Time Magazine 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

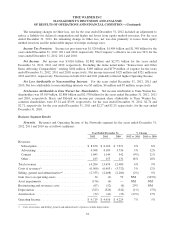

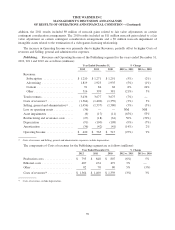

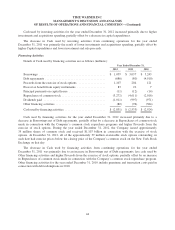

Theatrical film valuation adjustments for the years ended December 31, 2012 and 2011 were $92 million and $74

million, respectively. Other costs, including merchandise and related costs, decreased for the year ended

December 31, 2012 primarily due to lower distribution costs, associated with lower theatrical home video and

videogame sales.

As previously noted under “Transactions and Other Items Affecting Comparability,” the 2012 results

included $4 million of noncash impairments. The 2011 results included $21 million of noncash impairments, of

which $12 million related to capitalized software costs. In addition, the 2011 results included $9 million of

noncash gains related to fair value adjustments on certain contingent consideration arrangements.

The decrease in Operating Income for the year ended December 31, 2012 was primarily due to lower

Revenues, partially offset by lower Costs of revenues.

2011 vs. 2010

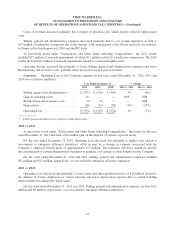

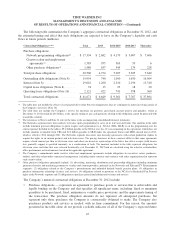

The increase in Content revenues for the year ended December 31, 2011 included the net positive impact of

foreign exchange rates of approximately $215 million.

Theatrical product revenues from film rentals decreased due primarily to lower carryover revenues from

prior period releases. There were 22 theatrical films released in 2011 as compared to 23 in 2010.

Theatrical product revenues from home video and electronic delivery increased due to higher carryover

revenues from prior period releases and catalog revenues of $78 million and higher revenues from releases in

2011 of $28 million. There were 20 home video and electronic delivery releases in 2011 as compared to 29 in

2010.

Theatrical product revenues from television licensing decreased due primarily to the quantity and mix of

availabilities.

The increase in television product licensing fees was primarily due to higher revenues from worldwide

syndication.

Television product revenues from home video and electronic delivery increased due to higher electronic

delivery revenues of $115 million primarily related to the recognition of revenue associated with a licensing

agreement with Netflix, Inc. (“Netflix”) that allows Netflix’s U.S. members to stream previous seasons of the

scripted series that aired on The CW Network beginning in fall 2011, as well as previous seasons of new scripted

series produced by Warner Bros. or CBS Corporation that premiere on the network through the 2014-2015

broadcast season, partially offset by lower revenues from consumer packaged goods of $81 million.

Other content revenues increased primarily due to higher revenues from videogames released in 2011 as

compared to videogames released in 2010.

The increase in Costs of revenues reflected higher film and television production costs, print and advertising

costs and other costs. Film and television production costs and print and advertising costs increased mainly due

to the mix of product released. Included in film and television production costs are theatrical film valuation

adjustments as a result of revisions to estimates of ultimate revenue for certain theatrical films. For the years

ended December 31, 2011 and 2010, theatrical film valuation adjustments were $74 million and $78 million,

respectively. Other costs increased primarily due to higher merchandise costs mainly associated with the increase

in videogame sales.

The increase in Selling, general and administrative expenses was primarily due to higher costs associated

with new business initiatives and acquisitions of $60 million, higher employee-related costs of $41 million and

higher distribution fees of $34 million, primarily associated with certain videogames.

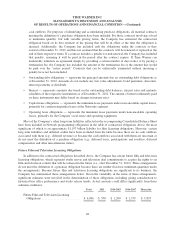

As previously noted under “Transactions and Other Items Affecting Comparability,” the 2011 results

included $21 million of noncash impairments, of which $12 million related to capitalized software costs. In

38