chief Executive Officer and three most highly paid executive

officers (other than the Chief Financial Officer) with the exception of compensation that qualifies as

performance-based compensation. The Compensation Committee considers Section 162(m) implications in

making compensation recommendations and in designing compensation programs for the executives. In this

regard, the 162(m) Bonus Plan and the Company’s 2006 and 2011 Stock Incentive Plans were submitted to and

approved by stockholders so that compensation paid under those plans may qualify as performance-based

compensation under Section 162(m). However, the Compensation Committee retains the discretion to pay

compensation that is not deductible, whether under such plans or otherwise, when it determines that to be in the

best interests of the Company and its stockholders.

44