Time Magazine 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

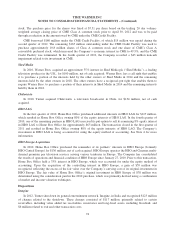

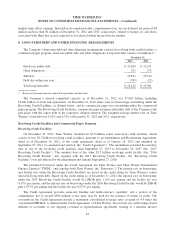

TNT Turkey

In 2012, Turner shut down its TNT television operations in Turkey and recognized charges of $85 million,

consisting of $57 million primarily related to certain receivables, including value added tax receivables,

inventories and other assets; $12 million related to exit and other transaction costs; and $16 million related to an

investment.

QSP

In 2012, the Publishing segment sold, solely in exchange for contingent consideration, assets primarily

comprising the school fundraising business, QSP, and recognized a $36 million loss in connection with the sale.

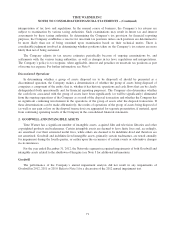

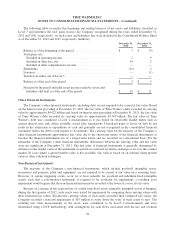

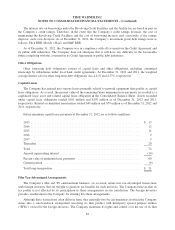

4. INVESTMENTS

The Company’s investments consist of equity-method investments, fair-value and other investments,

including available-for-sale securities, and cost-method investments. Time Warner’s investments, by category,

consist of (millions):

December 31,

2012 2011

Equity-method investments ........................................... $ 931 $ 939

Fair-value and other investments, including available-for-sale securities:

Deferred compensation investments, recorded at fair value ................ 251 254

Deferred compensation insurance-related investments, recorded at cash

surrender value ................................................ 358 337

Available-for-sale securities ........................................ 117 86

Total fair-value and other investments .................................. 726 677

Cost-method investments ............................................ 390 204

Total ............................................................. $ 2,047 $ 1,820

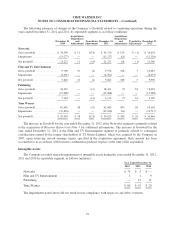

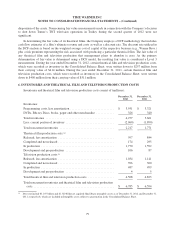

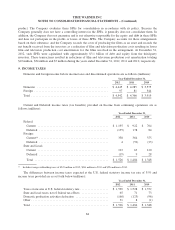

Available-for-sale securities are recorded at fair value in the Consolidated Balance Sheet, and the realized

gains and losses are included as a component of Other loss, net in the Consolidated Statement of Operations. The

cost basis, unrealized gains and fair market value of available-for-sale securities are set forth below (millions):

December 31,

2012 2011

Cost basis ......................................................... $ 96 $ 66

Gross unrealized gain ............................................... 21 20

Fair value ......................................................... $ 117 $ 86

Gains and losses reclassified from Accumulated other comprehensive loss, net to Other loss, net in the

Consolidated Statement of Operations are determined based on the specific identification method.

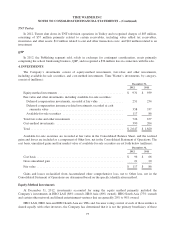

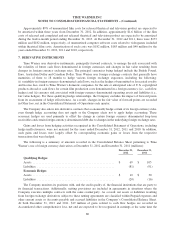

Equity-Method Investments

At December 31, 2012, investments accounted for using the equity method primarily included the

Company’s investments in HBO LAG (88% owned), HBO Asia (80% owned), HBO South Asia (75% owned)

and certain other network and filmed entertainment ventures that are generally 20% to 50% owned.

HBO LAG, HBO Asia and HBO South Asia are VIEs and, because voting control of each of these entities is

shared equally with other investors, the Company has determined that it is not the primary beneficiary of these

75